We can’t hide our excitement about strategic metals. It is a matter of time until they will outperform any other stock segment. EV stocks might have done amazingly well end of last year, but not only did they come back on earth… it is also doubtful if they will rise to former levels again. The 3 strategic metals charts in this article tell a story, and long term investors understand the story. Yes, we forecast much higher prices in green battery strategic metals to come.

From our article the Biggest Investing Opportunity Of This Decade

“Electric vehicle sales are only starting to take off. Major car producers are starting a new wave of mass production. It’s just the start, so we cannot look around us and observe how big this trend is. It is the start. And as we know financial markets are great in ‘sniffing’ new trends, and anticipating 6 to 9 months before trends make it into the real world.

Green batteries for cars, planes, but also homes. Will this be the next big thing. Will this offer once-in-a-lifetime type of opportunities?

It could be. Probably it will. But specifically the commodities that are inputs into this secular renewable energy wave. Why? Simply because of the big rotation that comes with market crashes. We saw this in 2000 and 2010 so we should see it again in 2020 and beyond. It is commodities that came out of a major bear market, so some segments in the commodities space should create a secular trend in 2020 and beyond.

Moreover, we continued our thinking and concluded in Super Cycle In Green Battery Metals Starts In 2021:

History shows that bull runs in these metals don’t happen concurrently. They rise one by one. As an investor the trick is to be go overweight, per strategic metal, as each bull run unfolds. It’s ok to keep a one or two smaller allocations for the long term, but we want to have a larger allocation in each bull run. That’s exactly the strategy we will apply in this strategic metals super cycle, particularly in our Momentum Investing strategy and portfolio.

These are crucial insights, and long term investors know what we mean. These insights lead to a long term investing thesis. And the investing thesis in green battery metals is among the strongest one of this decade.

Can we make the point solely based on price charts, not fundamentals nor projections?

Yes, we can.

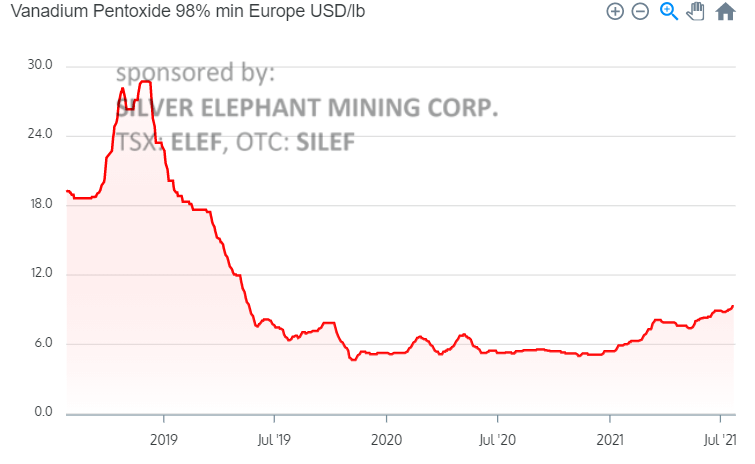

One of the green battery metals is vanadium. Below is the 3 year chart. What do you see? A big breakout, a big one!

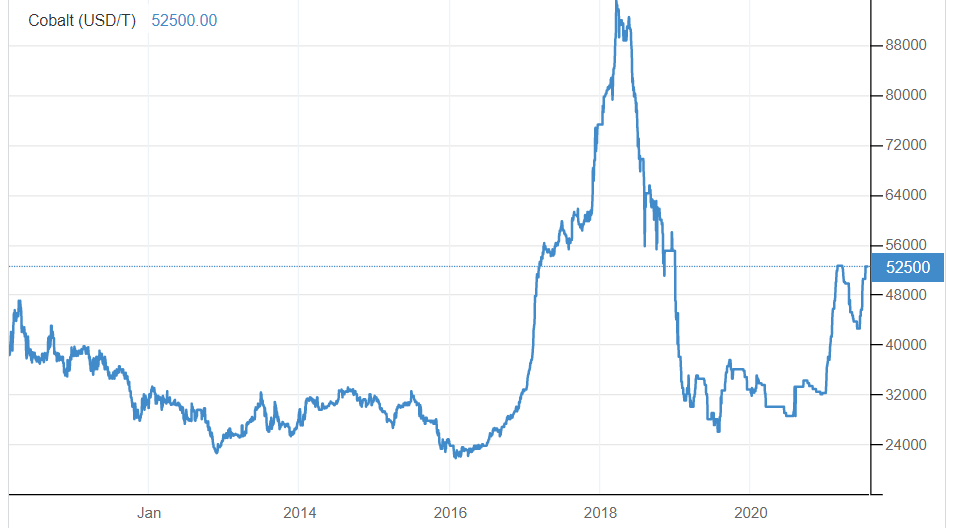

Another crucial green battery metal is cobalt. Below is the 9 year price chart. What do you see? A powerful bull market.

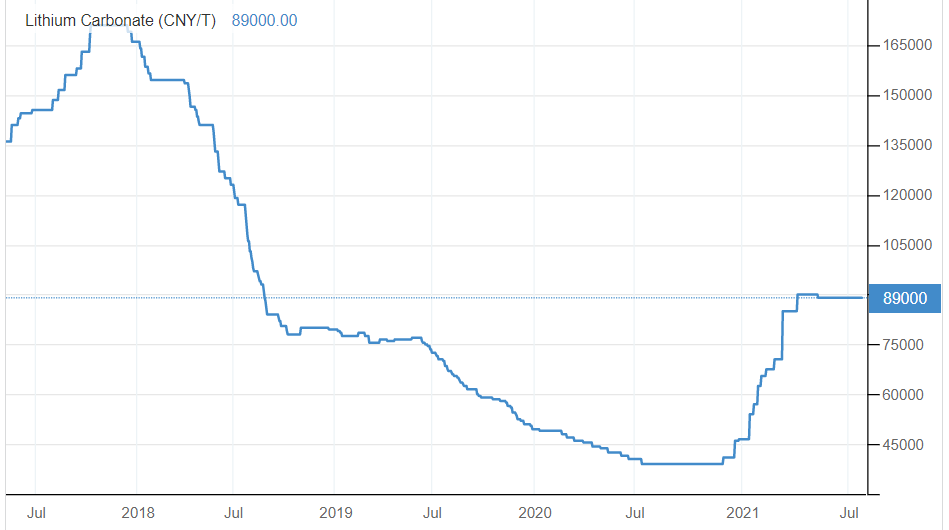

Here is lithium, another green battery metal and presumably the most well known. What do you see? A temporary break in the context of a major reversal.

This is the market telling a story, not us making up a story or being biased.

These price charts suggest a powerful bull market in strategic metals is here to stay, and to become more powerful over time. We don’t ignore this, and we give these markets the time they need.

Our Momentum Investing methodology suggests that long term positions in a select few stocks in these green battery metals is going to pay off. We published some 7 green battery metals stocks in the last few months. We will ensure to create one overview page which will be available in the restricted area for Momentum Investing members as of tomorrow.