Are you feeling anxious when reading this headline? That’s normal, you look around you, all you see is doomsday predictions about markets. The idea of a stock market crash in 2023 is dominant and will remain dominant for a few more months. But is it wise to follow the headlines? Let’s be very clear: the headline we used is not OUR headline, but what’s dominant out there currently. We look at two illustrations from 2022 to help you understand that these type of headlines are characteristics of turning points. You are free to make your own decision about the credibility of the “all hell will break loose” headlines about stocks in 2023.

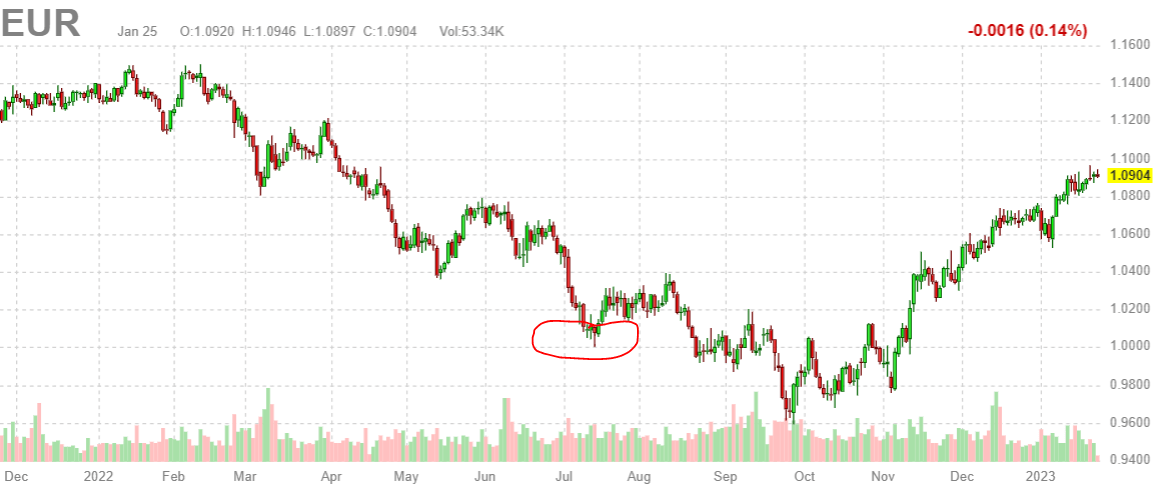

It all started with the EUR who fell to parity last summer.

Euro Falls to Equal the U.S. Dollar for the First Time in 20 Years

This headline is scary, especially as it was happening when inflation numbers were hitting 40 year highs. The Euro hit parity over summer, the article above was published on the NY Times on July 13, 2022.

This is the first paragraph:

In recent months, pressure on the euro has been mounting while investors have been flocking to the U.S. dollar, a haven in times of economic upheaval.

With the benefit of hindsight, we can look back at the EURO chart and see when this article appeared. No surprise, this article appeared exactly at a level where the EURO bounced in July and below which a bullish reversal was created in the period September/October (in the form of a W reversal).

Obviously, anyone who was concerned thought it was the right thing to do up until November when ‘suddenly’ the Euro started moving sharply higher along with stocks.

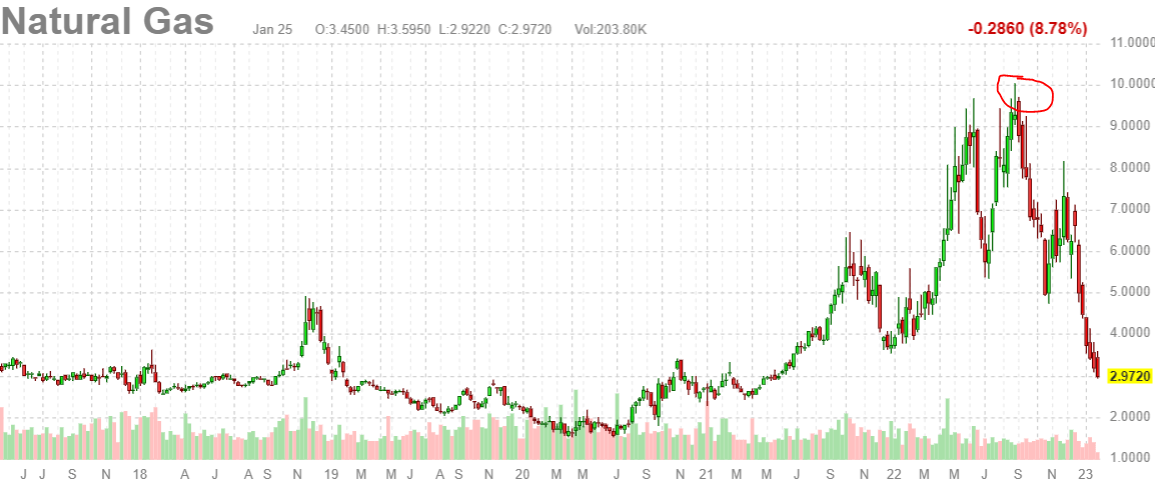

Here is another illustration, even more extreme: natgas.

The price of gas went to 10 /MMBtu last summer. This sparked beliefs about the natgas price going parabolic, all driven by the narrative that Europe would fall witout gas over the winter. It created a mental picture of an entire continent without heat, doomsday pictures. The conspiracy theorists predicted another lockdown-type drama, this time a winter without heat for hundreds of millions of people. The price of gas would go ballistic because of the supply/demand shock in gas.

This is the analysis (labeled by them, not by us) as it appeared on Reuters: ‘New shock’ for European markets as gas price spike fuels inflation fears.

This article appeared on August 24, 2022. The first paragraph:

LONDON, Aug 24 (Reuters) – Another dramatic spike in natural gas prices appears to have ended any hopes that Europe’s inflation battle is set to ease, with financial markets now bracing for higher prices, a faster pace of interest rate hikes and a deeper economic downturn.

With the benefit of hindsight, we look at the chart of natgas, the weekly chart. The circle with giant ‘wick’ is when the article appeared.

Those taking long positions in natgas at that point in time, based on thorough and reliable analysis by trusted names in financial media, might have been hurt, a lot potentially.

Those taking long positions in natgas at that point in time, based on thorough and reliable analysis by trusted names in financial media, might have been hurt, a lot potentially.

That’s what happens when you act based on fear and headlines.

Also, be careful with narratives. It’s the mother of all f*****s in markets. We explained this in 7 Secrets of Successful Investing.

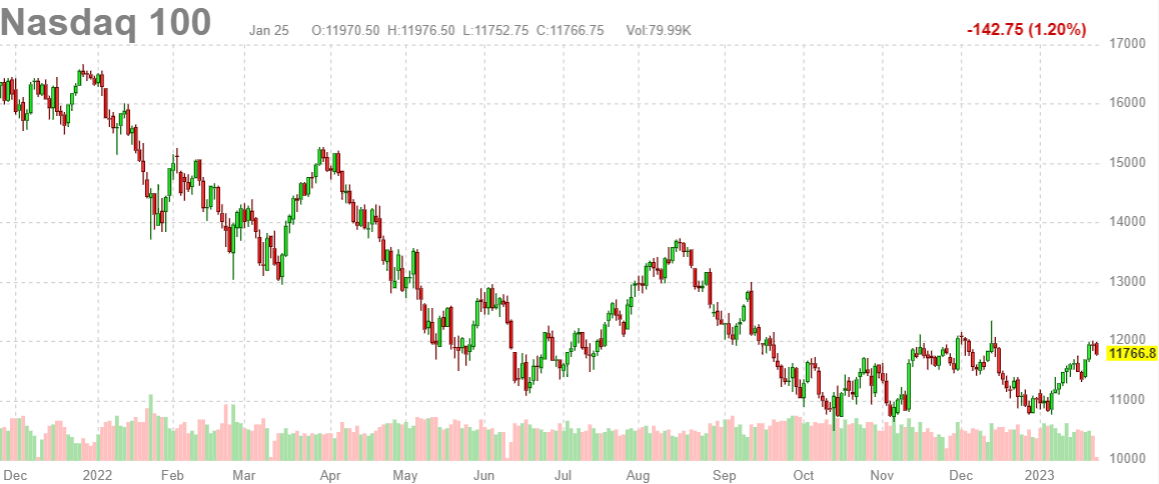

With all this in mind, look at what is appearing in financial media today: The Nasdaq is our favorite short. This market strategist sees recession and a credit crunch slamming stocks in 2023.

Waaw, this strategist clearly did not read InvestingHaven’s work:

- 2008 vs. 2022: Similarities and Differences

- Are Economic Experts Lying Or Confused Or Both?

- The Market Will Not Move 50% Lower Contrary To What The Gurus Are Telling You

- Must-See Charts: Q1/2023 Will Be Crucial, 7 Timing Conclusions, 2008 Comparisons (only for premium members)

That’s fine, we don’t expect strategists and gurus to read our work. They have their own method, we have our own method. No problem at all.

What we do know, based on ‘headline analysis’, is that the most extreme headlines appear near major turning points. Still doubting about this? Then let’s check the Nasdaq chart. What do you see? The answer: a bullish reversal.

Good luck going after fear-mongering headlines.

We recommend readers to check the latest research materials we published in our Momentum Investing research service, all available in the restricted area. We analyze markets based on ongoing trends, turning points and the time axis. Those are the components of thorough analysis, not headlines.