The new year kicked off in a rather stable way for markets. Interestingly, some specific commodities are doing quite well, and those stock market segments are outperforming most other segments. The trend in gold has clearly a bearish bias at this point. In this article, we explore 3 cross-market trends which could result in strong moves in specific stock market segments in the coming months.

Interestingly, this writer on Forbes got it right last year as he correctly called for a bullish stock market trend after the collapse of January. The indicator in his piece was the number of stocks at all-time highs, as those stocks are sensitive to sentiment in broad markets.

Although Wikipedia has a focus on technicals when discussing stock market trends, our focus is on intermarket dynamics. That is why below stock market trends are identified from a cross-market perspective as opposed to our sector specific news update 4 Stock Market Sectors Which Could Outperform In The First Months Of 2017.

Stock market trend #1: Copper stocks

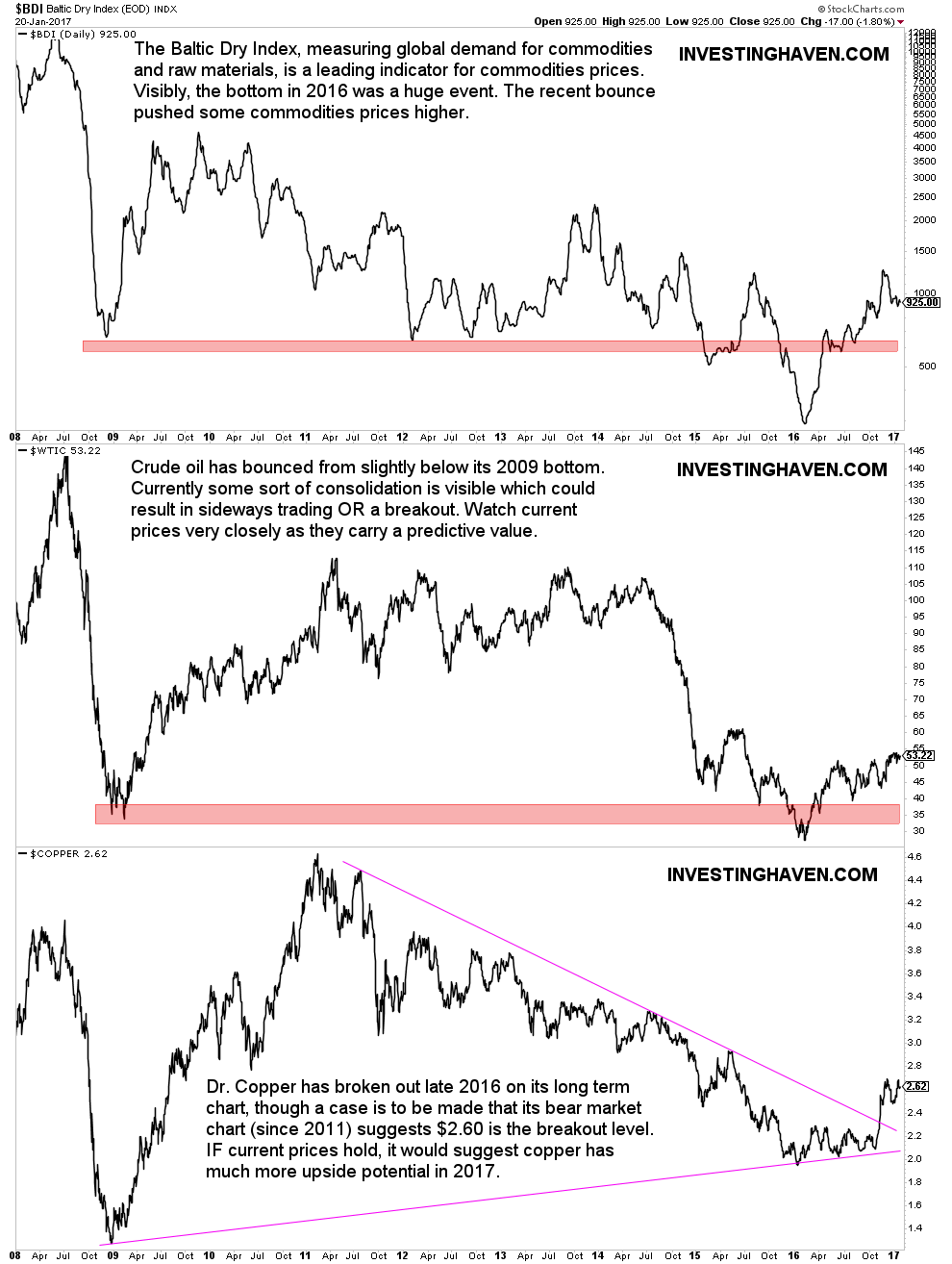

The Baltic Dry Index is a leading indicator for commodities. Both in 2008 and in 2016 the Baltic Dry Index collapsed to multi-decade lows. As the index recovered in 2016, it pushed some leading commodities higher as well, crude oil and copper being the most important ones.

Below chart visualizes the Baltic Dry Index, crude oil and copper. Visibly, copper has a more constructive setup at this point. In other words, with the recovery of the Baltic Dry Index, the copper market is set to profit most of it. Stock market investors should watch copper stocks very closely in 2017 as a potentially very profitable stock market trend.

This is not a new insight to our readers, as InvestingHaven’s research team recently wrote Copper Price At Secular Breakout Point and Copper Price Surging, Close To New Secular Bull Market. It is just that below view on the market provides an additional confirmation of that same viewpoint.

Stock market trend #2: Transportation stocks

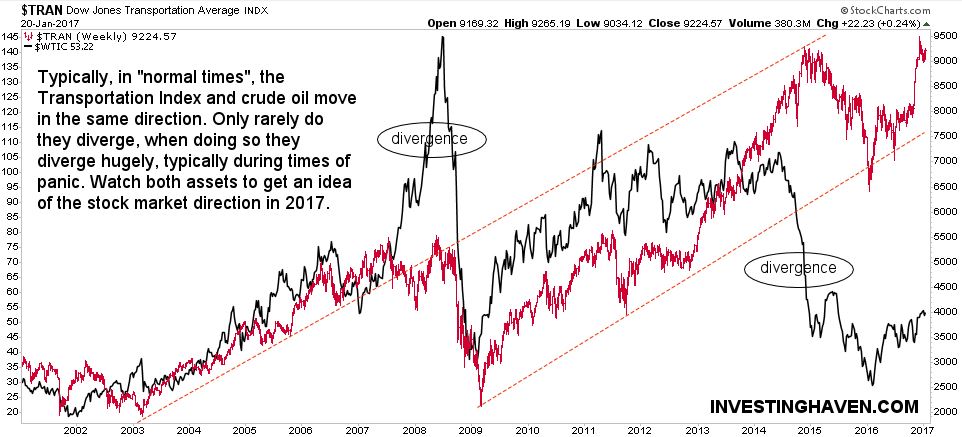

Given the first trend outlined above, it appears that crude oil’s negative effect on stocks in general and the transportation sector in particular. Both transportation stocks and crude oil tend to move in the same direction, except in ‘irregular’ times as seen on the second chart.

As crude oil collapsed since 2014, it seems that the worst is over. Because of the correlation between both assets, one could make the case for transportation stocks to move also higher in 2017.

The transportation index moved from resistance to support in its rising channel. Currently, the index is testing all-time highs. If this price level holds and if crude oil does not collapse back below $30, we will see higher prices in transportation stocks in 2017.

Stock market trend #3: Gold stocks

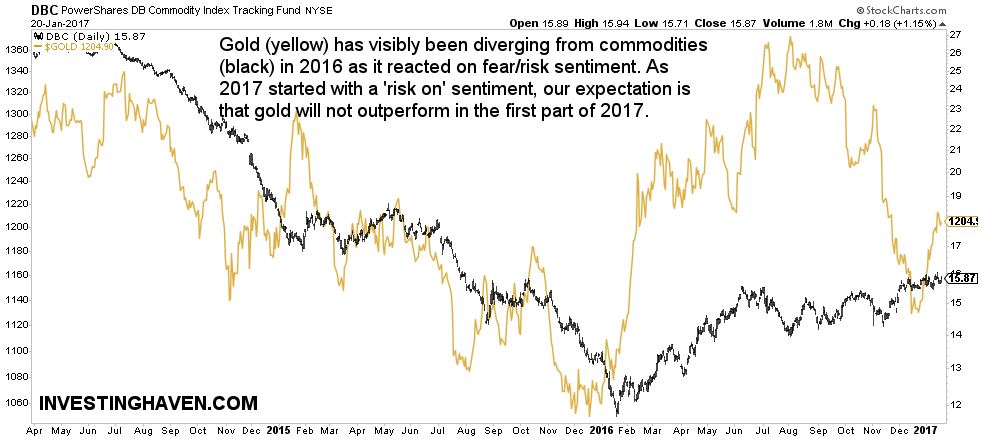

Last year, gold and commodities clearly diverged from each other. The challenge with gold forecasting is that gold has several faces, which makes it very hard to read the gold market. Gold can definitely move as a commodity, similar to the 2002 – 2007 boom, but it can also rise on fear/panic in markets.

Last year, gold was driven by fear. Once ‘risk on’ took over from fear, gold fell sharply. The general commodities index on the other hand rose slightly.

In 2017, the direction of gold will be key for gold stock investors. Whether gold stocks will outperform this year depends on two key price levels in gold: the $1220 gold price (first chart) and $1350 as a secular trendline (last chart). Reversely, if gold fails to move higher, gold stocks will certainly be very bearish in the foreseeable future.