If anything markets are constantly ‘on the edge’ in recent weeks. And many ‘decisions’ are made pre market and after market hours. We have witnessed multiple occasions in which the S&P 500 was testing a major breakout/breakdown level during a trading session, only to open the next day with a gap up of 3 to 5 pct. How exactly to play this, medium term and short term? And what about our long term bullish stock forecast: Dow Jones Forecast For 2020 And 2021?

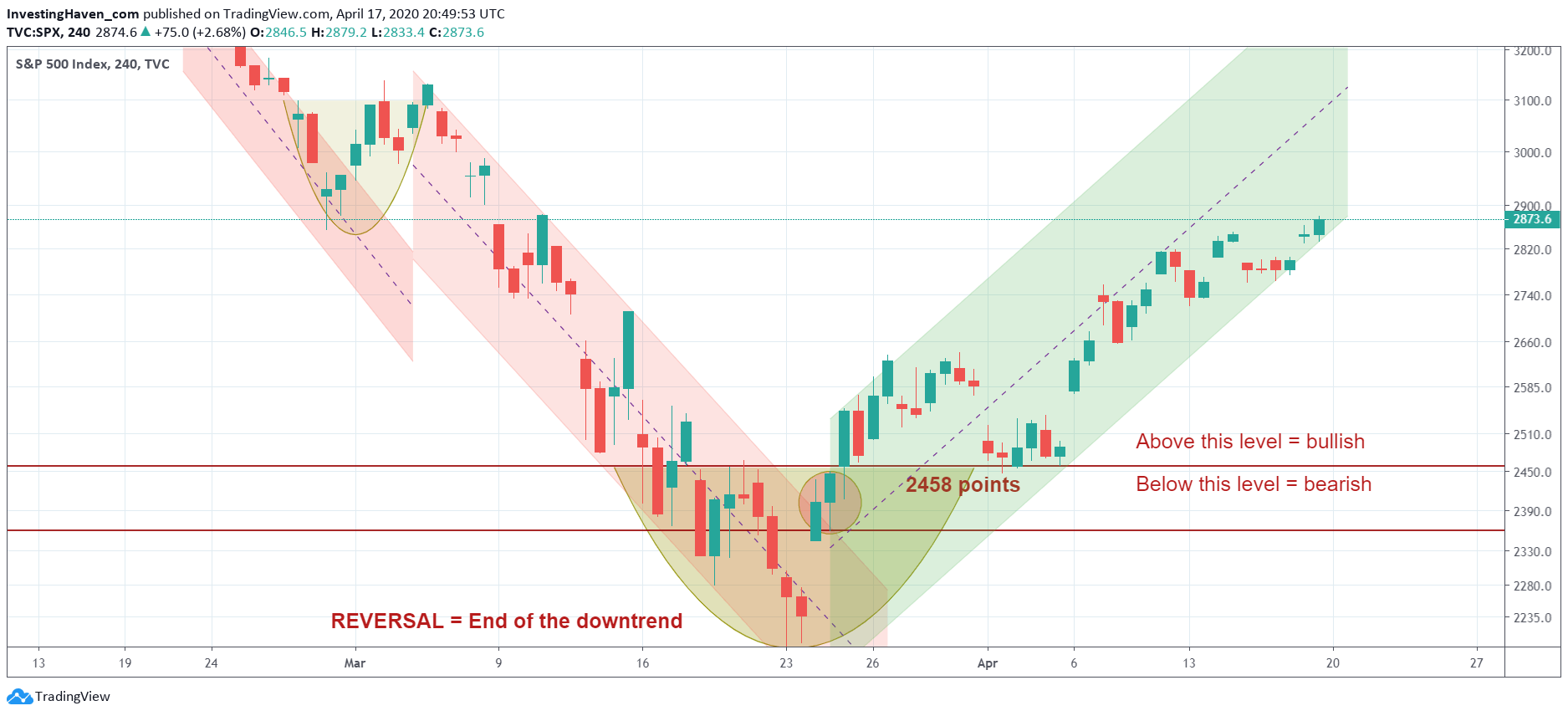

First of all, let’s map out on a chart what we mean by ‘on the edge’.

Let’s start with the 2458 level. Between April 1st and 3d, this level was tested multiple times. Any position was hard to justify those days. On Monday April 6th markets open with a gap up, and moves more than 5 pct higher that day.

Similarly, on Wed April 15 and Thu April 16, markets were testing again the same ‘edge’ of a short term rising channel. Very tough call to get in … what if the test fails and markets go lower (the backtest of 2458 would be next, a 12 pct decline). On Thursday after market hours futures rise +3 pct.

So here are key observations for short term and medium term portfolios which we shared in our weekend updates to our premium members:

- Short term trades: we believe risk management levels have to be very high, but the frequency of short term trades have to go down. The reason is not only what we explained before but more importantly the unusual fast pace of change. Something, somewhere, somehow in any short term trading methodology has to be adjusted to deal with these market conditions.

- Medium term investments: what stands out is the week-on-week market rotation. Every other week there is another sector that leads markets higher, and those leaders tend to underperform the week after. Combine this with ultra high volatility, and most investors find themselves chasing prices higher, from sector to sector, week on week. This is ultimately bad for results, and the antidote we propose to our members is to bring in more stability and accept the fact that in a given week a market may be trending but not the one we are invested in. It’s a mental game, it’s an emotional challenge, as an answer to the market challenge.

These markets are very misleading, and many investors even are not aware of this. They see indexes move higher, and check their accounts against moves of indexes. It’s literally an explosive mental and emotional reaction that an investor evokes by playing this game. More than any other time, a good balanced way to take trades / choose markets / pick timeframes is required. Anyone who has the skill to read a chart, and sees below chart, knows what we are talking about.