Stock markets are in a sideways trend for 18 months now. The vicious sell offs as seen twice last year did not return recently so the risk of a stock market crash has gone away. As per our assessment published recently we believe global stock markets will be bullish going into 2020 because of our stock market leading indicators: the Russell 2000 (RUT), 20 yr Treasury rates as well as the Euro. So far everything is lined up for a bull market continuation of global stock markets even though we are going through a critical test at a make-vs-break level!

We only look at the Russell 2000 index in this article.

As per our investing method it is only the Russell 2000 index that matters, not the other indexes like the S&P 500 or the Dow Jones.

Also, we focus on the Russell 2000 index as a proxy not only for U.S. stock markets but, more importantly, as an indicator for risk sentiment. In other words if the Russell 2000 index is in a bullish trend we can expect investors to be willing to take risk.

Why is this important?

Because this gives us green light (or not) for what most investors dream about: catching multi-baggers in high beta stock segments. Think of cannabis stocks, gold stocks, blockchain stocks, and so forth.

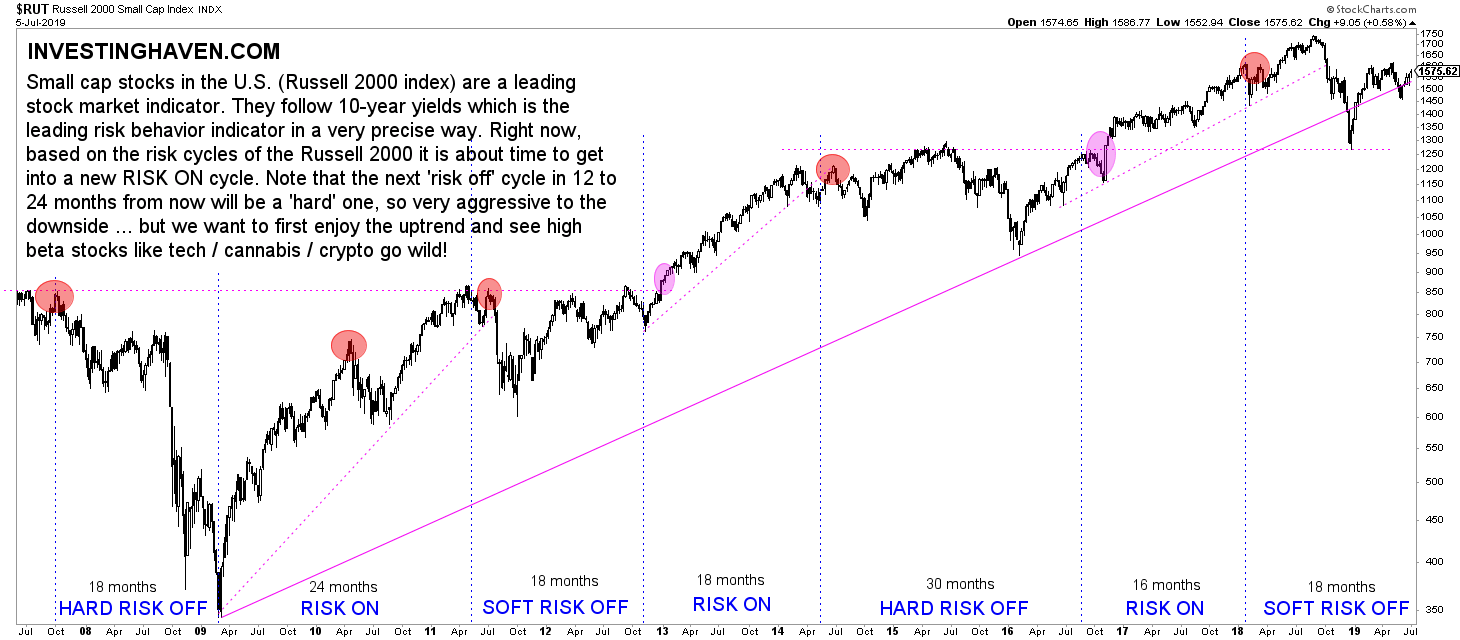

As seen on below chart with our annotations representing our proprietary view on risk cycles the Russell 2000 index is now going through an 18 month risk off cycle. It is now testing crucial support, a real make-or-break level.

We want to see this index rise above the red circle which represents the start of the risk off cycle in January of 2018. A sustained rise above 1625 points would mean (1) a rise above the starting point of the risk off cycle (2) a rise above rising support. It would imply the start of a new risk on cycle.

This would not only give green light to stock markets but more so to high beta stocks like the ones mentioned above.