Markets in 2021 are very tricky. The perception that stock indexes create is one of a rosy market where all stocks are doing well. It’s the most misleading situation we have seen in a long time, to say the least. Under the hood, really ugly things have happened. This article is not meant to include any prediction nor 2021 forecast. It is only meant to be educational, and the moral of the story is this: risk management is always, always, an important practice even if a stock and indexes are hitting ATH.

Wait a second, how comes stock indexes trade at ATH while ugly things are happening ‘under the hood’?

The answer is very simple: extreme sector strength vs. extreme sector weakness.

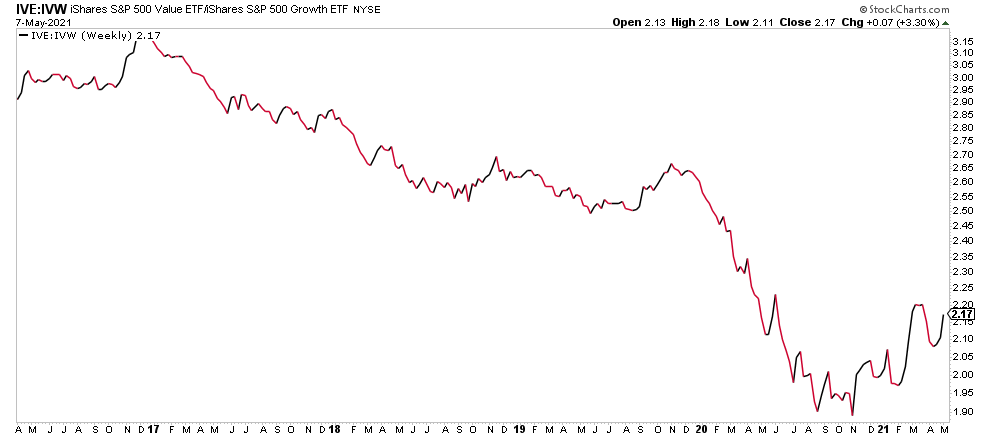

On the highest level it is the group of value stocks that are largely outperforming growth stocks. The ratio between both is mind boggling. Below is the weekly chart of that ratio.

To keep our members sharp, we picked out 4 of the most ugly crashes of individual stocks after they hit ATH recently. No surprise, most of them belong to the group of growth stocks.

The central point in all these cases is this: you don’ want to be caught up in a major top, especially if a fast decline starts which corners you. Getting out after a double digit red candle is hardly possible, and it’s by far the worst feeling an investor can have!

The first illustration comes from the electric vehicle sector. This daily chart of WKHS shows that a stop loss after hitting ATH would have had value.

Learning: Don’t get overly confident assuming that a stock goes from ATH to ATH.

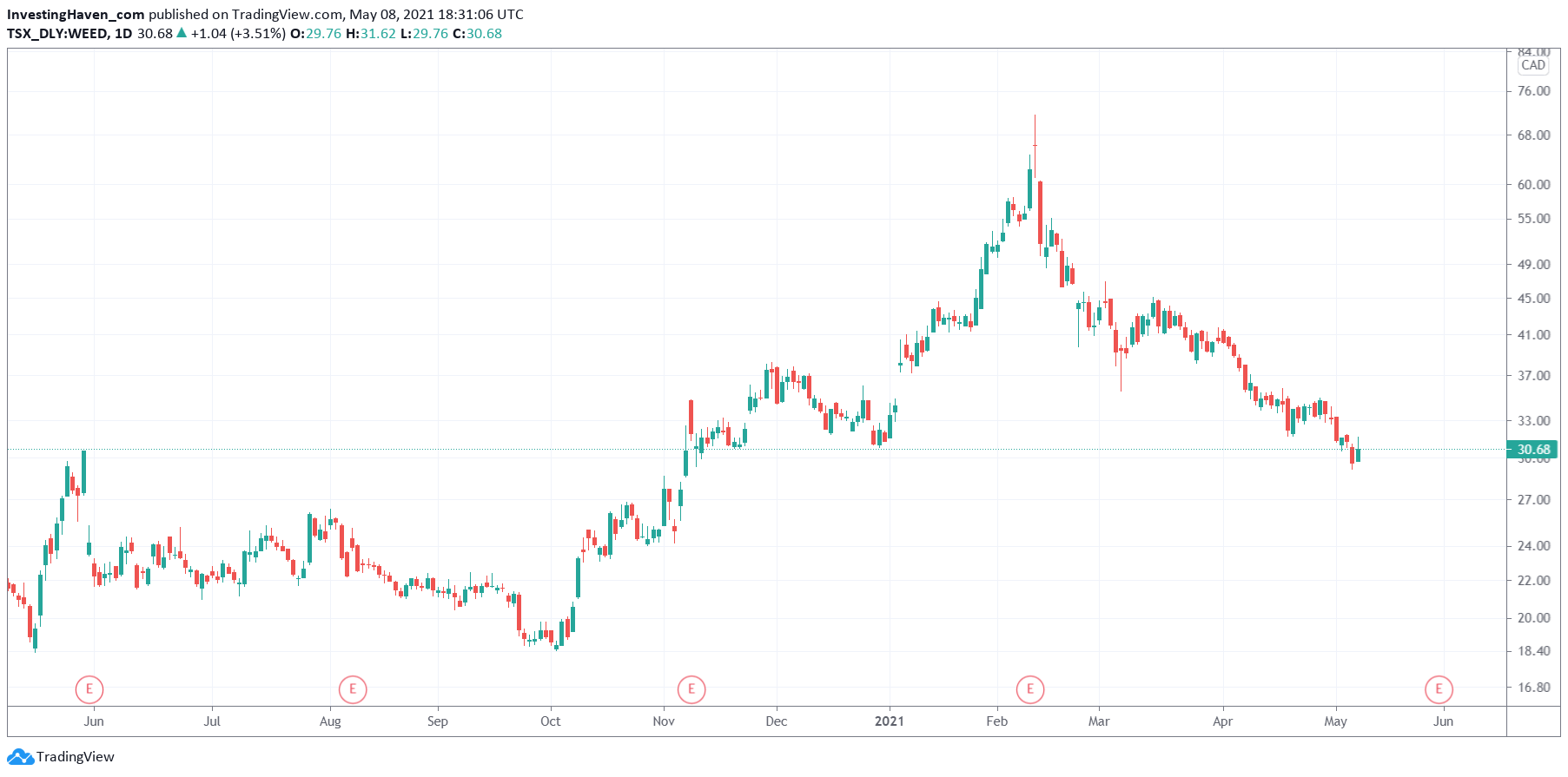

This next stock is the leader in the cannabis space. As a cannabis investor you could create bias by saying “Hey, Biden has a cannabis friendly policy, so the cannabis sector will continue to make ATH, let’s keep this position open even though I may have bought near rather high“. It won’t necessarily work out, and a stop loss (mental or real stop loss) would have served a real purpose in this situation.

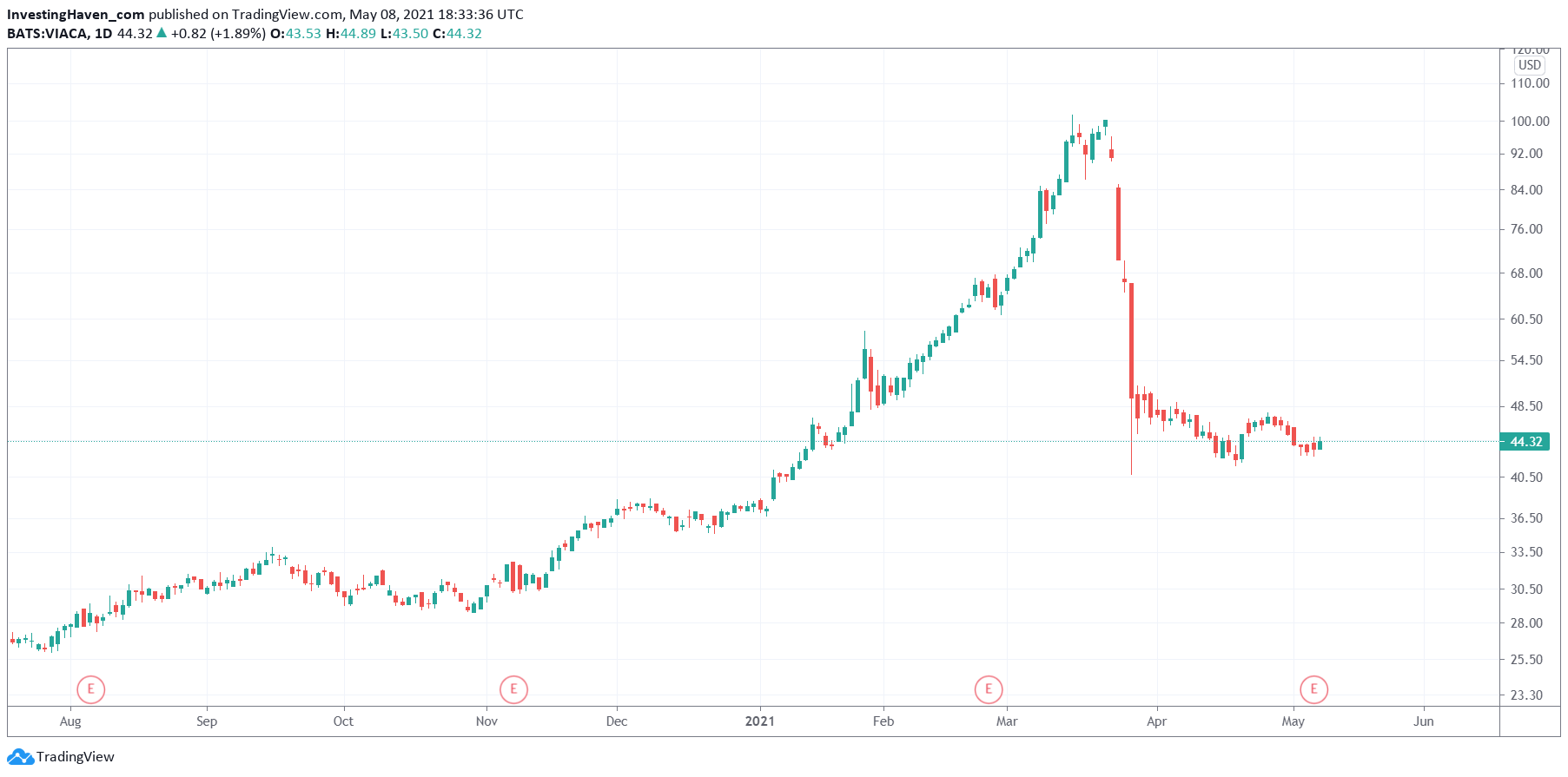

In the broadcasting space a real drama unfolded in March. No comment on the following chart. Several broadcasting stocks have a similar setup though not as dramatic as this one.

Learning: Discipline at ATH? Yes, it goes hand in hand!

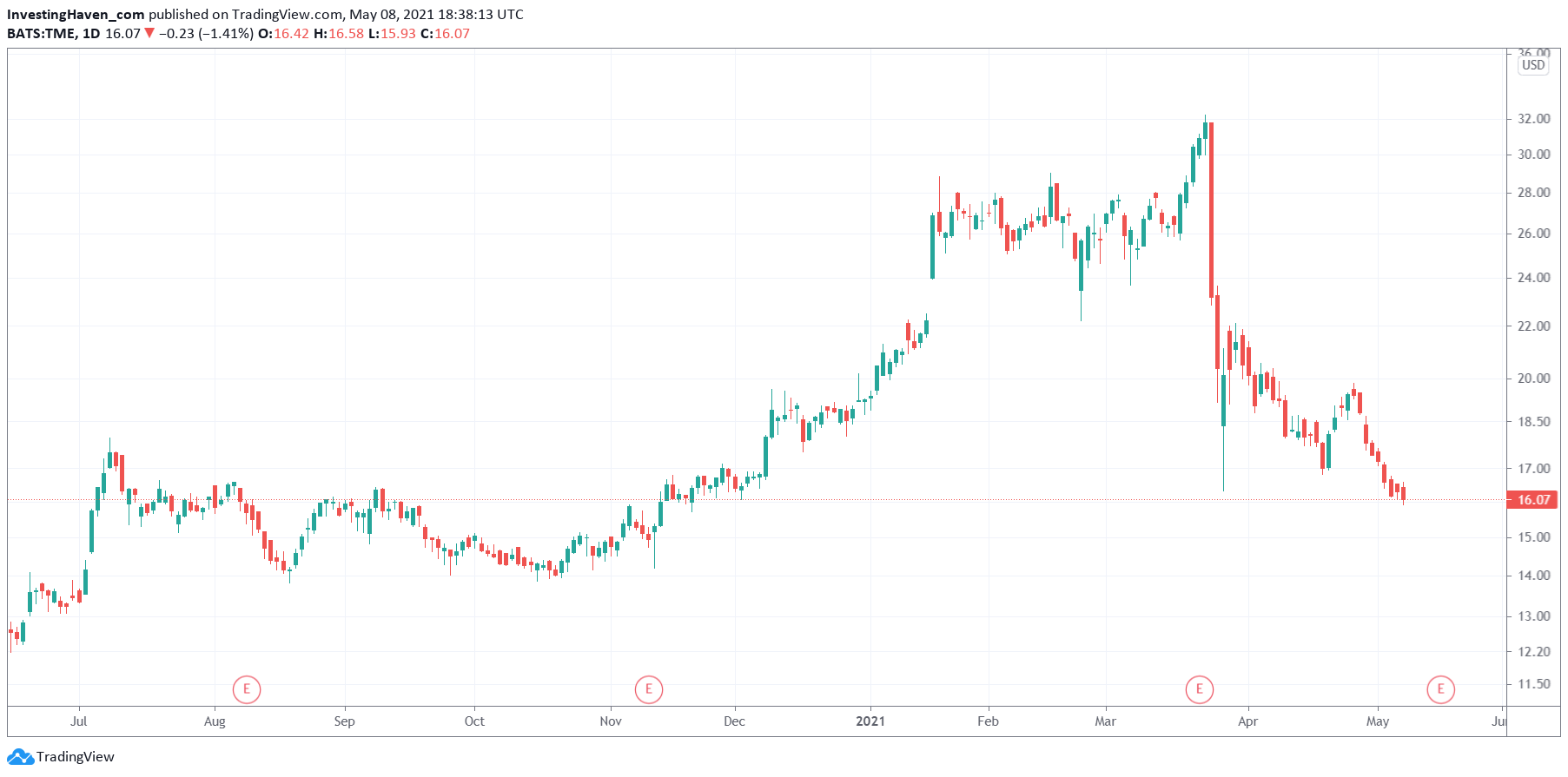

Last but not least, Tencent Music in China had a great outlook, fundamentally, and ATH excitement would have created a big issue to any shareholder holding this stock.