This market feels bad. That’s because of the trendless state and mini-cycles characterized by heavy rotation. However, in reality, the market is improving. It may well be the case that the market bottomed a long time ago, to be specific on October 13th, 2022, the day we wrote The Market Will Not Move 50% Lower Contrary To What The Gurus Are Telling You. If we are right with our assessment, there will not be a stock market crash in 2023, on the contrary.

Further to the market breadth chart we featured in The Nasdaq Looks Better Than You Might Think there is a similar breadth indicator on the NYSE Index that we must share with readers.

Below is the NYSE index in the lower pane, on 12 months. What you can see is a bullish reversal, one the started in April of 2022 around 16.8k points. This reversal may not be complete, but that’s besides the point. The important point is that the chart keeps on improving and that the reversal is about to complete 75% completion. That’s crucial as explained in 2008 vs. 2022: Similarities and Differences.

The really interesting data point is the one on the upper pane of the chart: the advance minus decline issues in the NYSE Index. This market breadth indicator confirmed the October 13th bottom. More importantly, in recent days, this indicator is moving higher, nicely in synch with the index price.

With this, market breadth and index are in synch after breadth was deteriorating in Aug and Sept of last year. That was concerning, very concerning. But the double bottom on Oct 3 and Oct 13 marked the start of market breadth improvement. That’s constructive, very constructive.

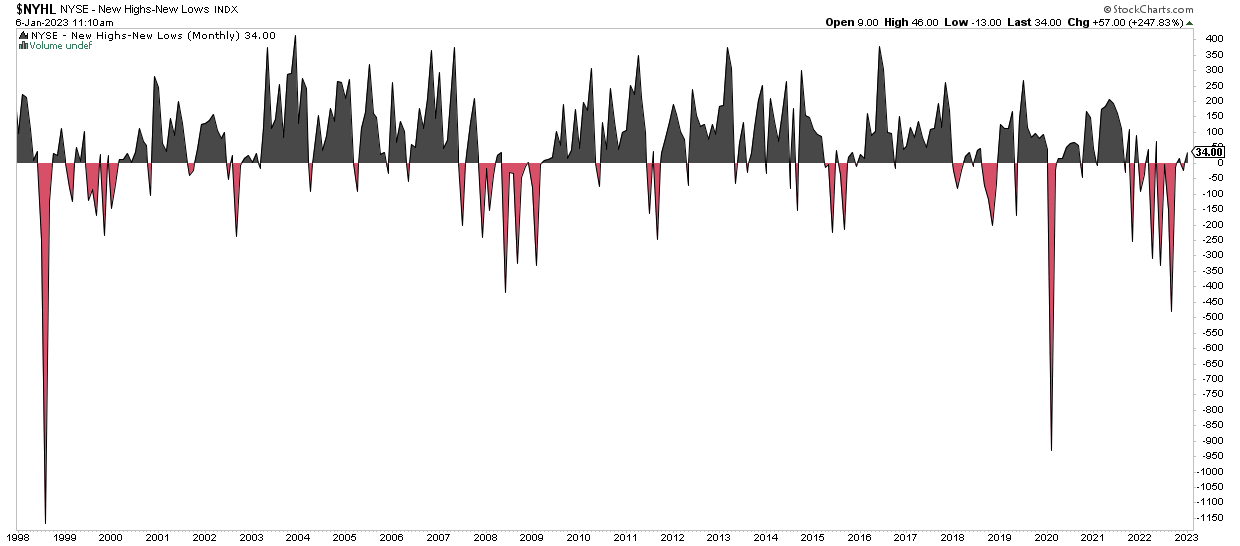

Moreover, and equally important, another breadth indicator is suggesting that there is plenty of upside potential. Below is the new highs minus new lows indicator on the NYSE Index. We take a big picture view here and look at a few decades of data.

The 2022 lows are clearly reflected in the readings of this indicator. But when you flip the view, you can see how much potential there is for this indicator to move up. Also, any period with new highs minus new lows readings below was followed by an increasing number of issues making new highs, in recent decades.

We believe there is sufficient evidence that markets have bottomed on Oct 13 and that the Nasdaq is the one that will follow its peers… higher throughout 2023.