Lithium remains on fire. It is by far the strongest sector of 2021. In this short article we will feature 3 lithium stocks to make the point. We have featured the lithium sector multiple times in the public domain, and it became the key topic since June in our Momentum Investing research.

We avoid featuring individual stocks, but we will make an exception in this lithium post.

As a reminder we wrote the following posts about lithium in the public space:

- January 2021: A Bullish Lithium Stocks Forecast For 2021

- January 2021: Lithium Stocks on Fire In 2021

- February 2021: Are Lithium and Cobalt Set To Become The Hottest Commodities Of 2021?

- July 2021: Green Battery Metals Investors Love These Strategic Metals Price Charts

- September 2021: The Clean Energy Super Cycle For Mega Profits In 2021 And Beyond

- October 2021: Green Battery Metals On Fire Heading Into 2022

We were very accurate in identifying this trend, and what’s more important the lithium sector gave us the cleanest charts of 2021. We can easily make the point that the lithium sector has the strongest, clearest and cleanest chart setups in history.

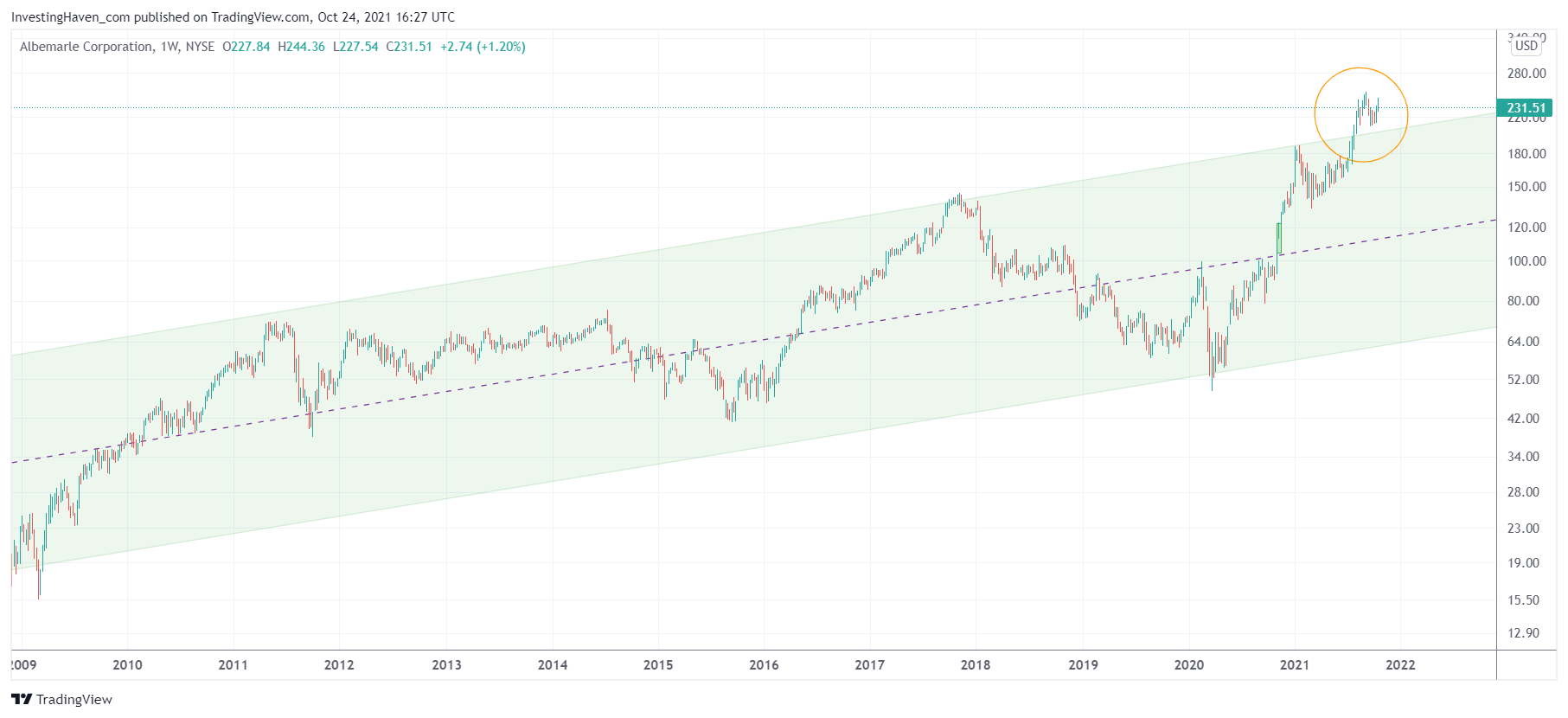

Here is one illustration: Albermale, weekly chart.

What’s so special about this chart is that a multi-decade pattern was broken to the upside in August. Absolutely strong and exceptional.

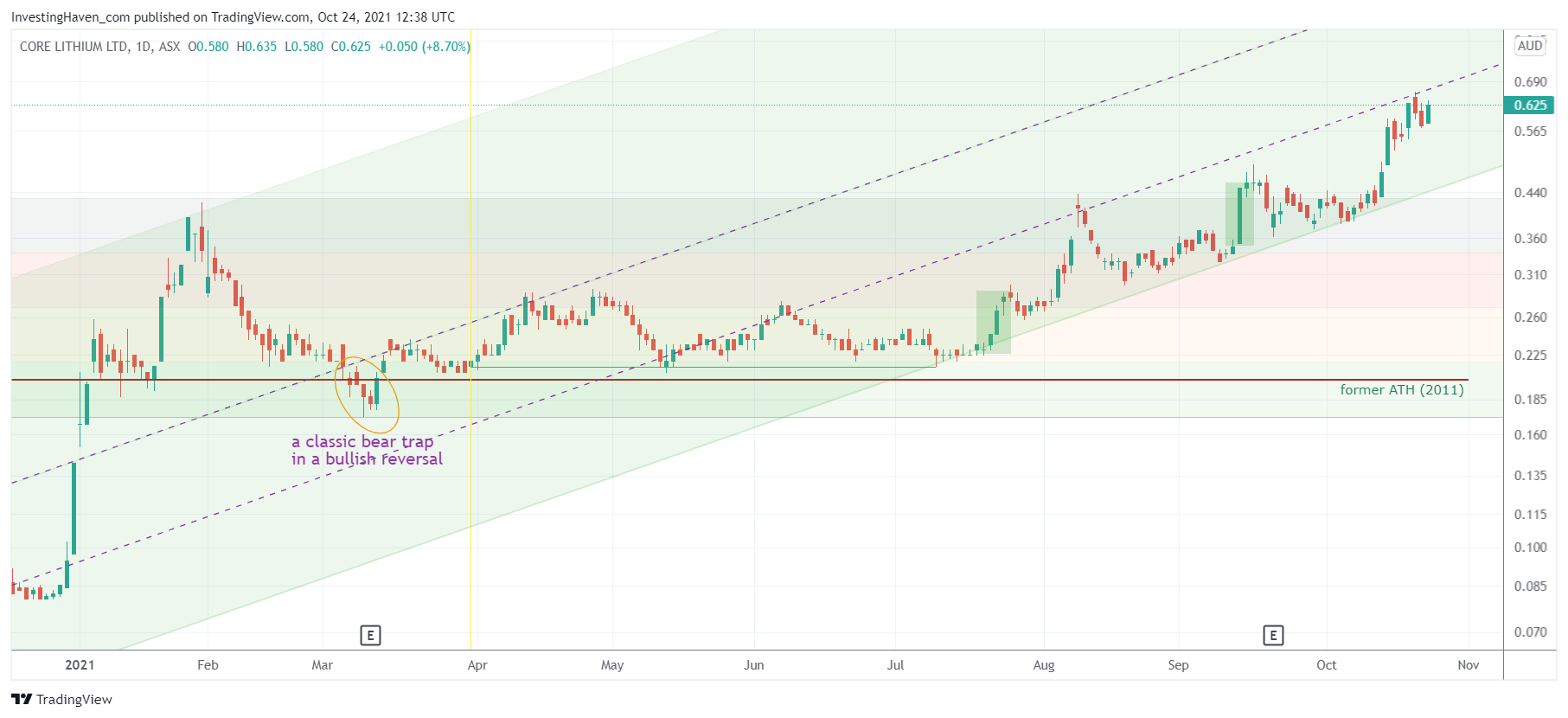

For members of our Momentum Investing service we started featuring an Australian lithium play back in June: Core Lithium. Recommended entry price was 0.24 AUD, it is close to tripling.

What’s so special? An absolutely phenomenal setup that is there and remains there. Many similar setups invalidate after a while, not so in the lithium space, they are unusually clear, clean and consequently powerful.

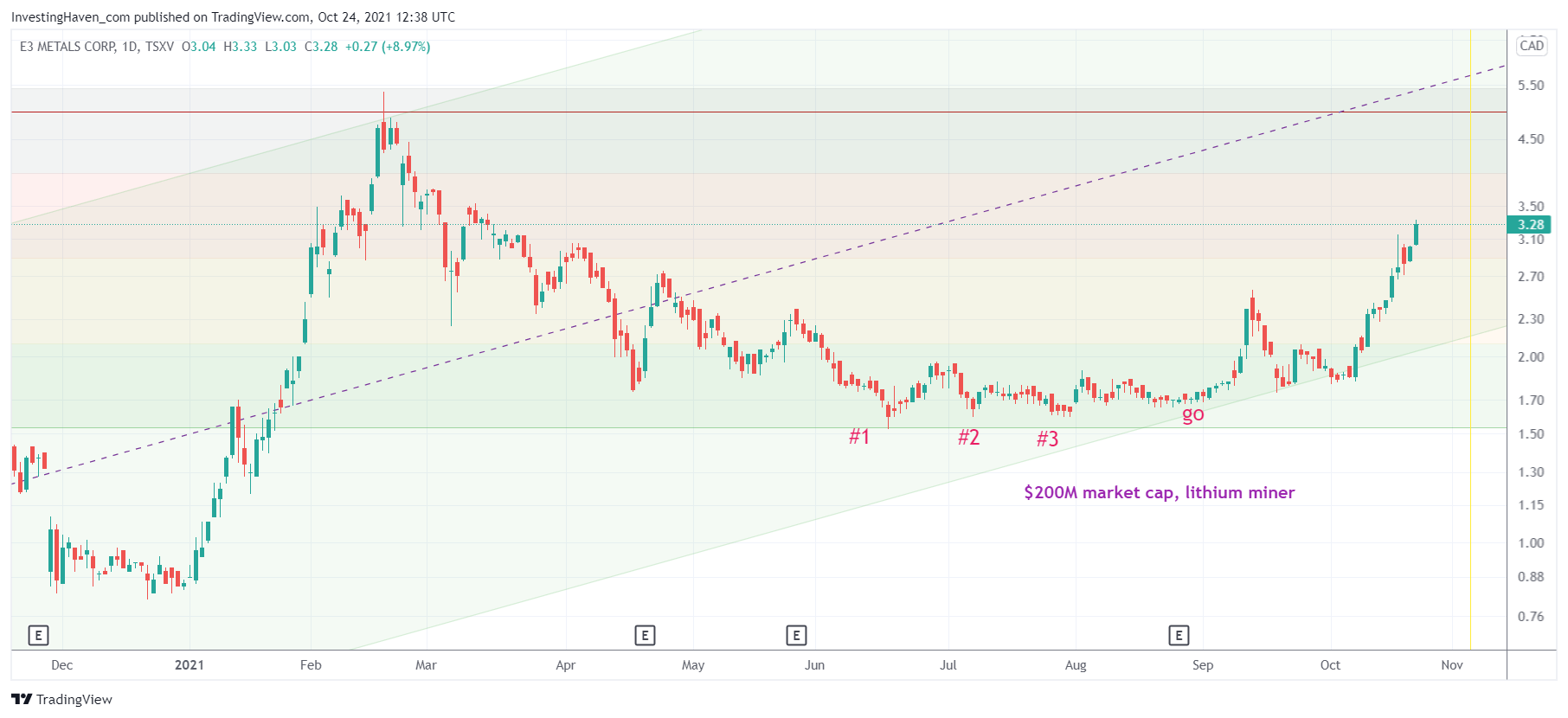

Here is a similar illustration of a small cap lithium miner, trading in Canada. We started featuring this stock below 2 CAD, now almost 70% higher.

We are not featuring these lithium miners as a recommendation. In fact it’s pretty late in the game to enter these positions. Not too late, but the real juice comes from early entries. All of them have much more upside potential but we explained in today’s Momentum Investing update that we believe that the graphite sector is about to accelerate. In a way graphite might be now where lithium was 3 months ago. We featured 3 specific names in Australia with serious upside potential.