2019 should be a good year for stocks provided the recent lows hold up. Tech stocks should be outperformers in 2019. This article features our top 3 tech stocks of 2019. The best 3 tech stocks in U.S. markets include Rapid7 (RPD), Mitek Systems (MITK) and AppFolio (APPF).

Our top 3 tech stock selection for 2019 has 2 mid cap and 1 small cap tech stocks. Interestingly, the 2 mid cap tech stocks have a very similar chart setup, and somehow comparable financials. The 1 small cap has a different but very promising chart setup.

Obviously the fundamentals of all 3 top 2019 tech stocks are awesome. Rising revenue, increasingly improving profits, a great market outlook because they are solving a real life problem!

Top Tech Stocks

One point of criticism we have when reviewing the keyword ‘top tech stocks 2019’ is that the results are not helpful. Barron’s has this list which is just this (a list). Yahoo! Finance has this table similar to this Nasdaq table.

Even Investopedia from which you might expect some more depth and breadth has this article with some facts.

One thing we absolutely miss is charts which tell the story combined with fundamentals. We have not found any.

That’s why we believe we can add value for investors looking for top tech stocks in 2019 by combining awesome chart setups with great fundamentals and outlook.

Top 3 Tech Stocks 2019: Rapid7 (RPD)

Rapid7 provides security services, cloud based. We consider this a high growth market segment.

It has a market cap of $1.7B at the time of writing. It is a fast growing tech stock that continues to upgrade its guidance.

Some of the key financials of this tech stock:

- EPS of -1.23, improving in recent years;

- Cash per share of 5.7x which is awesome;

- Short float ratio of 5.7% which is not unusually high for a mid cap stock though we would have preferred a slightly lower ratio.

- Recurring revenue over 30% and growing customer base, a growing average revenue per customer, a great recipe to future success

- Losses accumulated until last year after which an improvement started, clear path of the company to improve losses

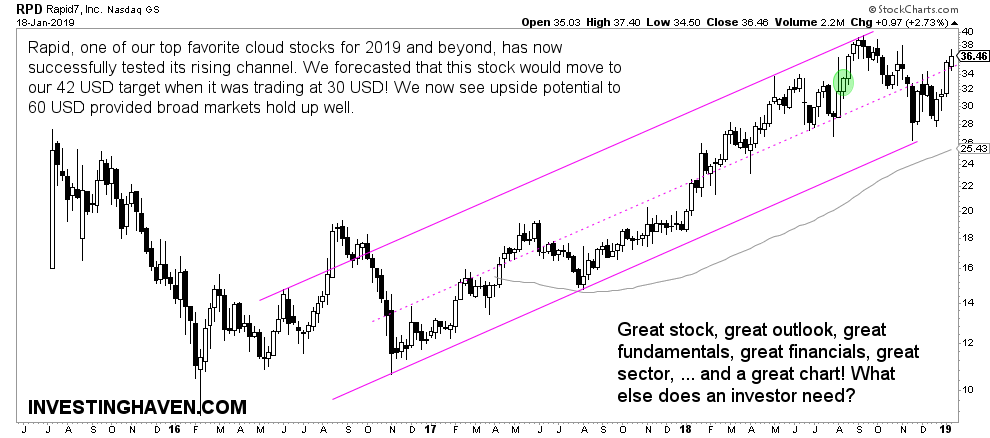

Top tech stock Rapid7 has a very juicy chart setup. It has a steeply rising channel which started 1.5 year after its IPO.

The recent decline brought Rapid7 from the top of its channel to the bottom. Note how perfectly the channel was respected with a double bottom set in 2 months.

We like the chart setup of this top tech stock very much. We like the fundamentals and financials of this top tech stock very much.

As long as broad markets respect the bottom that was set in the first days of 2019 Rapid7 is set to go much higher in 2019. In that scenario we can set a price target of $60.

Top 3 Tech Stocks 2019: Mitek Systems (MITK)

Mitek Systems creates digital identity solutions to authenticate users for instance on online and mobile banking apps (that’s just one of the many use cases).

It has a market cap of $438M at the time of writing. It is a fast growing tech stock that continuously upgrades its guidance.

Some of the key financials of this tech stock:

- EPS of -0.19, improving continuously;

- P/E irrelevant because of the negative EPS;

- Cash per share of 0.45x which is not good but they have a track record of ending their year between 5M and 15M USD so one way or another they can manage their cash flow;

- Short float ratio of 2.16% which is great.

Look at the revenue growth trend, this is so great:

- 2014: $19.15M

- 2015: $25.37M

- 2016: $34.7M

- 2017: $45.39M

- 2018: $63.56M

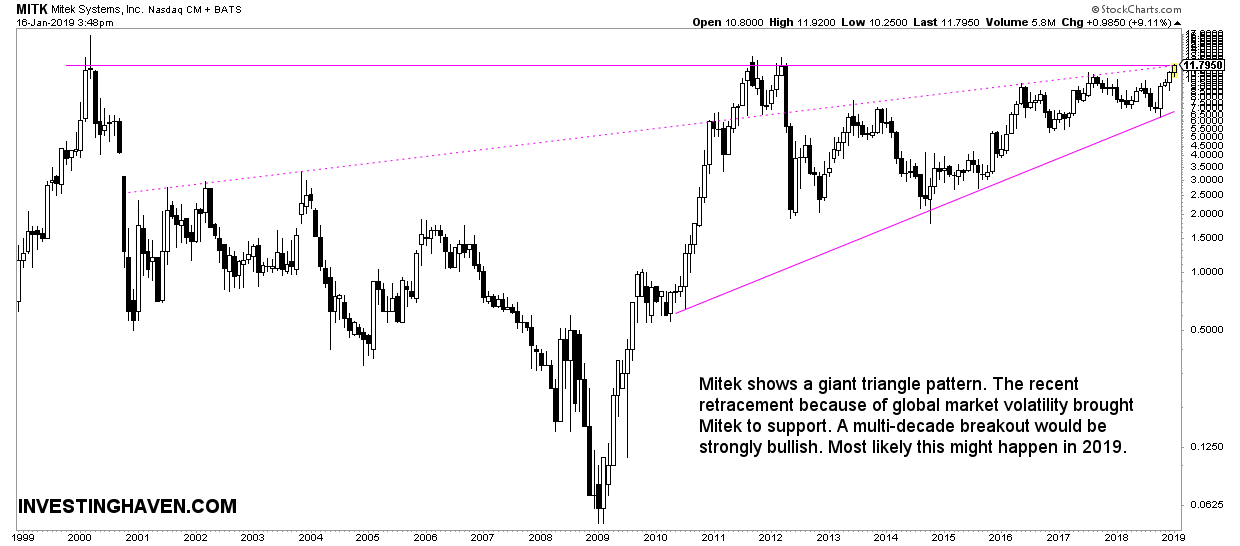

Top tech stock Mitek has a an amazing chart setup. It has a giant triangle formation, with an ascending pattern of higher lows over the last decade.

This stock is ready to attempt a major breakout attempt. Obviously, the recent rise from $6.5 to $11.7 at the time of writing is already stretched, arguably. But how it deals with major resistance will be telling.

If an once this tech stock breaks out we expect this to rise to $20 in the next few years provided broad market conditions are favorable.

Top 3 Tech Stocks 2019: AppFolio (APPF)

AppFolio creates cloud based applications for a number of vertical business markets.

It has a market cap of $2.1B at the time of writing. It is a fast growing tech stock that continues to upgrade its guidance.

Some of the key financials of this tech stock:

- EPS of 0.56, improving continuously;

- P/E of 110x which is very high but with rising earnings this should decline over time;

- Cash per share of 1.34x which is great;

- Short float ratio of 5.02% which is not unusually high for a mid cap stock though we would have preferred a slightly lower ratio.

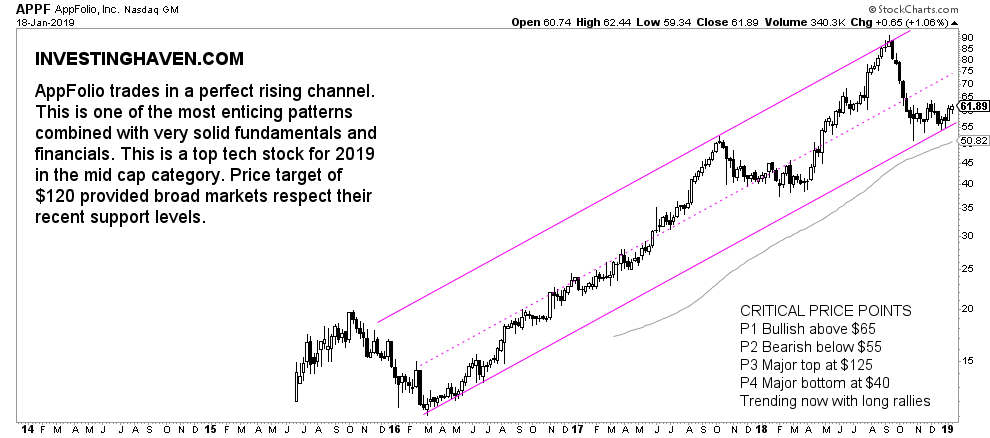

Top tech stock AppFolio has a very juicy chart setup. It has a steeply rising channel which started one year after its IPO. That’s remarkable as most IPOs take 2 to 3 years before the market goes back to the IPO prices after falling steeply.

The recent decline brought AppFolio from the top of its channel to the bottom. Note how perfectly the channel was respected with a multiple bottom set over 4 months.

We like the chart setup of this tech stock very much. We like the fundamentals and financials of this tech stock very much.

As long as broad markets respect the bottom that was set in the first days of 2019 AppFolio is set to go much higher in 2019. In that scenario we can set a price target of $120.

Investors can follow the evolution of broad markets to know when they tend to move in a bullish or bearish trend on this page: 15 Leading Indicators For The Dominant Market Trend. All our top tech stock tips for 2019 need a bullish broad market environment, if not they will not be bullish and not worth buying.