Silver investing in 2018 is on the radar of smart investors. Why? Because the price of silver (SILVER) in 2018 is about to move aggressively, the million dollar question is whether it will move higher or lower. Here is InvestingHaven’s take on the silver market, and, in particular, silver investing in 2018.

First, let’s notice how our stance against silver has changed in the last 9 months. Up until Q3 of last year we were bearish as explained in our Silver Price Forecast 2018 which we wrote last October. Since then the silver market has shown clear signals of bottoming which we did not ignore.

Silver investing vs silver’s monetary value

We are aware that some readers may seem surprised that we changed our stance. They should not. We follow the trends in the market, and the charts are our compass. We are not dogmatic about any market. However, gold and silver typically evoke lots of emotions which is because of the fundamental values attached to the metals. Traditionally, gold and silver acted as sound money, and, given current moneteray policies, there is a strong need for sound money as opposed to artificially created money by a central governance.

Let’s get one thing straight: when we talk about gold or silver being bullish vs. bearish, we are only looking at prices and profit potential. We have never, at least not on this blog, looked gold and silver from a monetary perspective, nor are we making any point about the (historic) monetary values from both metals.

Recently, we did find sufficient evidence to believe that the Gold And Silver Bull Market Of 2018 Was About To Start. As said, if the evidence is there we are the first ones to admit that our stance changes, which is exactly what we did.

Silver investing in 2018 looks promising

Silver investing has its own rules. Not only has silver investing its own rules, it also has its own means. Be that as it may silver investing in 2018 will be profitable across all silver instruments: physical silver which some refer to as silver stacking, silver miners both senior and junior, paper silver like ETFs.

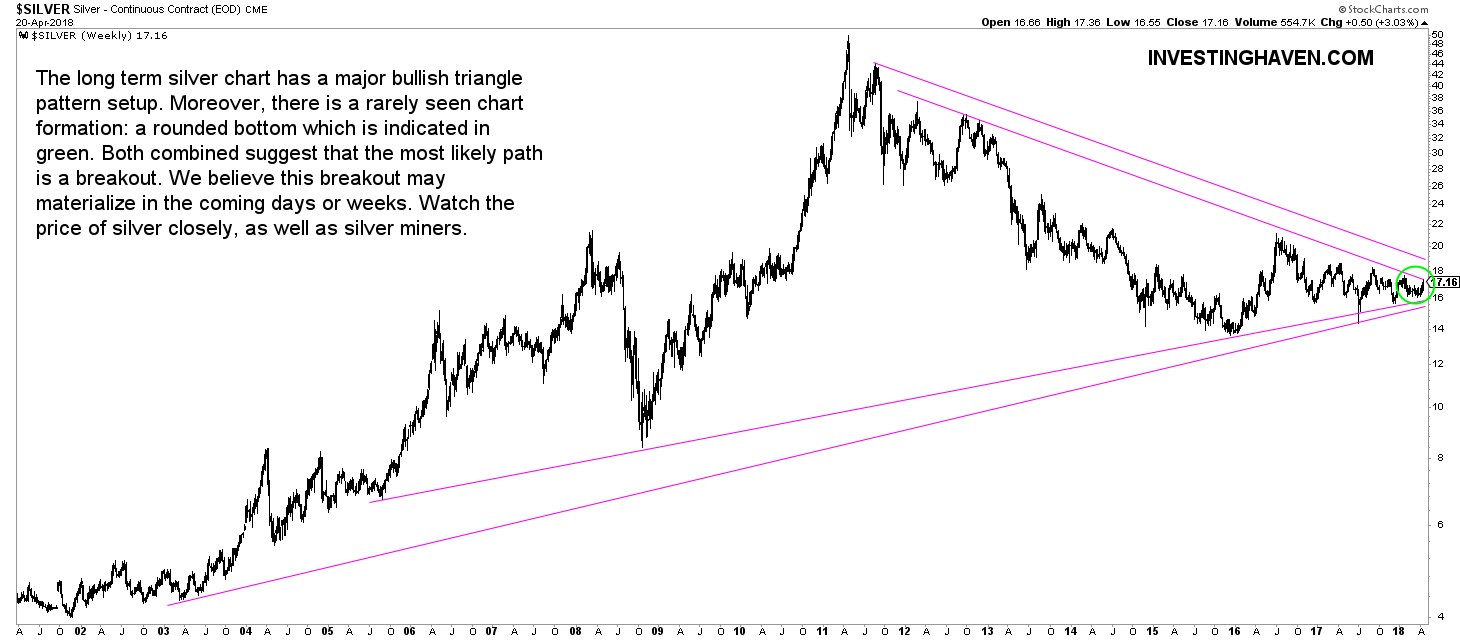

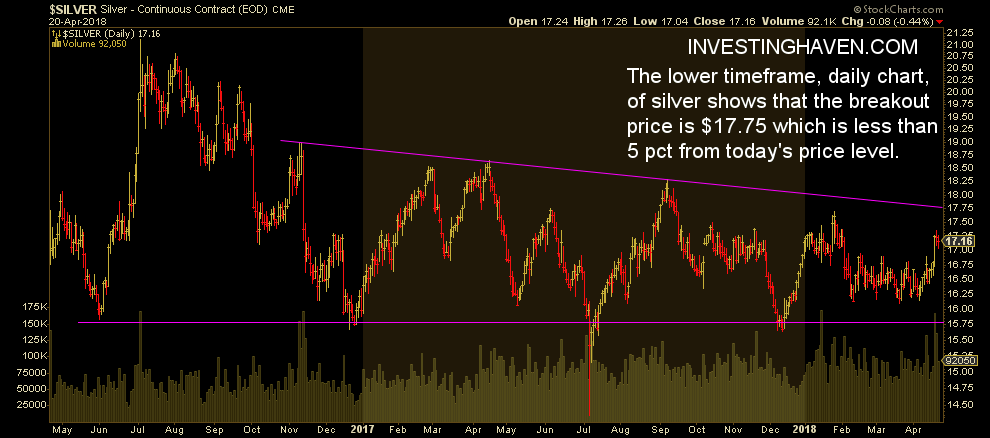

There are several leading and important indicators for silver, first and foremost the silver chart. Analyzing silver charts need to happen on three timeframes: the daily (short term), the weekly (long term) and the monthly (very long term). We have included the daily and weekly below.

However, there is more, much more to analyze. Without going into the details we sum up the list of indicators:

- Gold as a leading indicator for the precious metals complex.

- Precious metals miners, and the junior to senior miners ratio as an indicator for risk sentiment in precious metals mining.

- Commitment of Traders reports indicating what the futures market is signaling.

- Gold vs. other fear assets and broad markets indicating intermarket dynamics.

Long story short, all those indicators favor a precious metals outperformance in 2018.

Interestingly, this coincides with great charts setup in silver.

The long term chart shows an extremely important event is about to take place: a breakout or breakdown out of a very long term triangle pattern. Note that two data points suggest that the outcome will be bullish (breakout): the short term rounded bottom in green on chart as well as the long term rounded bottom (not indicated but clearly visible between 2013 and today).

The daily chart gives additional insights. First, the ongoing consolidation with strong support is visible. More importantly, however, is the fact that silver is just 5 pct away from the breakout point which is the same one as on the longer term chart.

This is why we believe that silver investing in 2018 will be very profitable.