We live in a world of information overload. That is why the news that really matters is almost invisible. Per our 1/99 Investing Principles only 1 pct of the financial news is relevant to investors. Here is one such example that ‘nobody talks about’: the S&P 500 is trying to confirm its breakout. It is the ultimate test for the S&P 500 (SPY).

This is one of those few important moments in a year on which smart investors pay serious attention.

This is the news that really matters.

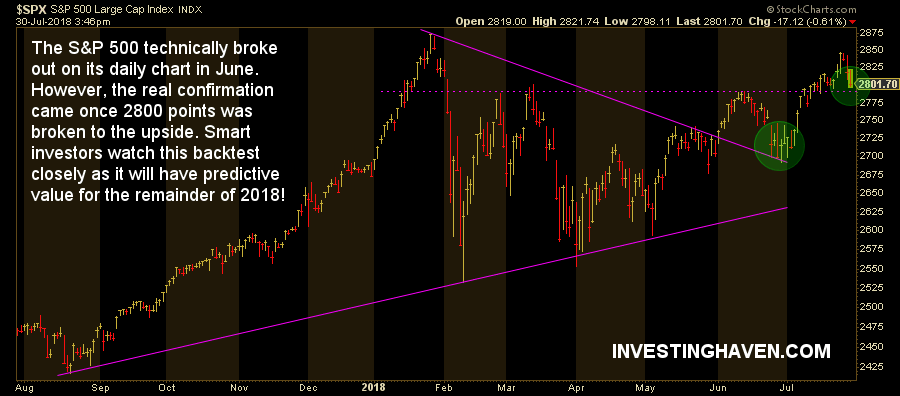

As seen on the S&P 500 daily chart embedded in this article the 2800 level is of crucial importance. Note that exactly one month ago we published US Stock Markets: Healthy Consolidation Almost Over, New Uptrend May Be Starting Soon in which we said that “the stock market retracement remained above resistance which is a good thing. As long as those price levels are respected there is no damage whatsoever, and stock markets will continue their rise, it is just a matter of time until the bull market resumes. All news that tries to make a bearish point is worthless whatsoever.” That was when there was quite some panic because of the trade wars and other related non-sense on mainstream media.

As there is so much information, and investors tend to forget fast, we want to re-iterate what we said in Risk On Indicator Favors The Global Stock Market Rally To Continue. “As said many times in the past, 20-year yields are also a great risk indicator. As said early 2018 The Most Important Chart Of This Decade is Yields and it is signaling a continuation of the ‘risk on’ sentiment in markets (it still does so today).”

Start with the chart, not with the news, is our mantra. Focus on leading indicators. For now, it says that the S&P 500 must hold the 2,800 in order to continue to be ultra-bullish. If not, it can retrace to the 2700 level, and even 2675, to be ‘just bullish’. It’s the ultimate test. That’s what really matters, that’s the really important news, the rest is most likely nonsense.