Global markets have been volatile since the first week of October. We said continuously that it would become really nasty if and once currency and credit markets started showing stress. That’s where a future market crash would be visible. So far, no real signs of this. Investors must pay special attention to the US Dollar which has been rising in recent weeks because it might reveal valuable insights about the ongoing market volatility.

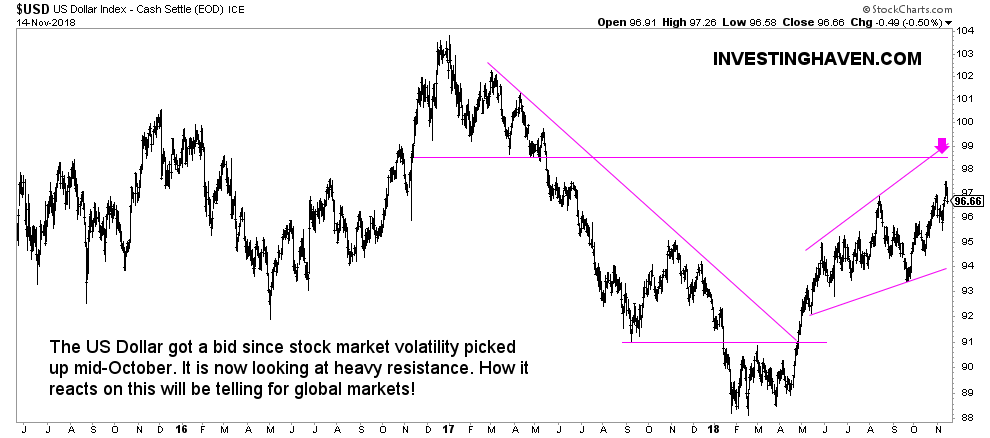

The US Dollar chart below is one that we focus on. This series of higher lows might be the start of something big. However, as there is serious overhead resistance it might also signal the end of temporary volatility.

That’s the point about the US Dollar, and similarly may other currency charts. They have multiple smaller formations which have to be taken into account as opposed to most stock charts which are clearer and cleaner in their setups.

What we are saying is that the way the US Dollar will react between 97 and 99 points will be telling. If overhead resistance appears to be too strong it will be very bullish for global markets, especially stocks and commodities. The opposite is true as well.

We clearly need more evidence and, also, additional indicators in order to see new trends. InvestingHaven’s research team is preparing to show a list of 5 to 7 indicators to understand where markets are going.

It is clear that markets are at a decisive point. This makes it very frustrating, and frustration on its turn feeds market volatility. As so often, patience is required, and this case is not any different. We wait patiently to see pointers of the (new) trends, and will publish our set of indicators any time soon!