Gold has had a great rally so far in 2016. But will it continue or not? That is the million dollar question.

We see 2 key drivers for the surge in the gold price in the first half of 2016. On the one hand, fear among investors has pushed gold much higher. In the first months of the year, we observed a climax in fear among investors, driven by a collapsing crude oil price which took stock markets lower. As a result, safe haven assets like gold, Treasuries and the Yen got a strong bid. Because of that, interest rates went much lower. All those trends were extremely “gold friendly”.

It is clear that risk is now replacing fear, as said in What’s The Message Of These 4 Risk Indicators? Markets Are Lined Up For Risk ON. We firmly believe that crude oil, the driver of fear when it was collapsing, is stabilizing here.

Hence, markets will be driven by another leading asset, and we already noticed a while back that stock markets will be the primary trend setter. Stocks are risk assets, which implies that safe haven assets will not do very well. We expect Treasuries, the Yen and gold to stabilize (best case) or sell off (worst case) in the coming months. That is not because we hope so, or we want so, but only because of intermarket dynamics.

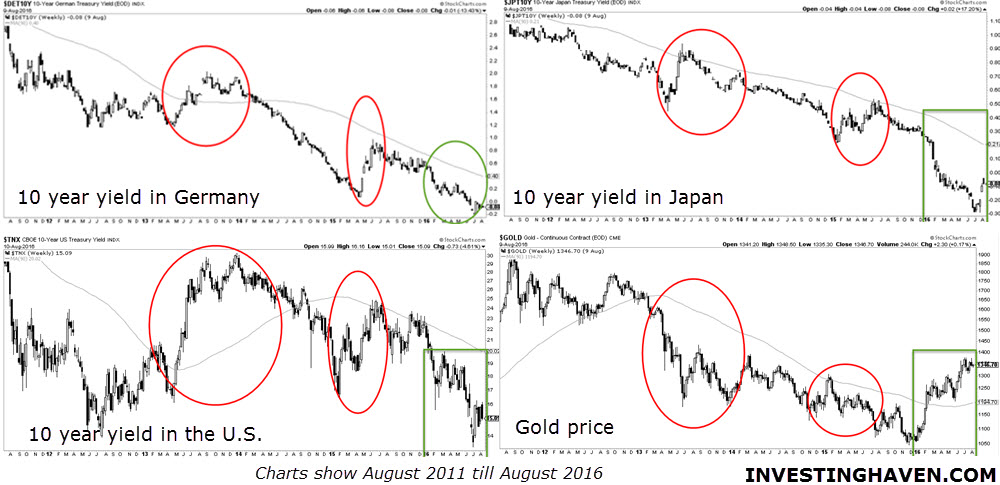

As evidenced by the compilation of charts below, interest rates have moved sharply lower in 2016, but have reached extreme readings. It seems clear that interest rates, in this new “risk on” environment, are ready to move higher in the second half of 2016. As gold’s chart in the right bottom shows, rising interest rates are mostly “gold unfriendly”, which is why we doubt that gold will go higher from here. Additionally, chart-wise, gold is close to secular resistance, as explained in Gold’s Most Critical Test: Strongest Resistance Area Of Its Bear Market.

Although we love gold, and we keep on iterating that physical gold is a must for everyone’s portfolio, we believe that gold is peaking right here right now. Time will tell whether our observations are correct.