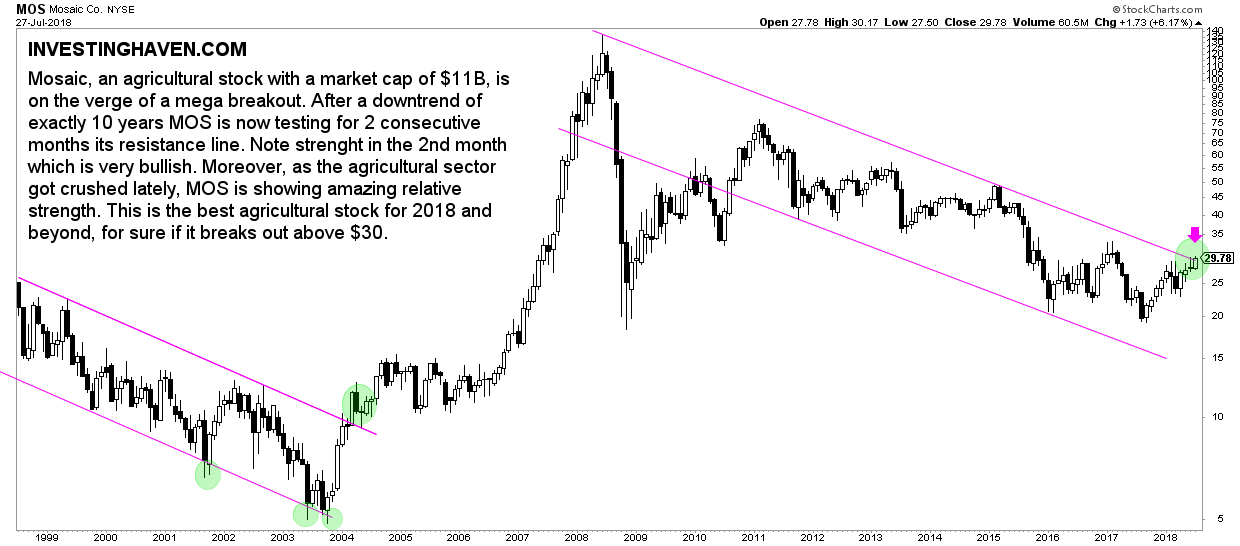

We covered the agriculture investing topic extensively in the last 12 months. Although there have been some periods in which the outlook was bullish they were followed by strong pullbacks, both in agricultural commodities as well in agricultural stocks. There is, however, one agricultural stock that shows amazing relative strength: Mosaic. It is an agricultural stock that is on the verge of a very strong multi-year breakout!

As said agricultural commodities behaved like a yo-yo, from bullish to pullback. This is what we wrote on InvestingHaven:

Agricultural Commodities: Grim Outlook For 2018? (July 2018)

Top 4 Agricultural Stocks Worth Considering To Buy In 2018 (April 2018)

Agriculture Stocks: Buy In 2018 Or Avoid? (January 2018)

Although we did not cover Mosaic so far it now seems to be close to a secular trend change and that is something that does not go unnoticed by InvestingHaven’s research team: it is attempting to break out of a 7-year falling trend.

Mosaic, symbol MOS, shows great relative strength against the agricultural commodities and several of its peers. That is a second strongly bullish signal.

Last but not least, its top line financials look great:

- EPS 1.11 with a future EPS of 1.9

- P/E 26.8x

- Short float 3.7%

- Cash position of $609M

- The number of shares are flat with an increase of 8% in shares outstanding in the previous (not last) quarter

The chart looks gorgeous. As we live by the mantra ‘start with the chart’ there is a monumental event taking place on Mosaic’s long term chart. This cannot go unnoticed, and it signals that this stock requires additional research. Before investing a deeper dive into the fundamentals may be required, and, for sure, a close followup on the chart, especially the $30 area, is critical before taking positions.