Pandora has recovered strongly after hitting a secular bottom in 2018. InvestingHaven’s research team is on record with a Pandora stock forecast for 2019: $12 at a minimum. Depending on the situation of broad markets, the music streaming sector and the outlook of the company in 2019, we may see prices in the $18 range by 2020.

Which method do we apply to do a stock price forecast like this one for Pandora? Very simple, it is based on the principle ‘start with the chart’.

InvestingHaven’s buy alert on Pandora very successful

Early this year InvestingHaven flashed a buy alert. Specifically, it was on April 27th this year when Pandora was trading at $5.4. Since then Pandora’s stock has risen 44 pct. That’s in 3 months time. This Pandora stock forecast is certainly one of the best we did in 2018!

Read the article with the chart setup in which we signaled a buy signal was triggered for Pandora’s stock: Online Streaming Stock Pandora Flashes BUY Signal In 2018

Particularly, this quote attracts our attention in the article we published 3 months ago: “The two things that stand out on Pandora’s chart, according to our 1/99 rule which says that only 1% of price points on a chart matter: the successful test of secular support early 2018 combined with the breakout attempt at $5.4.”

In other words, this is a great example of how a chart pattern has predictive value. It is one of the reasons why we recommend to apply the principle ‘start with the chart’.

A Pandora stock forecast for 2019

InvestingHaven stands for the investing principle ‘start with the chart’: the chart is the first data point to review. For the purpose of this article, only if Pandora’s chart looks attractive will we continue with our Pandora stock forecast for 2019 and beyond.

Pandora stock forecast: start with the chart

Per our 1/99 Investing Principles, only 1 pct of price points on a chart is relevant for investors, the other 99 pct is rather useless.

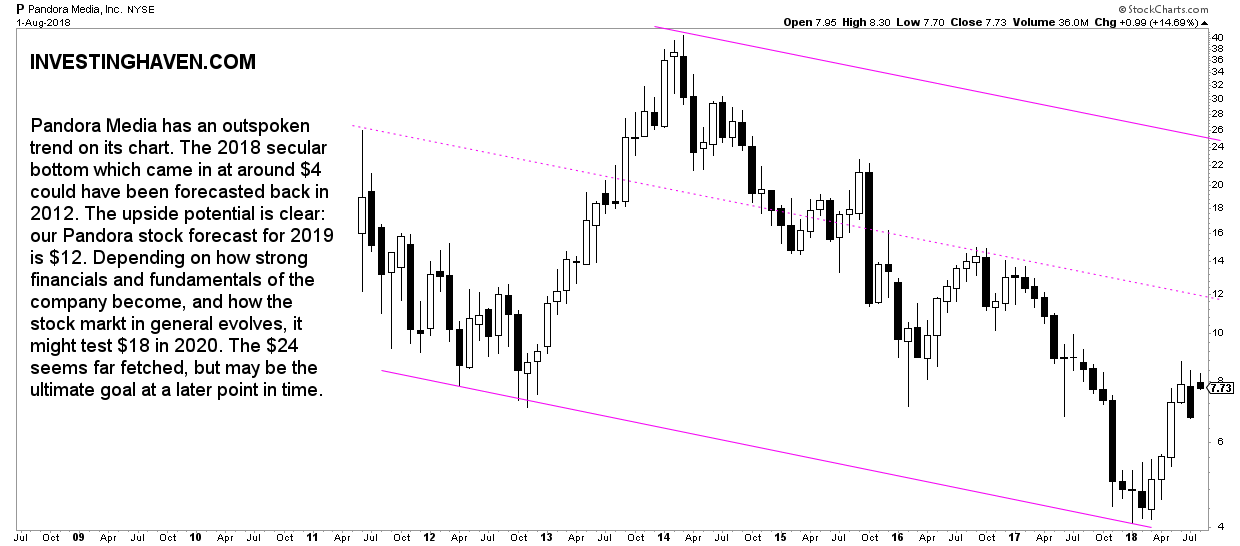

So per Pandora’s stock chart, obviously the monthly chart, there is an outspoken and clear pattern. As seen below, Pandora’s long term pattern is a channel with a media line (dotted line).

Remember, the reliability of our Pandora stock forecast rises the pattern is clear.

After Pandora’s IPO there was a (strong) retracement, which is a rule rather than an exception. The streaming music sector peaked in the first weeks of 2014 after which it literally crashed during 4 full years.

2018 was a great year as Pandora’s stock price tested the lowest support trendline.

This is an important insight in attempting to do our Pandora stock forecast. The absolute bottom on Pandora’s chart which it hit in 2018 could have been forecasted 4 years ago. How? By connecting the major selloffs in 2012. Yes, it is possible to forecast future price targets many years in advance.

For now, the chart suggests that Pandora is on its way to rise to $12.

Financials for Pandora

The second area to review, as part of our Pandora stock forecast, is top level financials, after we got green light from the chart analysis. What do Pandora’s top level financials look like?

- Quarterly revenue is on the rise. It went from $316M at the end of March of last year to $395M at the end of December last year

- Earnings per share (EPS) of -2.3

- Future EPS of -0.24

- Cash position of $496M

- Debt/equity ratio of 6.15x

- Shares outstanding are slightly higher in recent quarters: from 237M in March last year to 252M in March 2018

Admittedly, these are mixed figures. A very healthy revenue stream with serious losses and some shareholder dilution because of new shares outstanding.

Where does this leave us with our Pandora stock forecast for 2019? The outlook and fundamentals will be the crucial factor, see below.

Fundamentals of Pandora

Last, the fundamentals of the company are primarily the dynamics in its sector combined with the outlook of the company.

The sector is has picked up very well this year. Other major music streaming providers did well this year, so the sector has momentum.

What’s even more important is the outlook of Pandora. In applying the 1/99 rule we find this one piece of news which really is important and relevant to investors: Pandora CEO talks about partnerships and self service ad integration. This one quote stands out, and it really is an important data point for Pandora’s business outlook:

After single-digit stock gains immediately after the report was released, shares rallied following the remarks on the earnings call from Chief Financial Officer Naveen Chopra. He said the company expects revenue of $390 million to $405 million in the third quarter, compared with analyst expectations of $395 million.

“Our revenue guidance reflects the fact that we project continued momentum in our subscription business, albeit at a moderated growth rate as we are no longer growing off a small revenue base,” Chopra said.

Similarly, in the detailed transcript of the latest earnings call, we see this business outlook:

“We expect Q3 total revenue to be between $390M to $405M, the midpoint of which implies 10% growth vs the year ago period. Our revenue guidance reflects the fact that we project continued momentum in our subscription business albeit at a moderates growth rate as we are no longer growing off a small revenue base. Additionally, we expect an improvement in the year-over-year trend for advertising revenue, aided in-part, by the inclusion of AdsWizz-related revenue. We expect Q3 adjusted EBITDA to be in the range of a loss of $10M to a loss of $25M.”

What this learns is that Pandora is looking for ways to increase their revenue. A self service advertising solution is of course a catalyst for new and increased advertising, similar to Google and Facebook.

Pandora stock forecast 2019 of 12 USD

We conclude that our bullish Pandora stock forecast for 2019 is confirmed by Pandora’s chart as well as fundamentals. This leaves us with a high level confidence forecast of $12 by 2019, and, most likely, unless a crash takes place in broad markets, $18 by 2020 or the year after.