Emerging Markets have been front and center in our Global Markets research at InvestingHaven. 10 months ago, we wrote about how Emerging Markets Will Be Strongly Bullish In 2018. Towards the end of last year, we wrote our Emerging markets outlook for 2018 and 2 months ago, we confirmed a Bull market in Emerging markets.

Almost 3 weeks ago, Emerging Markets (EEM), along with the S&P, saw a sharp price correction. The correction was sharp, fast and took many by surprise. Today we will cover if the retrace is a healthy retrace or the invalidation of our Bullish outlook (a reversal). We will also cover if we still believe Emerging markets will outperform the US Stock market:

Global stock markets are outperforming U.S. stock markets in 2017. What’s more, it seems that a new era has started in the stock market, one in which U.S. stock markets are not leading any longer. InvestingHaven.com

Emerging Markets performance as we start 2018

In the Emerging Markets Outlook 2018, we reiterated our Bullish stance on these markets and provided the following Important price level that investors need to watch in 2018:

In other words, as long as EEM ETF trades above 42 points it will be hugely bullish in 2018.

Therefore we still maintain a Bullish stance on these markets. As scary as the move earlier this month was, it is very unlikely that we see a reversal in the current uptrend. But to properly assess the recent price action, we need to zoom out a bit to have a clear picture of the strength in Emerging markets performance as well as potential threats that could invalidate our positive outlook.

These are some interesting observation from the below chart showing the iShares MSCI Emerging Markes ETF performance for the last 4 years:

- The sharp retrace in Emerging markets that happened earlier in February 2018 didn’t even touch the 42 Level (horizontal support area) let alone the 44 area (diagonal support area).

- Since Horizontal support usually provides a stronger support area (relative to the diagonal support) and the price didn’t even touch any of those area, if anything, the retrace just confirmed the strength of the uptrend in emerging markets.

- We have a strong support area in the 42 to 44 USD area and even with the recent correction in Emerging markets, the uptrend is intact and they remain very Bullish.

Emerging markets will outperform the US markets in 2018

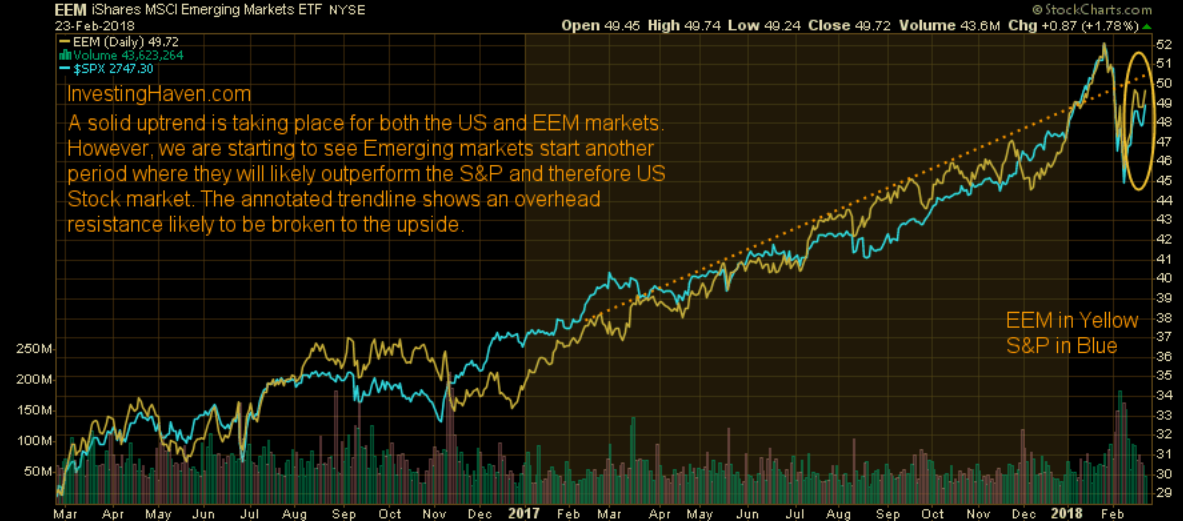

The chart below compares the performance of the S&P 500 relative to the EEM ETF that represents the performance of Emerging markets. We see how the annotated circle is showing that EEM was first to bounce back and outperforms SPX since the correction. We foresee this to be the dominating trend in 2018, emerging markets to outperform the US markets with China in the lead.

Our readers who were following our research were able to catch the inception of the Bullish run in EEM or the major dips at a minimum as we were closely following the sector and updating along the way. This interesting article by Bloomberg from 2 days ago is covering how multiple hedge funds are starting to see the opportunity in emerging markets, specifically China ( A market for which we dedicated a Premium report with our top picks to benefit from this Bull market), India and are planning to chase these returns in 2018.

As these new players initiate positions in these still undervalued equities, we expect more and more funds to rotate towards emerging markets leading to both a stronger performance for the latter and a widening in the performance gap.

To conclude, 2 key points we derive from our price analysis: 42 USD is the key level investors need to watch. As long as emerging markets trade above this level, the uptrend is still intact. That is the beauty of spotting the very few crucial price levels, it makes assessing the current and future moves possible and straight forward.

The second takeaway is Emerging markets are not only likely to lead the way, they actually started to since February’s correction and will likely continue for 2018.

![[:en]emerging stock markets[:nl]groeimarkten[:]](https://investinghaven.com/wp-content/uploads/2017/05/emerging_stock_markets-1024x682.jpg)