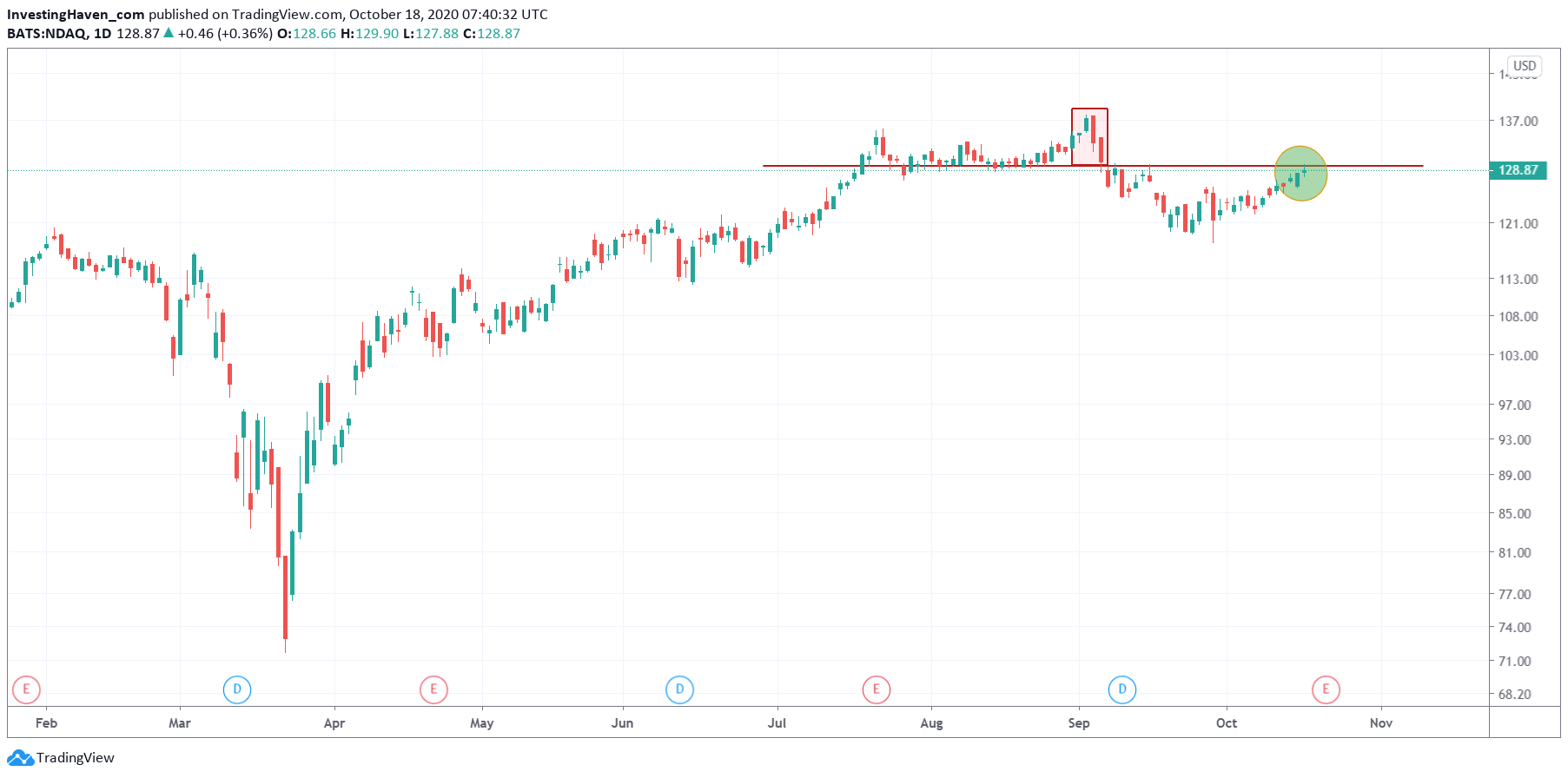

For more than 3 months now stock indexes have gone nowhere. They are playing with their respective make or break levels. They are fooling bulls and bears. They are creating hope, and the week after fear. Technology stocks are no exception to this, and a 5 second view on the Nasdaq chart says it all. We are still forecasting a good outcome, and we continue to hold a bullish market forecast for 2021. However, the short term is much less certain, also for tech stocks.

The Nasdaq chart says it all, and you don’t need to spend more than 5 seconds to get the message from this chart. You can even use the chart without annotations.

The strong and fast revival after the Corona crash lows is the big topic on this chart. The subsequent recovery had a rather short consolidation in the period May/June. July was a good month, but since early August (approximately) this chart is as flat as possible.

Needless to say the August support levels were breached in the September mini sell off. And support is now resistance. We are at a make or break level.

Now there is one important thing to note here: the last 4 weeks marked a rather bullish setup moving back to the current resistance level.

This may or may not mean anything for next week, unknown.

It will definitely mean something going into November and December. We may see a break up in the short term, or we may need another similar 4 week reversal.

But whatever happens in the short term we do know that 121 is the level that *absolutely* must hold for tech stocks to thrive in 2021.

And that’s the key point we wanted to convey in this brief update: KISS. Keep It Stupid Simple, also in financial markets and when investing. There is an overload of information out there, there are so many charts and indicators you can check. But you always, always have to be able to bring things back to the simplest possible conclusion which is maximum 3 price points or 3 conditions for you to work with in making decisions.