It will be an important week for stock markets, globally. Three weeks ago Black Thursday, last week the start of a V-type reversal. However, it’s not a given that this V-reversal will continue. It may become a W-reversal or it may even invalidate. What are we watching for a confirmation?

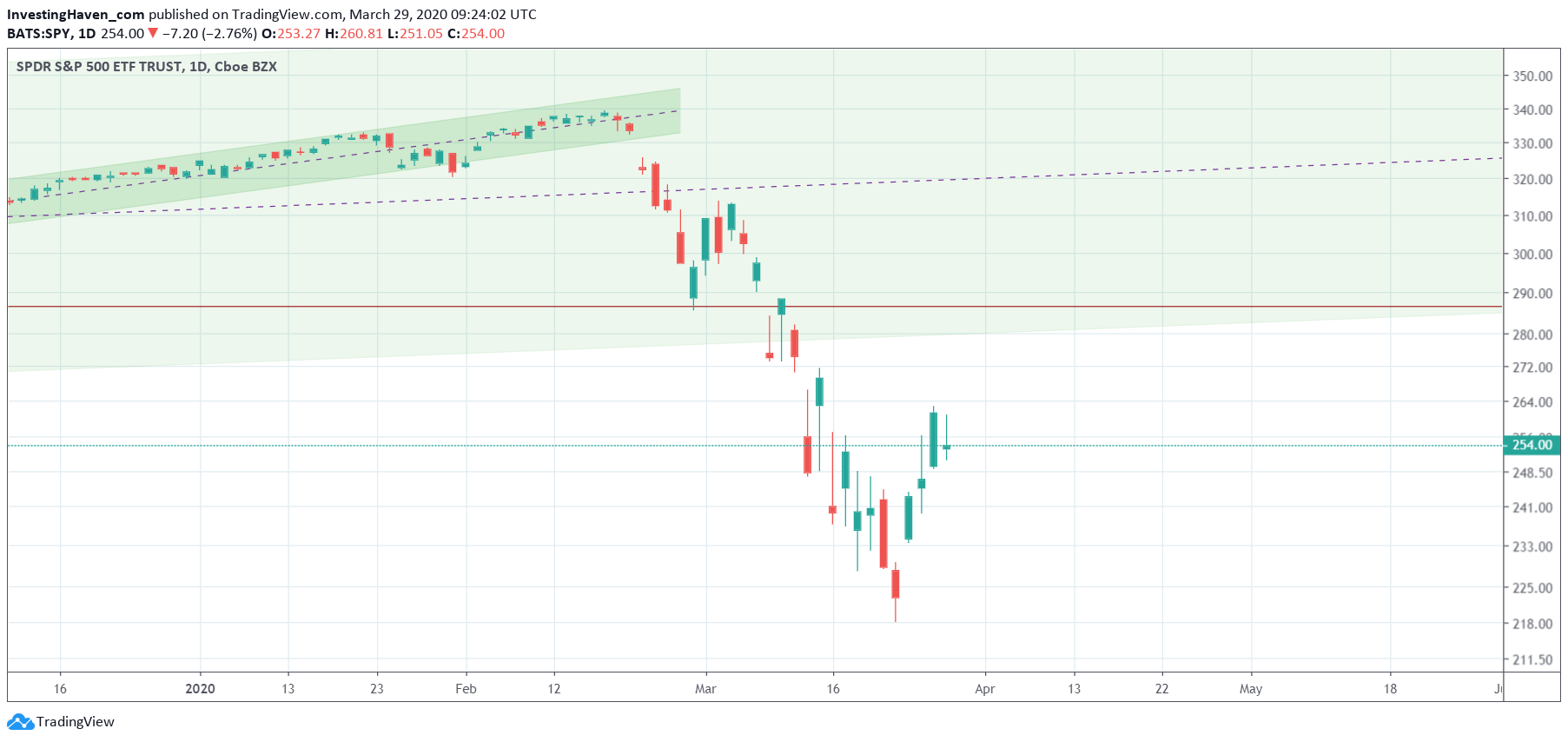

Below is the S&P 500 chart.

Good luck taking a trading solely based on this chart. It can go any direction. A trade at this point is like a coin toss.

We need much more information before taking a trade decision, especially short term trades.

The formation currently might look like a V-shaped recovery, but it can morph into a W-reversal or even a crash continuation in the next 2 trading days.

At InvestingHaven we use several indicators to understand (1) what may lie ahead (2) the very precise price levels for this formation to confirm a V, morph into a W or worst case scenario continue crashing.

At this point in time our method indicates that a formation between V and W reversal is the most likely scenario to play out.

With our method we prepared a trade last weekend, and it resulted is a quick 10% profit in our short term portfolio last week. Similarly, in our medium term portfolio we hold 2 very promising positions as well as a bit of cash to play the next trend(s).