Two leading stock indexes are sending a mixed signal. Our forecast is for a choppy month of May, despite several bullish leading indicators. While systemic risk is contained, at this very point in time, we certainly do not expect a market crash (like many others) but rather a slow market with alternating bullish and bearish impulses.

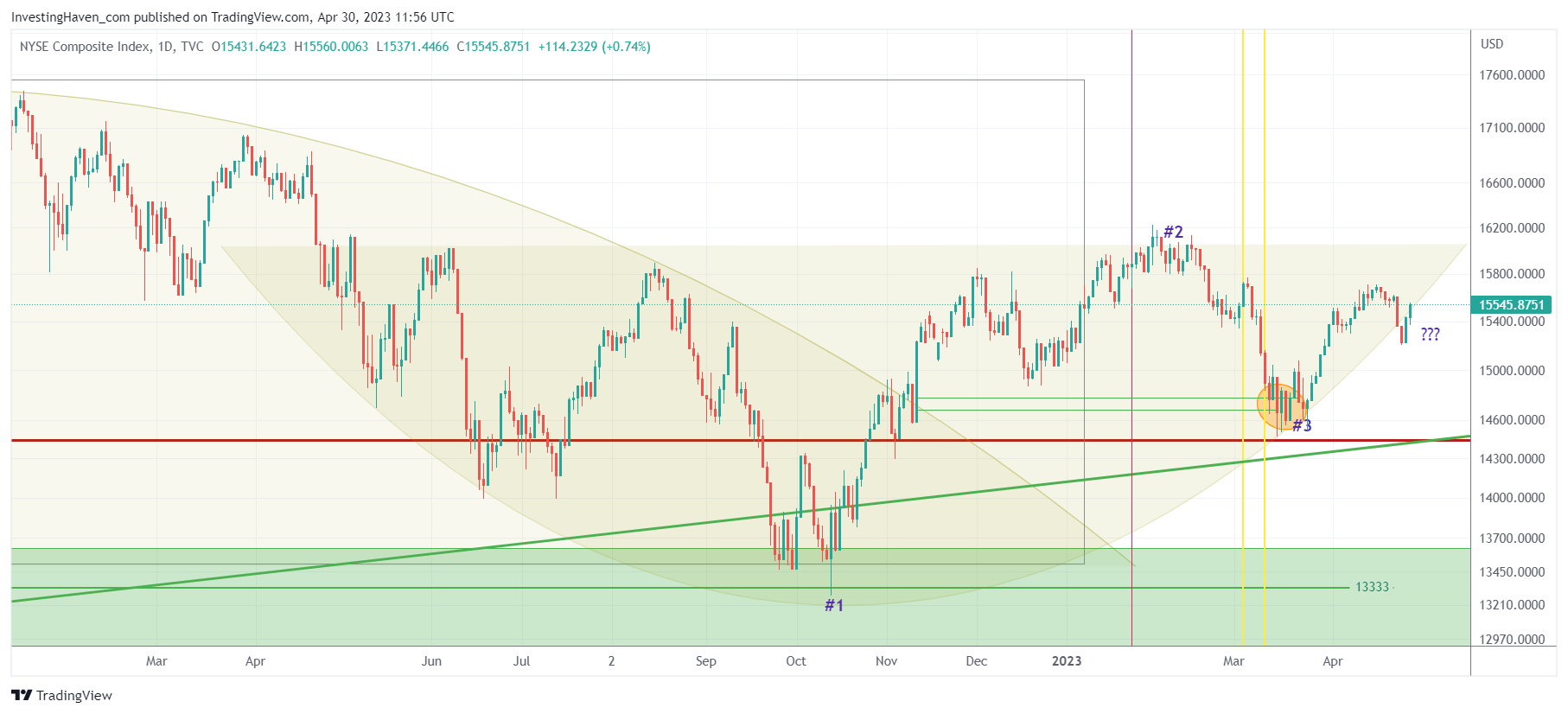

About a month ago, Investing Haven wrote an article on the markets and their downside target: Markets Downside Target Reached. The article forecasted that the markets would reach their downside target, which was expected to be a drop of 5 to 10 percent in the short term. The article was based on the chart analysis of the NYSE composite.

The article further elaborated on the reasons behind this forecast, which included the market’s overextended status, the completion of a long-term pattern, and the technical indicators suggesting a correction was due. The article advised investors to prepare for a potential drop and monitor the markets closely. The forecast was very precise, and the downside target was reached as expected, which validates the chart analysis and technical indicators used in the article.

Now, the question is, what’s next?

We look at the same rounded pattern in the NYSE Index, the one that gave us the downside target at the depth of the 2023 banking crisis. While the NYSE Index is trading some 7% higher, it is testing the edges of the 12 month pattern.

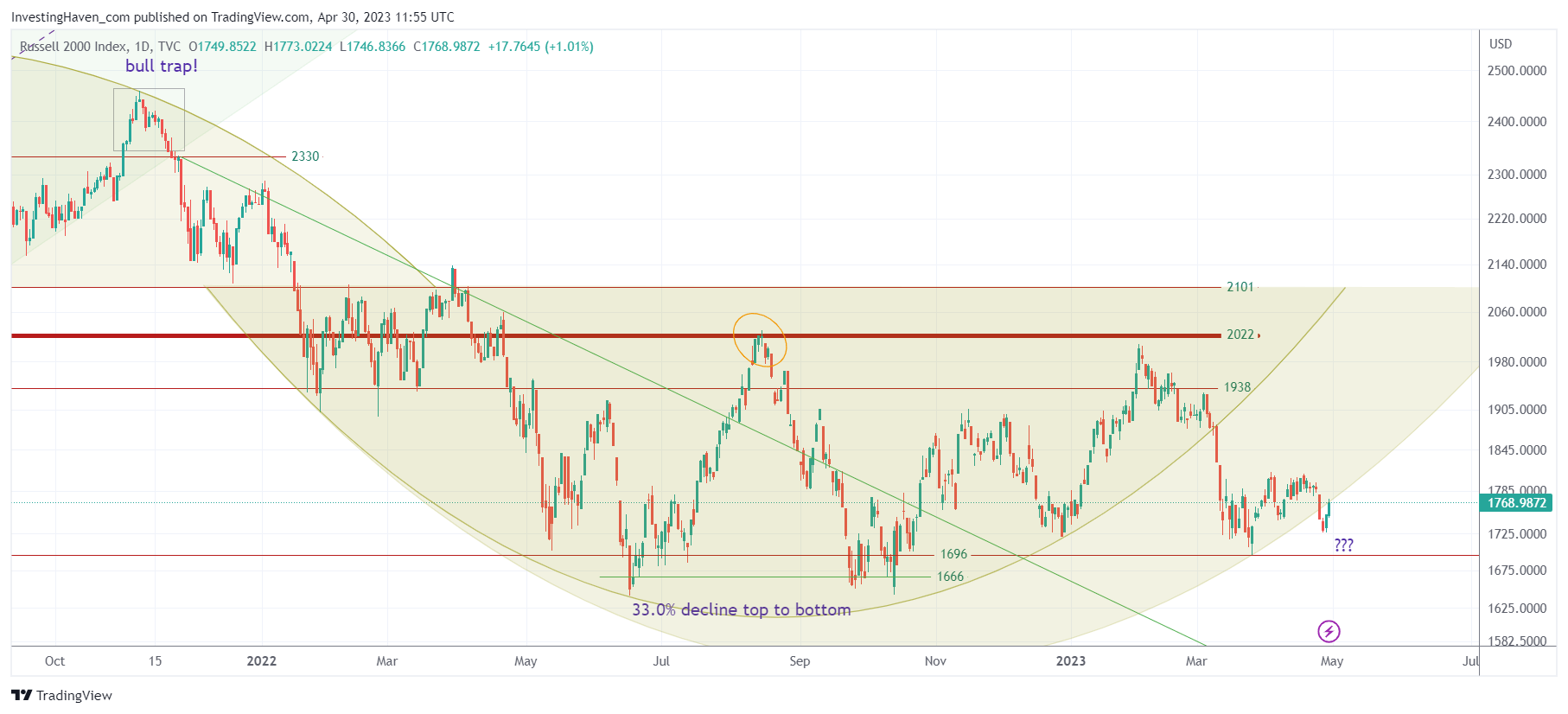

The Russell 2000 is also showing a similar setup.

Remember, a breakdown (similarly, any breakout) require 3 to 5 closing prices below a chart structure or price level. We don’t have this on the above charts, so arguably the rounded structures are still in place.

What do we make out of these setups? Also, what’s next, based on our leading indicator readings?

Honestly, we believe that hesitation and consolidation are the name of the game at the moment. The dynamics of rotation between sectors in the markets show that intra-market capital is flowing between sectors, but only for one to three weeks at a time. This dynamic is expected to remain dominant, resulting in a very consolidation with a bearish bias.

We expect a drop in the markets in May, as we anticipate a turning point in the current three-month cycle (April to June). However, the rotational effect should continue during and after the drop in May/June, leading to consolidation with a bearish bias.

July should come with a summer rally, and we believe that it is essential to keep a close eye on the dynamics of rotation between sectors during this period. This rally may be short-lived and may provide an opportunity to exit positions before the markets resume their bearish bias.

In conclusion, the NYSE composite and Russell 2000 are showing signs of hesitation and consolidation, which may lead to a drop in the markets in May. However, the rotational effect is expected to continue, resulting in consolidation with a bearish bias. July should come with a summer rally, and investors should keep a close eye on the dynamics of rotation between sectors during this period. By doing so, they may be able to exit positions before the markets resume their bearish bias.