There is an enormous fear among investors about an upcoming recession. In fact, ‘everyone’ already accepted that a recession in 2023 is unavoidable. While a recession might come, it’s not ‘a given’ it will happen. In fact, there is a solid case to be made that a ‘rolling recession’ hit the world in 2022 and that it is near completion. If our thesis is true, then there will be no stock market crash in 2023. That said, here is one really interesting data point that confirms our thesis which supports most (if not all) of our 2023 forecasts.

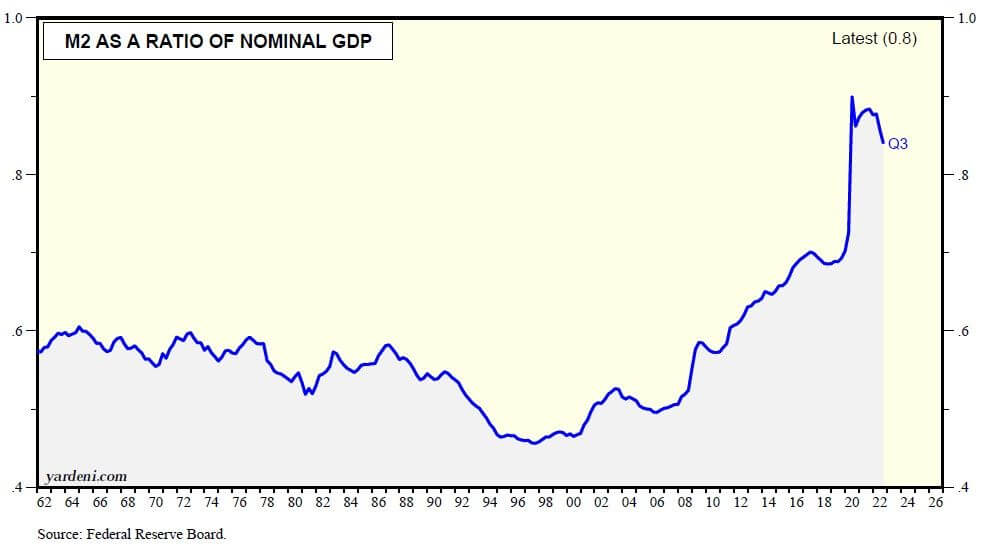

The data point below is M2, one of the measures of the money supply (source: Yardeni Research).

While it is true that M2 is shrinking lately, the point is that it is doing so from elevated levels. The fact it started shrinking is a standalone data point that requires context.

One of the ways to bring some context to the M2 money supply trend is by looking at it in a relative way. Below chart does so, it looks at M2 as a ratio of nominal GDP.

The economy remains awash in liquidity, with the ratio of M2 to nominal GDP (i.e., the reciprocal of M2 velocity) still near its recent record high, 84% during Q3-2022 (chart).

We picked this chart because it tells something about liquidity. Here is the point: if the market was about to start a market crash it would happen on absence of liquidity. All previous crashes came with a credit crunch. There are no such signs today, on the contrary, that’s what below chart tells us.

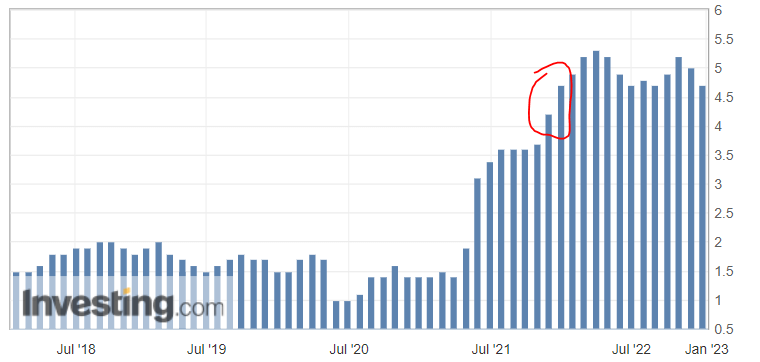

Moreover, as seen on the PCE inflation index below, month-over-month readings, we are entering a period in which monthly inflation readings will start showing significantly lower year-over-year readings.

Moreover, as seen on the PCE inflation index below, month-over-month readings, we are entering a period in which monthly inflation readings will start showing significantly lower year-over-year readings.

The acceleration started in November/December of 2021. Consequently, as of January 2023 (Dec 2022 readings), the y-o-y inflation readings will be against very high readings one year prior. This suggests that these cataclysmic headlines like ‘inflation at record highs‘ will be something from the past.

In our Momentum Investing portfolio we are fully invested and are playing the rebound of markets that we expect to start in Q1/2023. We hold positions in nicely valued payment software and semis, beaten down stocks in automotive and silver, among a few other small positions.