The Nasdaq was the first index to fall in 2022. The first 6 months of 2022 were dominated by weakness in growth stocks. In a way, the Nasdaq did lead the rest of the market lower. While the Nasdaq is not bullish, it might turn out to become the leader to push markets higher going into 2023. As said, Markets Should Resume Their Uptrend The Latest In March of 2023. The Nasdaq has an opportunity to shine in October and start supporting the rest of the stock market.

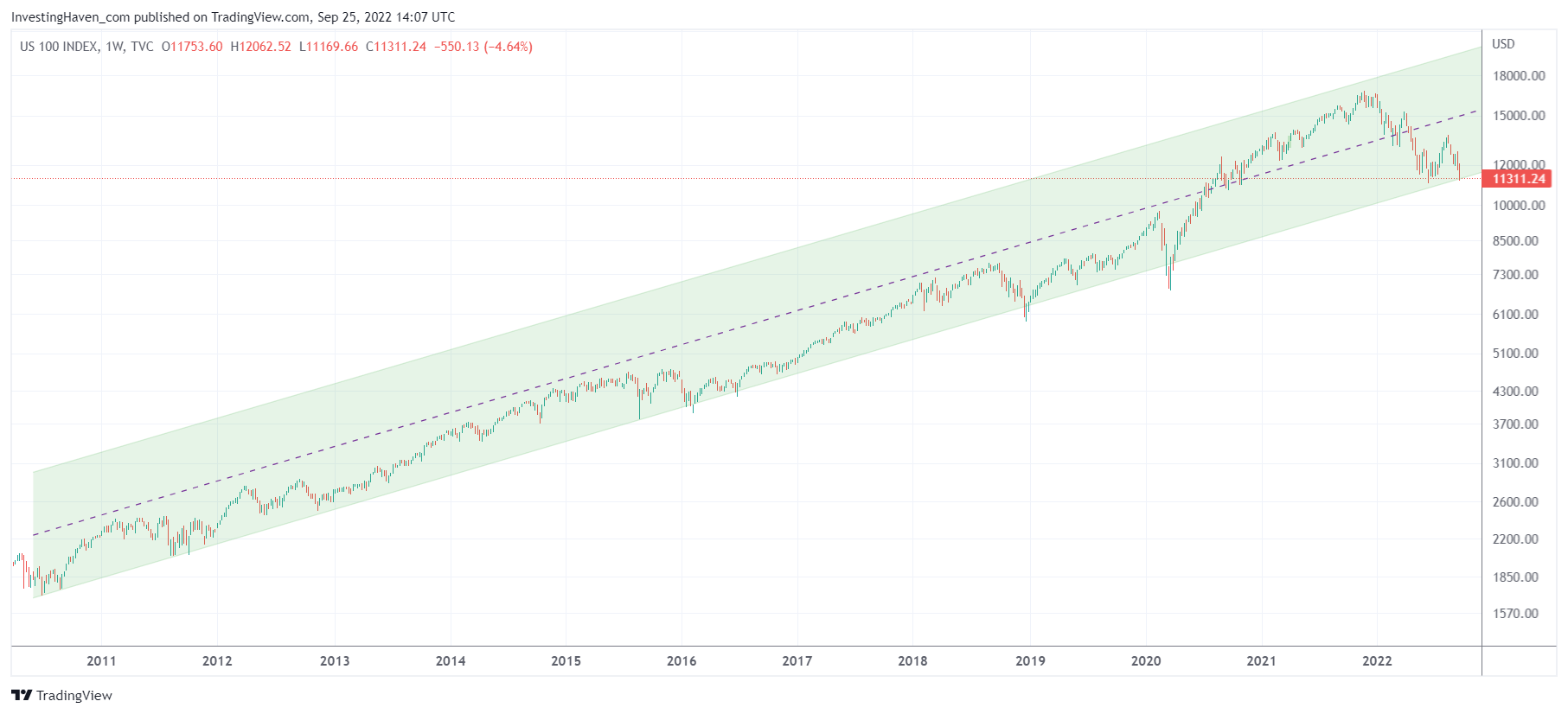

In order to back up the point that we made in our introduction we use this one long term Nasdaq chart.

This is the Nasdaq chart since 2010, after the big market crash. It has been pretty consistent in leading sell-offs but also in getting out of sell-offs. The Nasdaq reached a make-or-break level now.

If you look really carefully, you will notice how the current setup might become a bullish W reversal. Not there yet, the market needs to avoid a breakdown, but IF (that’s a big IF) the Nasdaq can move higher in October it will be a fantastic setup and epic buy opportunity.

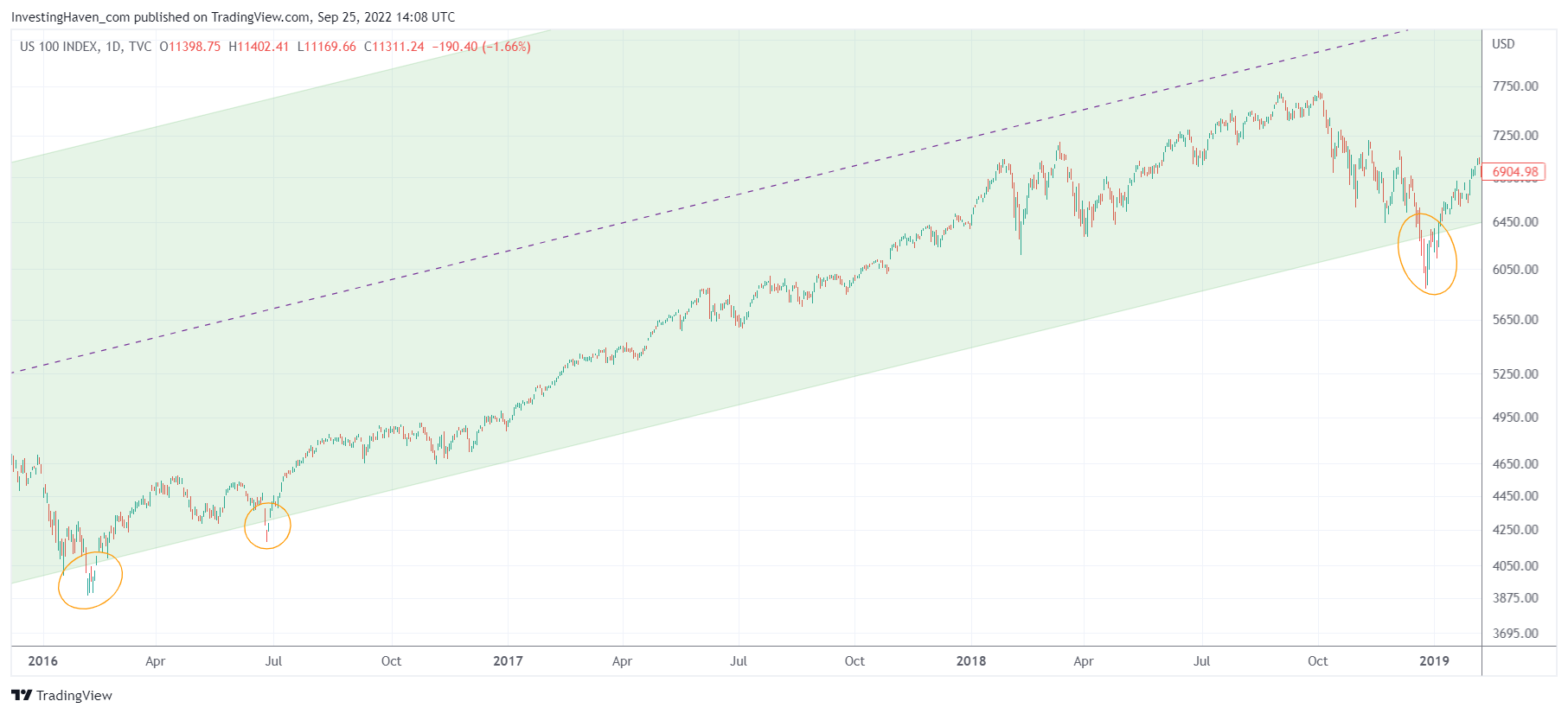

If we zoom into a few sell-off periods in the last decade we will see how the tests of support were really violent. We use the daily chart below (as opposed to the weekly shown above) to highlight the fake breakdowns.

In February of 2016, the Nasdaq spent 5 full days below this long term channel before re-entering. In July of 2016, it spent only 3 days below support. In December of 2018, it spent some 2 weeks right at support, bouncing to test support, print a higher low and get back into the channel as January of 2019 kicked off.

Next week will be all about testing support, in an aggressive way. The million dollar question is what the Nasdaq will do in the first week of October as it relates to its long term pattern.

We continue to believe that You Should Invest In Tech Stocks in 2023 (not in traditional energy). Last week, we got a confirmation that traditional energy stocks should be avoided. Next week, we might get a confirmation that tech stocks will drive the market higher going into 2023.