Almost a year ago we warned readers about a potentially very important evolution on the very long term trends which we tend to call secular trends. In this article published early last year Disruption Ahead In Stock And Bond Markets? we explained what we are watching, and why.

This is from last year’s article:

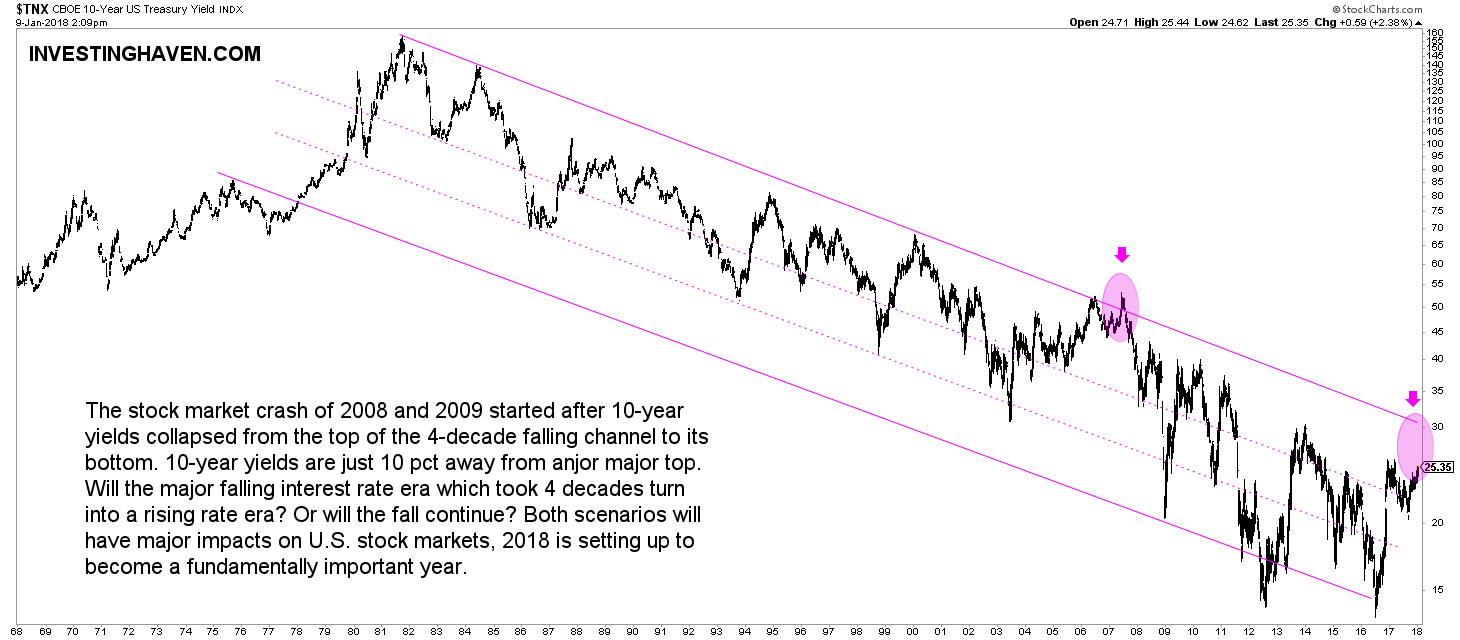

Our favorite leading indicator for stock markets is 10-year Yields. On its very long term chart we spot a potentially very disruptive event: a trend change after 4 decades. This could become MAJOR news once this materializeds, and it could disrupt (stock) markets.

When we mention potential disruption ahead, we really talk about a very longer timeframe, in particular 3 to 5 decades.

The bond market and Yields, both inversely correlated, have moved in one and the same direction in the last 37 years (over the long run, notwithstanding shorter term moves): bonds have gone up, Yields have come down. The historic chart of 10-year Yields, see below, shows how Yields topped around 16% in 1981 and bottomed twice below 1.5% in recent years.

If, and that’s a big IF, 10-year yields break outside of its falling channel it will be very disruptive for U.S. markets. First and foremost, U.S. stock markets would look entirely different. A new paradigm will hit U.S. stocks. We prefer not to predict the exact evolution as that’s largely unknown. We will assess how intermarket trends play out at that moment in time. If anything, interest sensitive sectors would do very well. The banking sector would outperform.

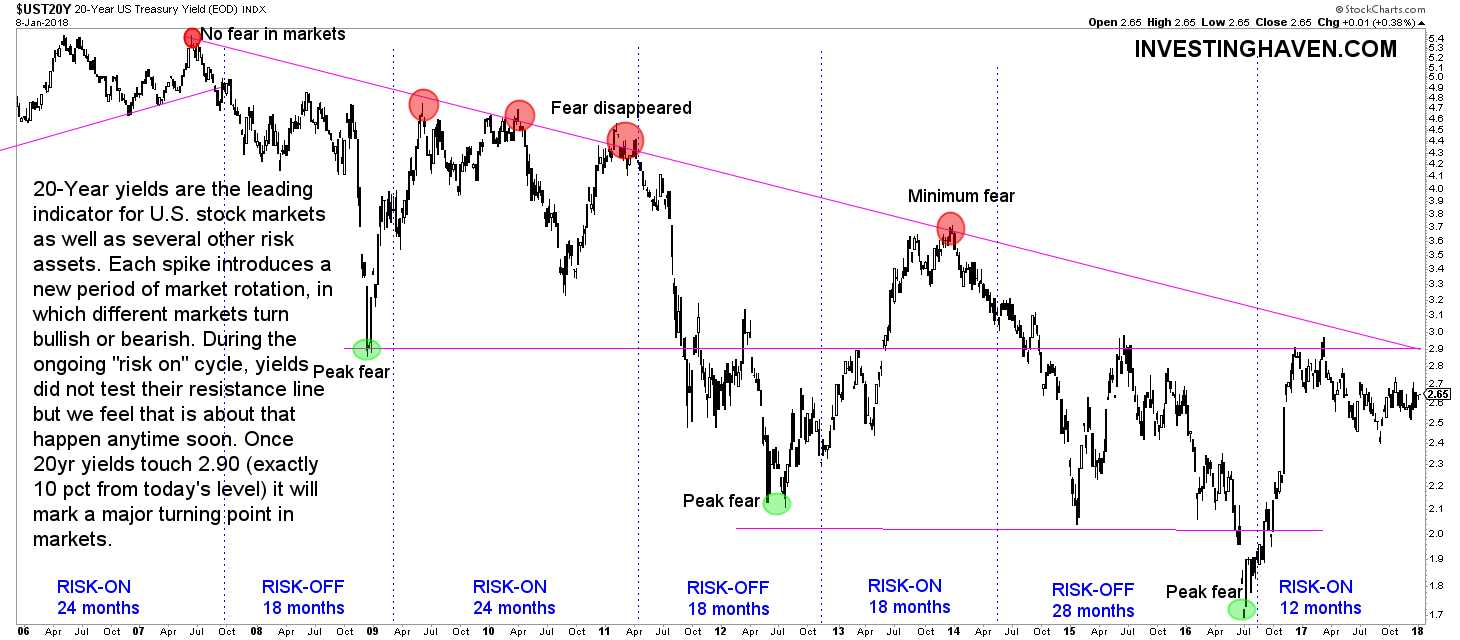

On the shorter term timeframe we spot another important trend. 20-year yields are near a very important trendline. As seen on the next chart every time 20-year yields hit major resistance in the last 12 years it marked the turn of a ‘risk on’ to ‘risk off’ period which, in plain simple terms, means that U.S. stock sold off strongly.

20-year yields are just 10 pct away from hitting major resistance. If the 2.9 pct level in 20-year yields would mark a top (that’s a big IF) we are likely going to see a Stock Market Crash In 2018.

2018 is setting up to become a very important year, whatever happens with yields, that is for sure.