U.S. small cap stocks are one of our few ‘risk on’ leading indicators. If they do well it is a good time to invest in stocks while the opposite is true as well. Right now, at the start of October 2018, U.S. small cap stocks are at a make-or-break level. Is this the start of a Stock Market Crash In 2018 or the end of a temporary retracement?

As said recently markets are witnessing one of the most important market events of this decade. Markets are at a major turning point with the End Of 40-Year Bull Market In Bonds. This will have major implications though the market has to show the direction.

In essence, this is what the market and investors have to deal with now:

In other words, a massive level of capital, never seen before, in the order of $40 trillion, will start moving around. Obviously, not all of it, but a considerable part will move elsewhere. Can anyone imagine what will happen if this becomes a trend into the same direction. Correct: stampede.

Logically, capital will seek its way to one of the other key assets, either risk-on or risk-off assets. If the bond exodus will go to risk-on assets we will see stock market indexes move higher in the next weeks and months. If markets will favor risk-off we will see a steady rise in the USD as well as the Yen, presumably also the Swiss Franc. What about gold? Hard to say, as gold has many faces, it can behave as a fear asset but also as an inflationary asset.

U.S. Small Cap Stocks Testing Breakout In October 2018

It is critical to closely follow what the U.S. small cap stock index Russell 2000 does. That’s because it is one of our few risk-on indicators.

We pay special attention to trend changes and pattern invalidations, or, the opposite of course, pattern continuation.

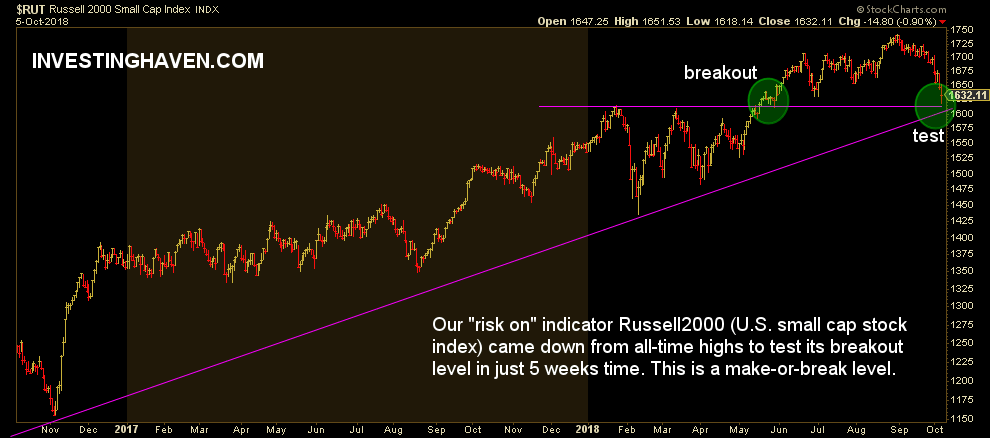

The daily chart of U.S. small cap stocks has a clear and outspoken pattern. The Russell 2000 index, representing U.S. small cap stocks, came back from its all-time highs some 5 weeks ago only to test its breakout level now. Note the two green circles on this first chart.

Moreover, the breakout level at 1610 points coincides with the rising trendline.

This means that 1610 in Russell 2000 is a critical price point as it represents double support. Per our 1/99 Investing Principles only 1% of price points on a chart is relevant, this is a textbook example of this principle.

U.S. Small Cap Stocks: The Bigger Picture

It is key when doing chart analysis to check multiple timeframes of the same chart.

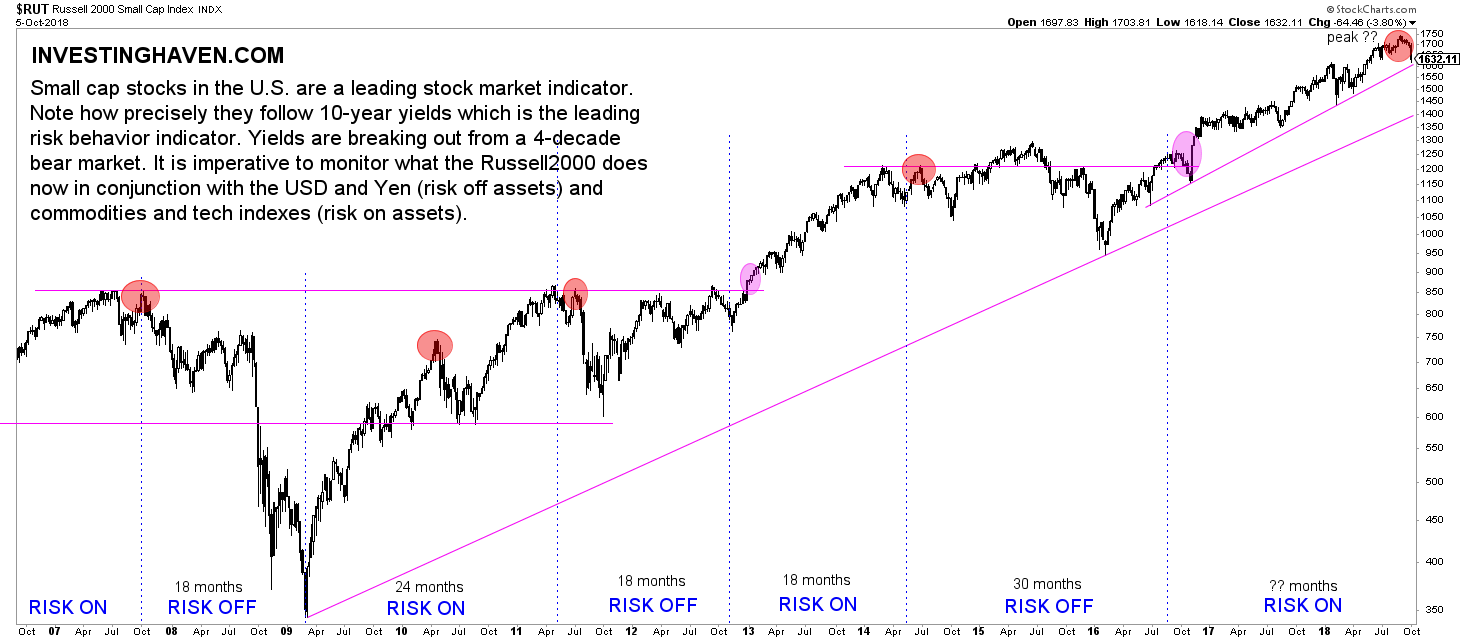

While the above chart is the daily timeframe on 2 years we embed the weekly timeframe on 12 years below.

Moreover, below chart indicates the dominant risk-on vs. risk-off periods in the last 12 years.

As seen, the current retracement represents a normal move to the support area of the rising trend. No harm done, and that’s in line with the daily chart above.

Is the Rusell 2000 all-time high of 1,742.09 set on August 31st 2018 the turning point, and is this in any way correlated to the breakdown of bond markets discussed above? This may be the case, but seems hard to accept since falling bonds (risk-on) and falling stocks (risk-off) would imply that capital moves to the USD which is a trend we have not really seen yet.

It is early to draw conclusions. Although a falling bond market may come with a falling stock market, you better never say “never” in markets, this really seems a counter intuitive scenario.

We favor the scenario in which there is sector rotation in stock markets right now, something that typically happens during a retracement.

We stay open for every scenario though!