Our emerging markets (EEM) outlook for 2018 and beyond is very bullish. At InvestingHaven we believe that capital will slowly but surely rotate out of overly expensive U.S. stocks and will flow into mostly undervalued emerging markets. 2018 could become the year in which this move would accelerate, the tipping point in other words.

InvestingHaven signaled already a long time ago a bullish 2018 outlook for emerging markets. More than 8 months ago we wrote this:

From a contrarian perspective, emerging markets are hugely bullish. Bloomberg, for instance, published right after Trump’s victory some scary charts which show a stampede out of emerging markets. No surprise, as Bloomberg was also already very bearish emerging markets more than a year ago; that visibly has not changed.

In that same article we tipped 5 emerging markets to buy in 2018. So far they have all performed extremely well.

7 months ago we went one step further and listed 3 reasons why emerging markets would be hugely bullish in 2018:

- Emerging markets have suffered for too long. The economic and market cycle move from positive to negative and back.

- Emerging markets still have significant growth potential in the middle class, infrastructure, consumption, etc. Economically, there is a reason why they are ’emerging’ and not yet ‘developed.’

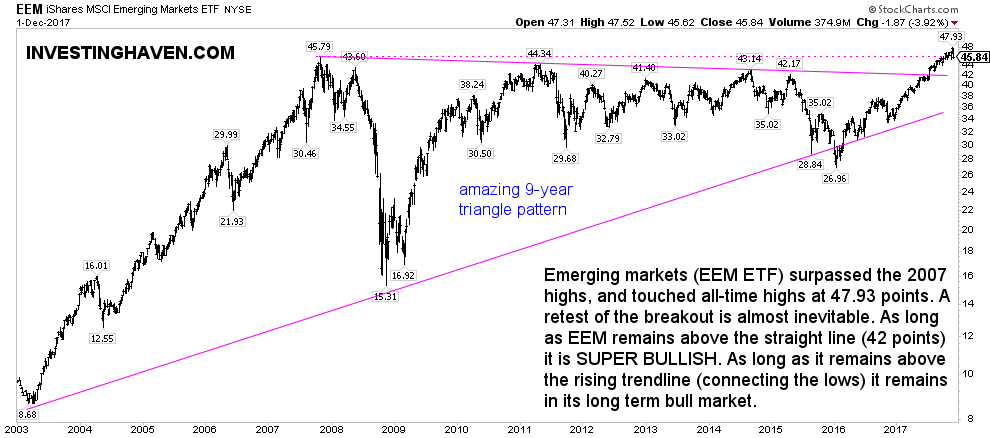

- Emerging stock markets have consolidated for an unusually long period, as seen on the chart below. The longer the consolidation period on a stock chart, the stronger the trend afterwards.

So far what we forecast a long time ago. Let’s focus on both the fundamentals and the chart.

Emerging markets fundamentals in 2018

Emerging markts are thriving off fundamentals as this Bloomberg interview reveals. We agree with the points made in there.

More importantly, however, the undervalued P/E ratio is what has attracted our attention. The chart in this article makes the point, as it nicely compares it with the expensive U.S. markets and the average of all world markets.

We very much agree with this quote in the same article: “Over the next few years, emerging markets are expected to report healthy growth. Corporate debts in EMs are shrinking, while companies become more prudent in choosing projects with a favorable risk-return profile. Capital expenditures have fallen in most of the emerging markets, leading to higher margins. While fundamentals are improving, emerging markets are still trading at over a 25% discount to the developed markets.”

HSBC goes even one step further. Forbes reports the following as a point of consensus: “Emerging markets will see greater inflows in 2018 than it did in 2017.” HSBC recommends buy any dip as there is lots of upside potential in emerging markets.

Last but not least, a good indicator is the health of debt in a certain country or region. Reuters says that emerging markets debt is expected to see continued interest from investors.

Chart analysis: Emerging markets outlook is bullish going into 2018

The long term chart of emerging markets is one of the most amazing charts we currently see. The extremely long triangle pattern which is in the making for 15 years (last part is ongoing for 9 years) is unusually long.

What happens durnig such a long period of time is that momentum builds up. That is what in reality happens during such a triangle pattern.

Moreover, the gap between resistance and support is now so narrow that it is almost a pressure cooker ready to explode!

It is almost a given that the emerging markets outlook for 2018 and beyond is (hugely) bullish based on this chart setup. Three important tests of the support line since 2003 have survived the test. Moreover, there are 6 tests of resistance since 2007.

In October of 2017 the EEM ETF reached all-time highs when it closed at 47.93 points. What happens in such a situation, typically, is that the market comes down to the test the breakout level. Most likely the breakout point is 42 points.

In other words, as long as EEM ETF trades above 42 points it will be hugely bullish in 2018. In case emerging markets fall to 36 points, and go higher from there, they will be ‘just’ bullish.