This article highlights the 3 hottest trends in markets during summer 2017.

Although the focus of most financial sites and analysts is on banking stocks and all-time highs in the major U.S. indexes we are focused on different segments in the market. However, InvestingHaven readers know much better as they are informed of the hottest trends and breakouts as they arise (even before they arise).

Our top 3 for summer 2017: emerging market stocks, uranium mining stocks, biotechnology stocks and coffee.

Market trend #1: emerging market stocks

We started writing about emerging markets more than a year ago, and we identified an emerging markets forecast for 2017 in which we identified 42 points in the EEM ETF as the most important price point to watch. Well, we have news: this week, EEM ETF broke above 42 points. This is MAJOR news and InvestingHaven readers were lucky enough to follow all this long time in advance. Even now, as this major event took place, major financial sites are not spotting this incredible buying opportunity, as seen in tese emerging markets articles on Bloomberg and CBS News.

We wrote both articles in April of this year Emerging Markets Will Be Strongly Bullish In 2018 and 5 Emerging Markets To Buy In 2017 And 2018. We wrote in February Emerging Markets About To Start A New Bull Market In 2017.

All this profitable advice with the highest accuracy is made available for free by InvestingHaven’s research team.

Market trend #2: uranium mining stocks

Uranium mining stocks are number 2 on our list of 3 hottest market trends playing out right now. Here as well, no surprise for InvestingHaven readers as we identified uranium miners a long time ago as a hot trend. As URA ETF (representing uranium mining stocks) doubled in price last winter it fell down sharply. We started becoming concerned and called for a breakdown. However, right now, we see spot a beautiful bottoming pattern on the chart. Not only is June’s bottom a higher low compared to the ones of January and October 2016. More importantly, we just got a confirmation of the breakout, see the purple circle (the one right above the trendline). The breakout is now confirmed, and we interpret this as a new bull market in uranium miners!

The ‘real deal’ is URA at $15, because, as said before, Uranium Stocks At $15 Has Huge Implications. Our top pick for uranium stocks is UEC.

Market trend #3: coffee and biotechnology stocks

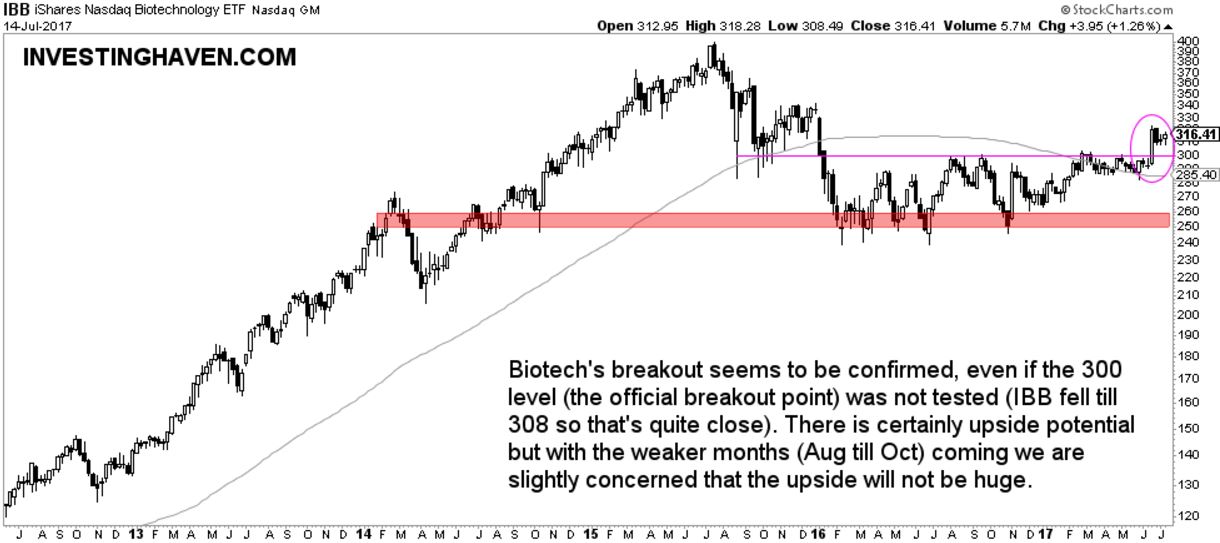

The third place is shared between biotech stocks and coffee. That is because the upside potential of both is not as high as emerging market stocks and uranium mining stocks.

Coffee has a beautiful setup. We noticed the coffee price crash of 2017, and said that coffee was at a make-or-break level. Visibly, support held, and we see coffee moving higher from here. The upside potential is some 30 percent. The way to play it is through JO ETF.

However, if $1.6 is broken to the upside, coffee will be in a raging bull market.

The biotech space is also bullish right now. Prices should move higher, but we are concerned about the fact that the seasonally weaker months are coming. Otherwise, for the short term, biotech looks great.