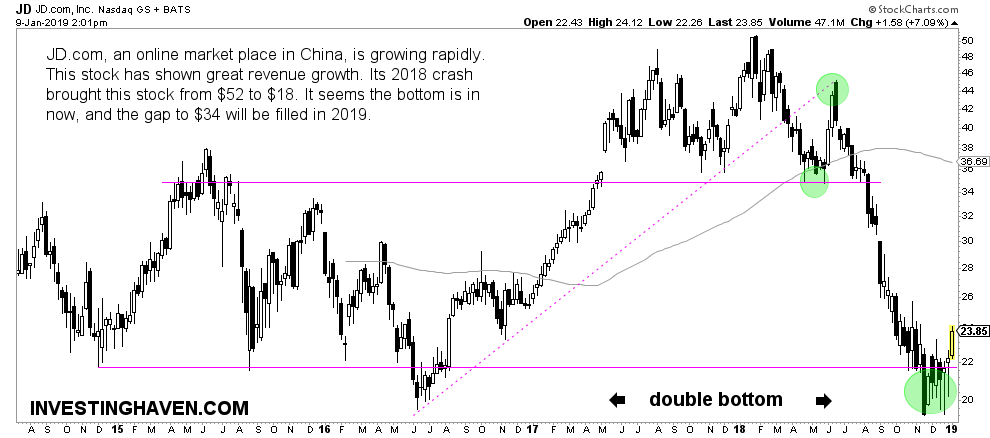

We may be looking at a major bottom, and, hence, buy opportunity, in China’s stock market. As per our China Stock Market Forecast 2019 the current level of China’s stock exchange (SSEC) should hold in order to qualify as a buy opportunity. Moreover, in terms of tech stocks in China, we see a rebound now, and, specifically JD.com is a stock that has a very enticing setup. Right now, JD.com (JD) shows a giant double bottom, and might have a 45 pct upside potential in 2019. Not that JD should not be looked at in isolation, but together with the findings from our 15 leading indicators and dominant market trends.

Some 2 months ago we reported that JD.comWas A Buy After Its 57 Pct Decline. Obviously, most investors do the opposite, they tend to sell near a major bottom because they can’t stand it any longer.

As per our 100 tips for successful long term investing:

Selling pressure mostly peaks near major bottom. This is what many call the ‘puke phase’. It occurs when investors cannot stand the pain any longer, and sell collectively, which, mostly, marks a major bottom.

Obviously, from an intermarket perspective, China’s stock market respecting secular support, at least so far, is an important support factor. Also, tech stocks in China, in general, tend to rebound strongly.

More specifically, though, we see three important news items in recent weeks.

First, JD.com announced a $1 billion share buyback program in a bid to lift stock prices weighed down by concerns about China’s economy and potential sexual-assault charges against the company’s chief executive. The buyback program is worth about 3.5% of the company’s market capitalization, and the company said it would be completed over the next 12 months.

Second, announcement of the buyback plan comes just a few days after authorities in Minneapolis declined to charge JD.com Chief Executive Liu Qiangdong in a sexual-assault case that arose in August. It was ‘uncoincidentally’ the same time period when this scandal made it to the public that the decline of JD.com accelerated, a started falling much faster than the rest of the internet stock sector in China (KWEB).

Third, as reported by the WSJ JD recently split its core JD Mall business into three divisions: a unit that analyzes customers’ shopping habits and market shifts, another that provides services for customers, and a unit that will handle the platform’s infrastructure, service support, and risk management services. All three segments will report to Xu Lei, who became the rotating chief executive of JD Mall last year. This move should reduce JD’s dependence on Richard Liu, and address the “key-person risk” that became painfully apparent after Liu’s arrest.

JD.com: 45 pct upside potential in 2019

2018 crash brought this stock from $52 to $18, a 52% decline.

Chart-wise, we now see a major double bottom. This may suggest that a long lasting bottom is in. If that’s the case we expect the gap to $34 to be filled in 2019.