Our methodology is centered around leading indicators. We look at instruments like the US Dollar, bond yields, volatility indexes to understand the underlying trend but also trend changes. We explained in the past Why Volatility Analysis Can Be Powerful And Even Predictive. In this article, we look at one of the volatility indexes that we believe is forecasting ‘volatility ahead.

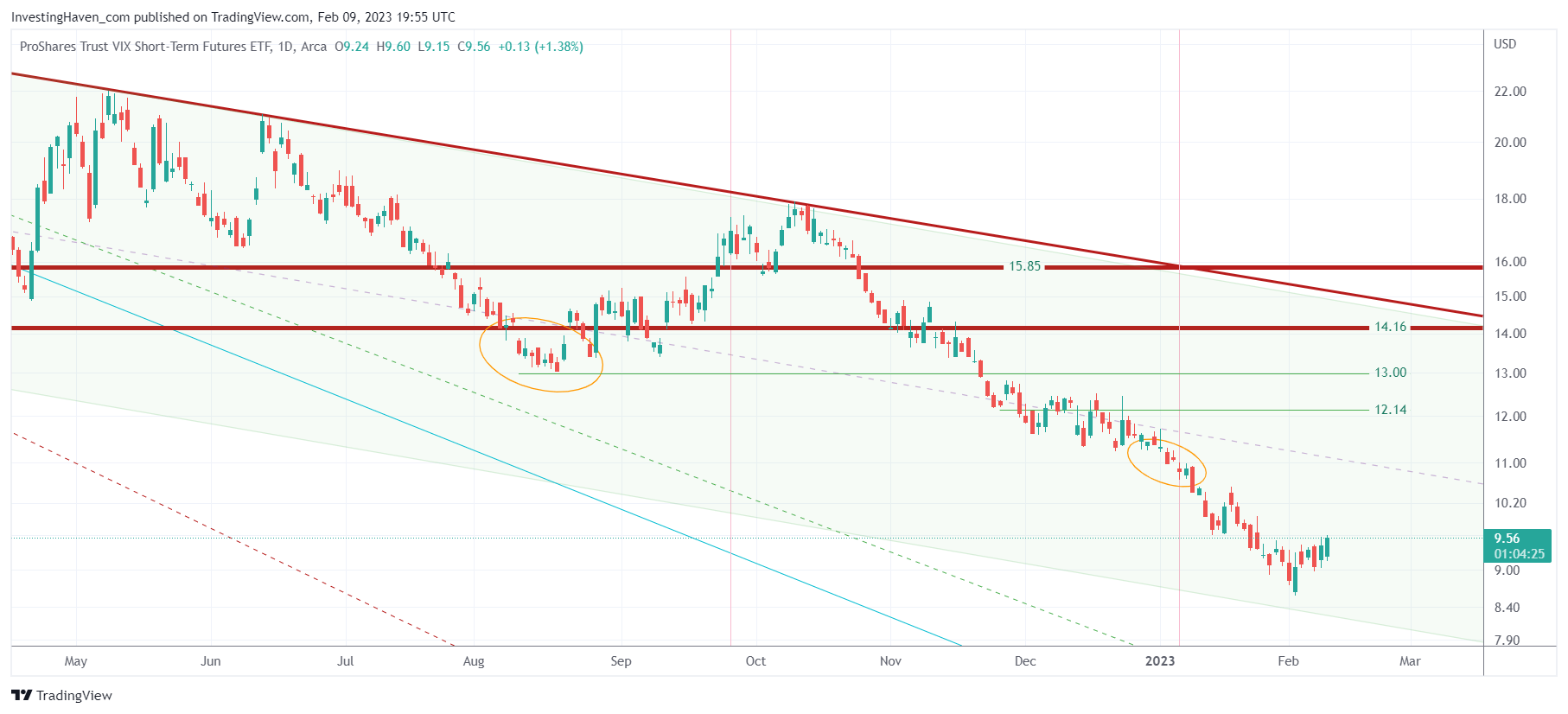

The volatility index we picked out this week is the short term volatility index, chart embedded in this article.

Every volatility index should be read in a different way. It’s not simple nor straightforward.

The general rule of thumb when reading volatility indexes is that they are inversely correlated to the underlying index. So, if the chart below is in a downtrend is implies that the S&P 500 is in an uptrend.

What we are looking for on this short term S&P 500 volatility index is the trend and turning points. A bullish turning point on this chart coincides with a bearish turning point in the S&P 500.

Here is the caveat: finding patterns on these volatility index charts is very challenging because they move at a very different pace than regular indexes like the S&P 500.

Our annotations visualize the trend channel: a down channel represents an uptrend in the S&P 500. As seen, since Oct 13th, the trend in this volatility index is down.

However, last week we spotted a turning point in this volatility index. This probably coincides with a local top in the S&P 500.

Our chart reading suggests that the market will move lower unless and until the downtrend on this volatility index is broken to the downside.