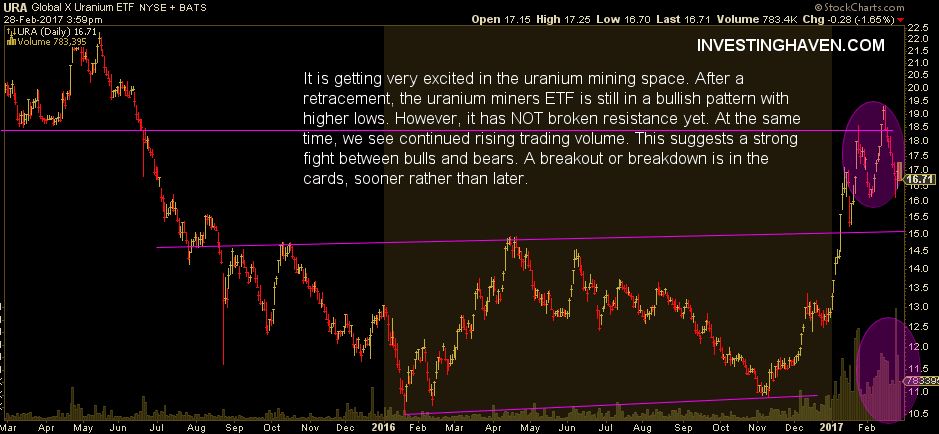

Uranium mining stocks will have a very exciting period in March 2017, without any doubt. The chart of URA ETF, representing uranium mining stocks, reveals that a strong fight is going on between bulls and bears. In the coming weeks that fight will find momentum.

Price analysis is the most valuable source of information an investor has at its disposal. The trick is to spot the important and relevant observations on the chart.

The daily chart of uranium mining stocks (URA) reveals how the sector is trendless at this very point. After a strong rally in December and January, URA is still in a pattern of higher lows, as indicated with the purple circle. However, at the same time overhead resistance at 19 points has appeared to be too strong. In other words, when it comes to price, the only indicator for supply and demand, there is a fight between bulls and bears, with no clear winner at this point.

The picture becomes even more interesting when looking at trading volume. Visibly, volume has risen extremely hard. In the last few days, there was a peak on a strong down day, but that was followed by strong volume on today’s up day. Prices bounced higher in order to set a higher low, on strong volume.

Bulls and bears are fighting at this point, and investors better let the market do its work. Meantime, we recommend investors follow the uranium mining stocks very closely, and prepare themselves in case the bulls win this fight by reading these two articles: 3 Uranium Mining Stock Charts That Make You Go Hmm and A Look At Junior Uranium Mining Stock Uranium Fission.