Identifying long-term investing opportunities is the cornerstone of securing financial success. Recently, we discussed Industrial Stocks: Secular Breakout In Progress Promising A Hot 2023 For Industrials. The breakout we mentioned in our previous article seems to be confirmed now. In this article, we turn our focus to industrial stocks and an enticing prospect that shouldn’t be overlooked. Delving into the chart, on multiple timeframes, we explore the 10-year channel that has been respected and a recently completed bullish reversal pattern. This combination signals the potential for significant upward movement in the coming years, making industrial stocks a very attractive long-term investing opportunity.

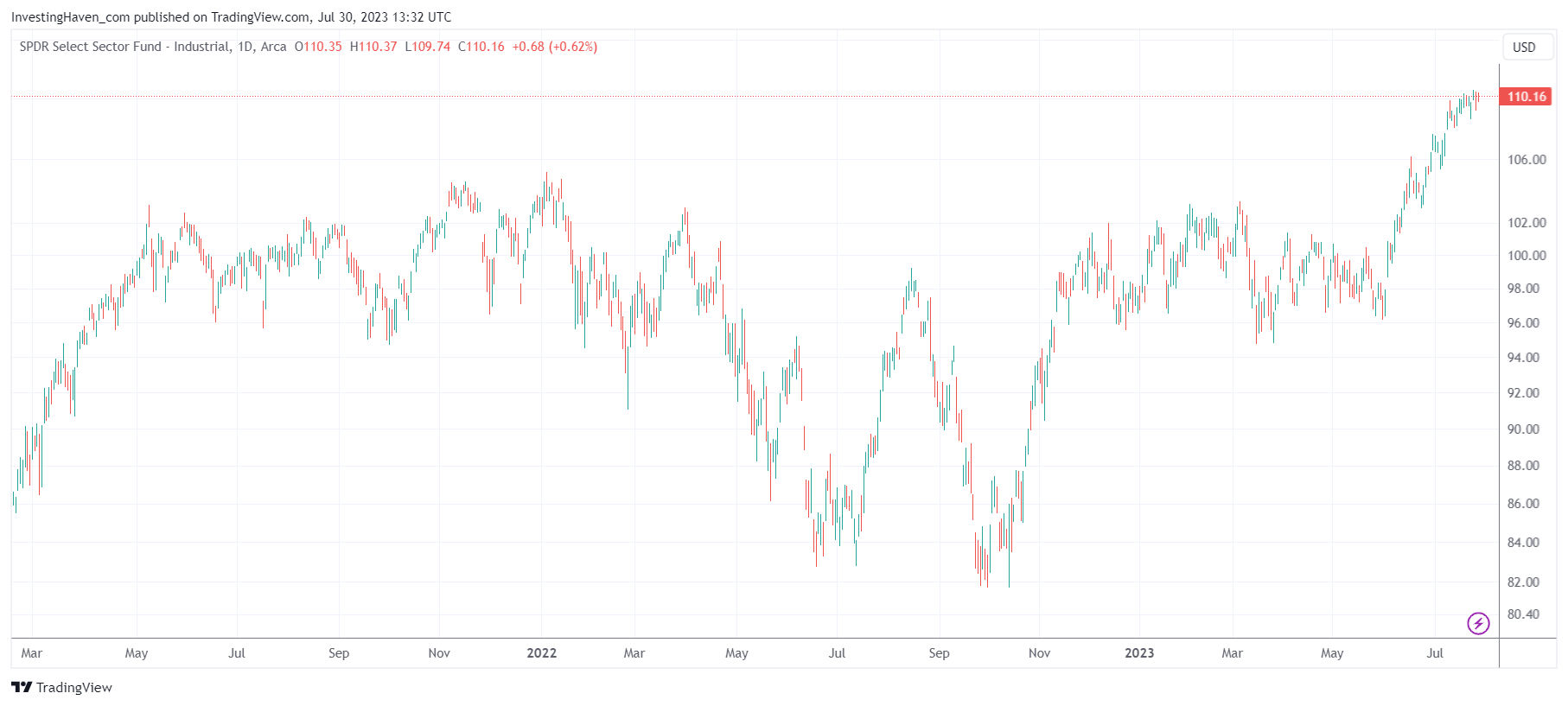

In this post, we feature the daily and weekly XLI ETF charts.

Moreover, as a general market trend, our research suggests:

Forecasting The Next Bearish Turning Point. Hint: No Secular Bearish Turning Point In 2023.

Both conclusions, as per our 2023 forecasts, are essential to the long-term investing opportunity in industrial stocks.

Industrial Stocks Chart: It’s Not What It Looks Like

We start with the daily XLI chart which features a consolidation with a breakdown, a year ago, that turned out to be a bullish W-reversal.

The daily chart of industrials stocks is a textbook example of a chart that looks cluttered, not interesting enough, even though there is a recent breakout.

The 10-Year Channel and Bullish Reversal Pattern

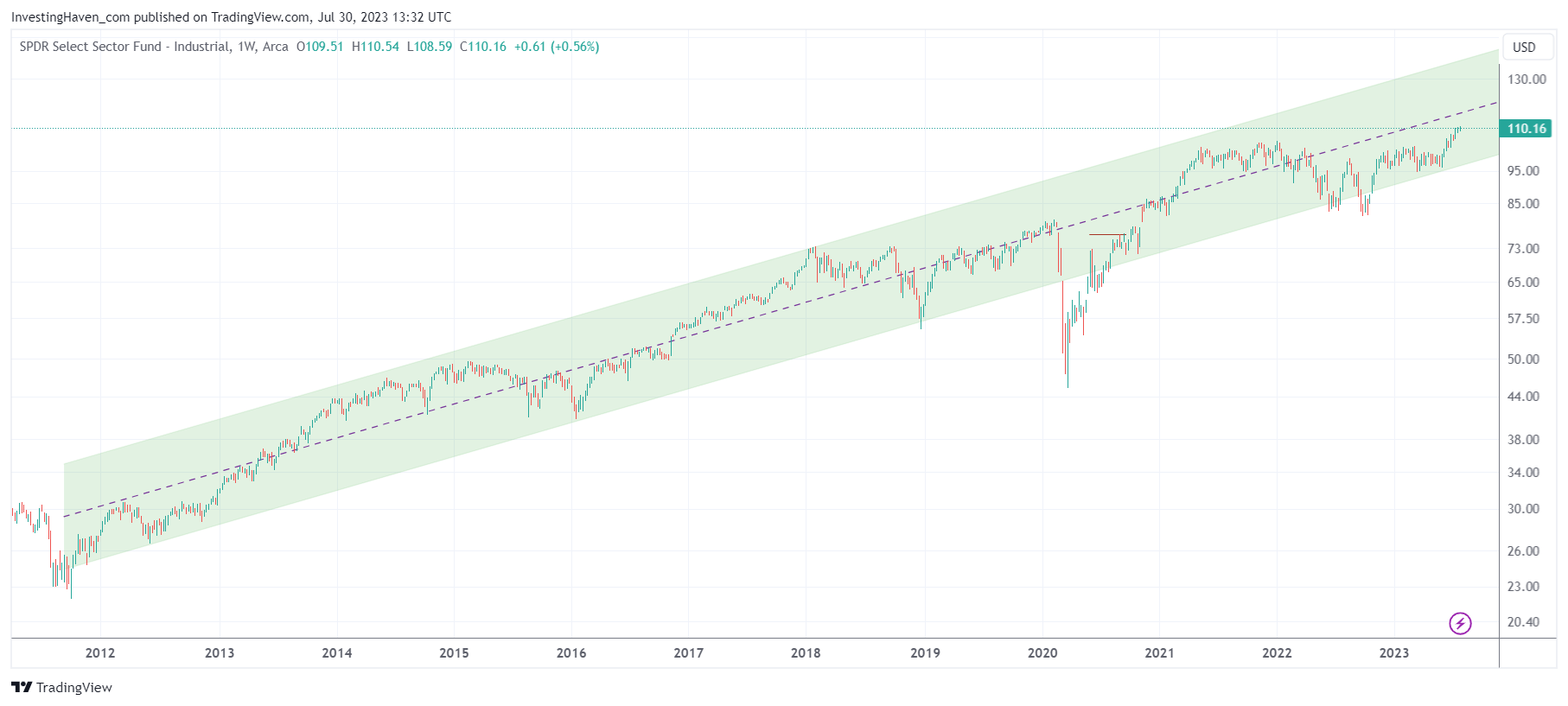

The chart shown above needs a longer timeframe to understand context.

Below is the weekly XLI chart. It showcases a 10-year channel that has proven to be a reliable indicator for industrial stocks. Over the years, this channel has acted as a critical support and resistance zone, guiding the price movements of these stocks. Recently, the chart reveals a clear bullish reversal pattern, indicating a decisive shift in sentiment from bearish to bullish.

The completion of this bullish reversal pattern presents an exciting opportunity for investors seeking to capitalize on long-term growth prospects. The respected 10-year channel adds further weight to this potential, hinting at a stable and sustainable trajectory for industrial stocks.

Long-Term Investing Opportunity in Industrial Stocks

With the long-term bullish reversal pattern in place, industrial stocks appear primed for substantial gains in the coming years. Investors who recognize this opportunity and position themselves wisely can reap the rewards of long-term growth.

Industrial stocks have historically displayed resilience and the ability to weather economic cycles effectively. As the global economy recovers and industries rebound, these stocks are well-positioned to benefit from increased demand and expansion.

AI & Robotics Resulting in Investing Opportunity

Several factors contribute to the optimistic outlook for industrial stocks. First and foremost, the ongoing recovery from the economic downturn provides a fertile ground for growth in various industries. As businesses invest in modernizing infrastructure, technological advancements, and capacity expansion, industrial companies are poised to thrive.

Moreover, the accelerating pace of innovation in sectors such as renewable energy, automation, and artificial intelligence presents immense growth potential for industrial stocks. Embracing these transformative technologies positions companies in the sector to stay competitive and capture new market opportunities.

Central to the captivating growth prospects of industrial stocks is the transformative power of artificial intelligence (AI) and robotics. As industries rapidly embrace these cutting-edge technologies, companies in the industrial sector are poised to lead the charge in efficiency, productivity, and innovation. Automation-driven solutions and smart robotics are revolutionizing traditional manufacturing processes, leading to improved cost-effectiveness and superior product quality. With AI’s ability to analyze vast datasets and derive meaningful insights, industrial companies can make informed decisions, optimize operations, and identify new avenues for expansion. This convergence of AI and robotics propels the long-term growth trajectory of industrial stocks, positioning them as frontrunners in the evolving landscape of global industry.

Conclusion

In conclusion, the current chart analysis and the completion of a 10-year bullish reversal pattern present an enticing long-term investing opportunity in industrial stocks. The respected channel and potential for sustained growth make this an attractive proposition for investors seeking to capitalize on the market’s long-term potential.

As with any investment decision, thorough research, diversification, and risk management are critical components of a successful long-term investment strategy. By embracing the long-term outlook and staying informed about industry developments, investors can position themselves to benefit from the growth prospects of industrial stocks and achieve their financial objectives. It is justified to embrace the long-term investing opportunity that industrial stocks have to offer.

In our Momentum Investing service, we shared this alert with members Sector Rotation: Our Top Picks & Phenomenal Reversals in which we featured a few no-brainer long term positions from the NYSE Index (in the industrials sector). Sign up for instant access >>