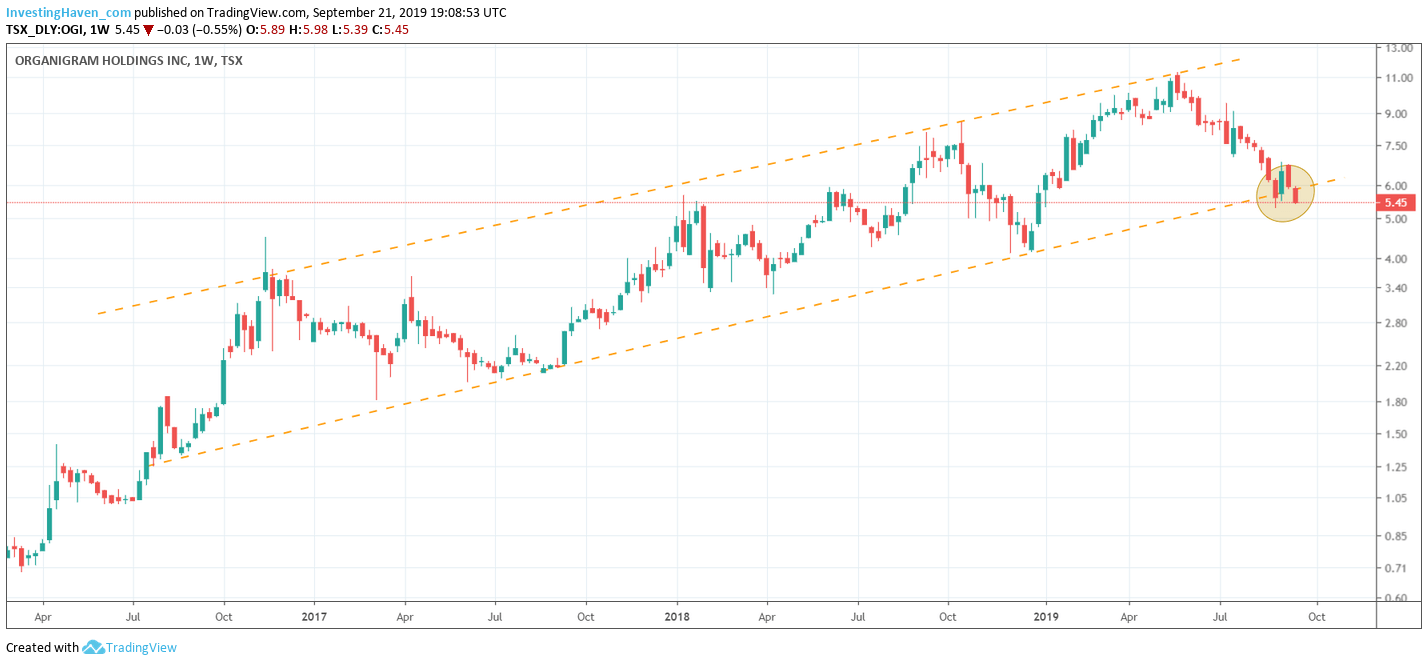

Organigram Holdings, symbol OGI.TO on the Toronto Exchange, is going for 4 full months through relentless selling. Yes, in this same period the whole pot sector has been dumped like never seen before. But we consider OGI.TO among the quality names, so seeing them lose more than 50% in 4 months is a big thing. It got so bad that OGI.TO officially registered a first weekly close in breakdown territory.

It is a month ago that Organigram Holdings graduated to the Toronto Exchange (upgraded from the Junior exchange). According to the press release:

“Graduating to the TSX is a significant milestone for us as a corporation,” says Greg Engel, CEO, Organigram. “Our stakeholders have an eye on this marketplace and this graduation will broaden our reach within the investment community and encourage new investors to learn more about our business, our growth plans and corporate objectives.”

Instead of attracting a bid it seems that selling accelerated. This one positive week in the first week of September did not help yet.

We keep on looking for data points that might suggest bad things are happening inside the company. Think of how EMH.V raised capital and shares as of April of this year, and wasn’t vocal about it (we could only find out by reviewing the SEDAR.com documents): The Verdict On Cannabis Stock Emerald Health Therapeutics (EMH.V)

Nothing of all that is happening with OGI.TO.

Even the shares short report from Sept 20th shows this company has 1,123,420 shares short which is approx. 1% on shares outstanding.

All in all we see a ‘throwing the baby out with the bathwater’ phenomenon taking place here.

Regardless, bearish momentum is bearish momentum, and it continues until it doesn’t.

We keep a very, very close eye on OGI.TO as there are crucial days for this stock!