Talking about challenging markets … we are on record calling for the weirdest market ever in history! Why? Because gold trades near (at) all time highs, stocks are right below all time highs … and Treasuries (risk off trade) are right below all time highs. Doesn’t make sense, does it? We certainly did not forecast this outcome in this way even though we were bullish on stocks and gold in our 2020 forecasts we did not expect Treasuries to be equally bullish. The Corona crash explains everyting of course. But let’s try to make sense of this, because in the end there is a ‘logic’ explanation for all this.

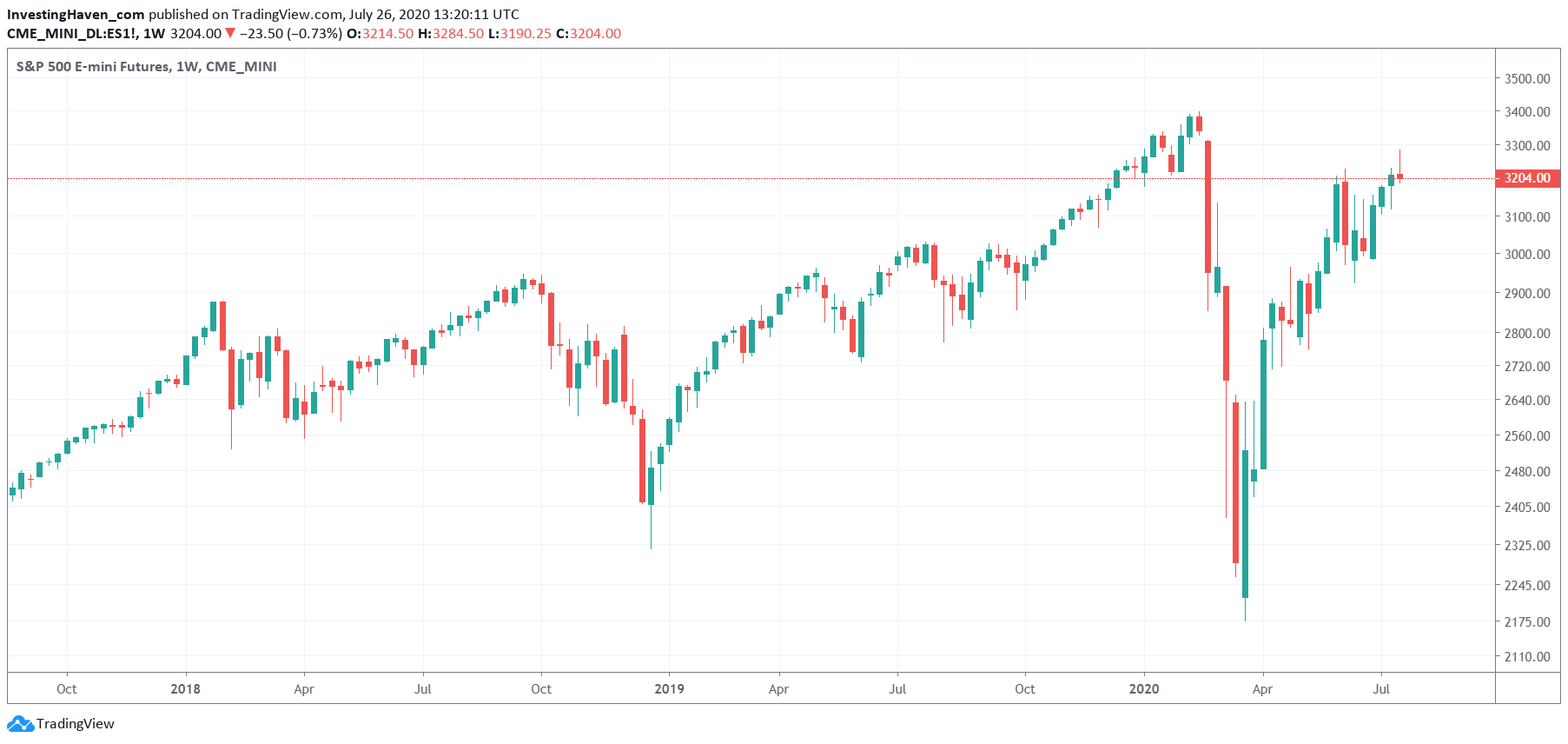

First, stock markets.

As seen below, the S&P 500 trades some 4 pct below all time highs, registered in February of 2020.

It looks like this market is not done with its bull market. Short term we can reasonably expect some consolidation. Long term, though this wants to move higher.

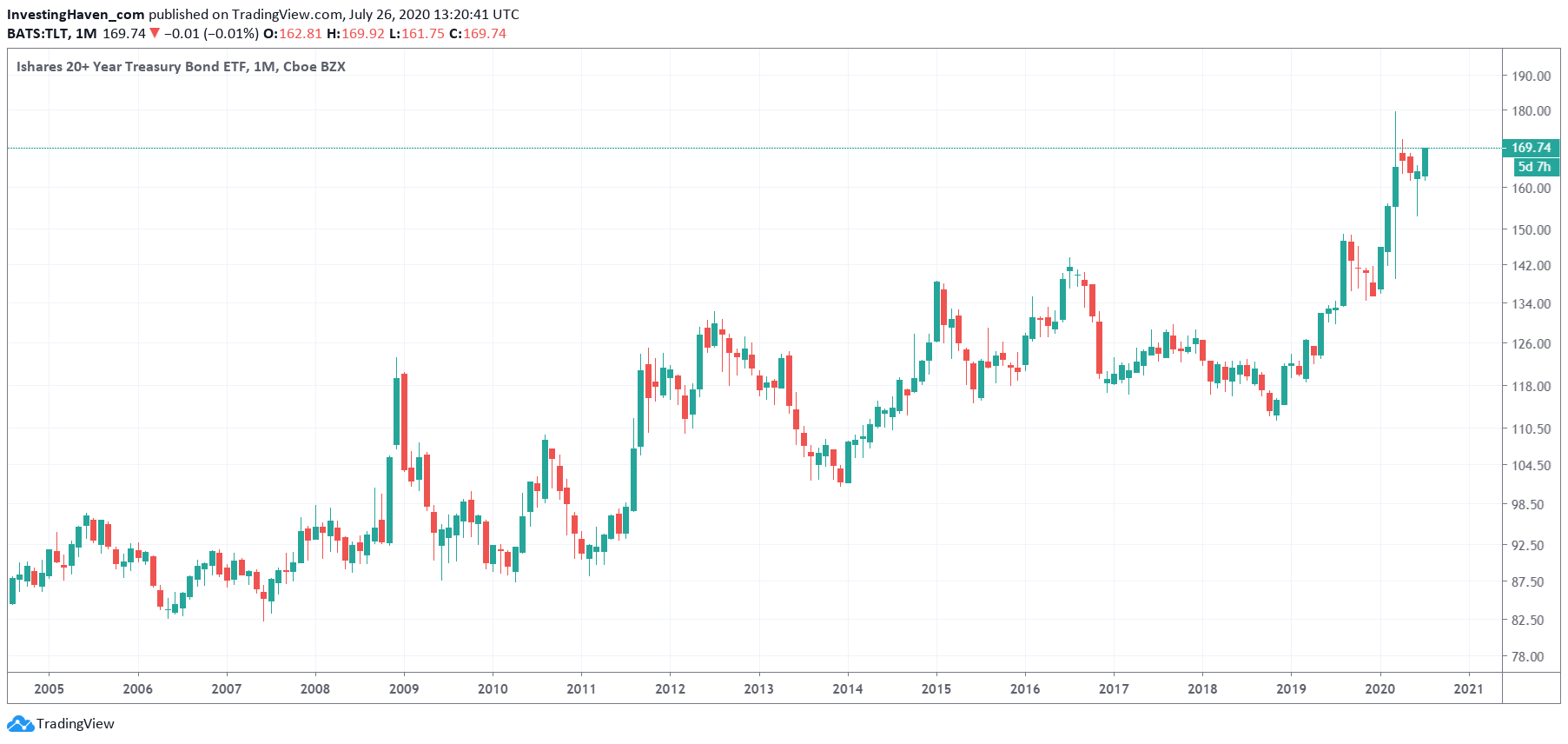

Treasuries, the ultimate risk off trade, looks ultra bullish here.

After the spike on Black Thursday, during the once-in-a-century type of crash (Corona crash) there was a big drop but it got followed by a continuation of the rise. This upward move is not over yet … and it certainly will help gold (both are inversely correlated most of the time).

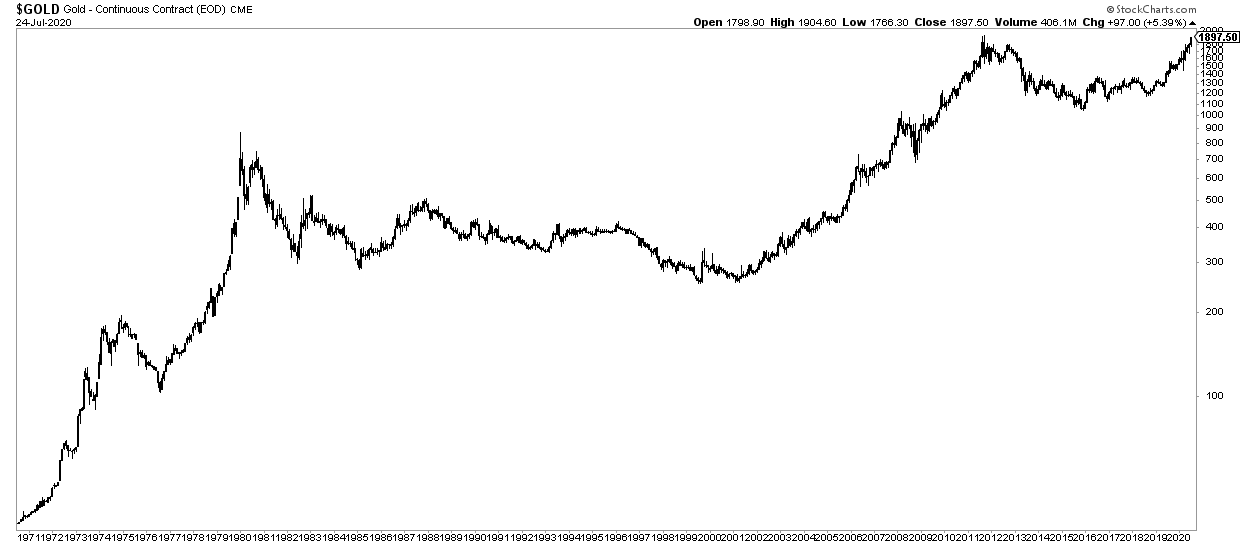

Third, the gold price on the very long term.

As said in Gold Price Ready To ‘Blast’ Through All-Time Highs (which we published earlier today) the gold price is moving higher, strongly higher. The long term chart does not suggest the recent gold price rise is ending here, on the contrary!

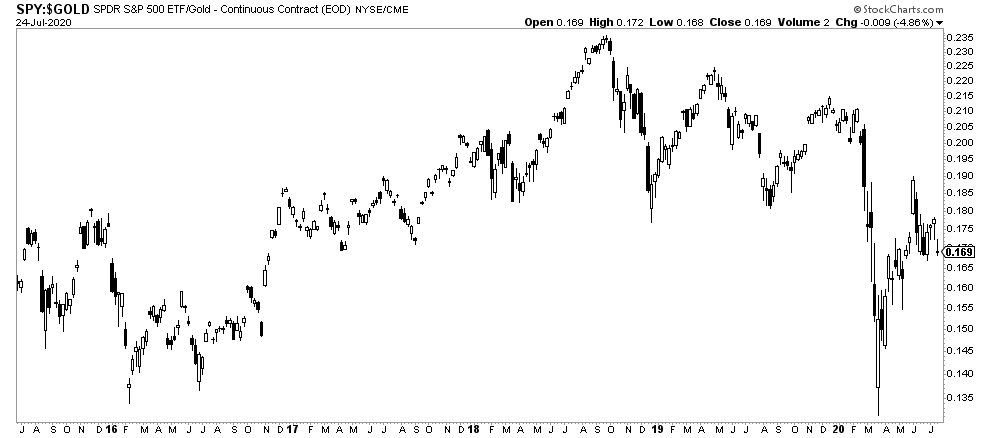

So does all this make sense?

Yes and no.

The one and only way to think of it in order to make sense out of this: the inflation trade.

Gold is an inflationary trade. Treasuries, our fear indicator, at all time highs suggest investors are afraid. But then how comes stocks (risk asset) is also moving higher? Because stocks are valued in the USD, and their nominal (absolute, in USD expressed) value is rising.

But when expressed in another unity, gold, they are not really rising.

Gold can be considered a neutral measure, regardless of the gold price manipulation theme (different purpose, different story). If we do this, we get a totally different view on the S&P 500.

In the end there is only one trade currently: the inflation trade. That’s gold and cryptocurrencies, as explained here: Bitcoin Will Move Higher Because Gold Is Moving Higher