InvestingHaven’s research team has been watching a new trend in markets: an inverse correlation between gold and cryptocurrencies led by Bitcoin. In recent months bitcoin clearly went up at the same time when gold was going down, and vice versa.

Before we go any further into analyzing the correlation between Gold and cryptocurrencies / Bitcoin it is very important to remind our readers that these are two completely different asset classes, that the horizon for studying such a correlation is rather short and that, at least for now, the investor profile is different for each of these assets. So as much as we encourage investors to observe this important correlation and as fascinating as it is to ” follow the money”, any early findings should be taken with a grain of salt, at least untill the cryptocurrency market matures further and trends as well as dynamics become clearer.

A new inverse correlation between Gold and cryptocurrencies (Bitcoin)

The chart featured in our article comes from the team at Goldchartsrus, and shows how a tight inverse correlation is starting between Gold and Bitcoin, specifically since December 2017. Watch the upper pane of this chart especially since last August / September.

In fact, Bitcoin’s Top in December 2017 happened towards the same time as the recent bottom in Gold price. How could an extremely risky asset such as Bitcoin be correlated to one of the top safe havens, if not the top one?

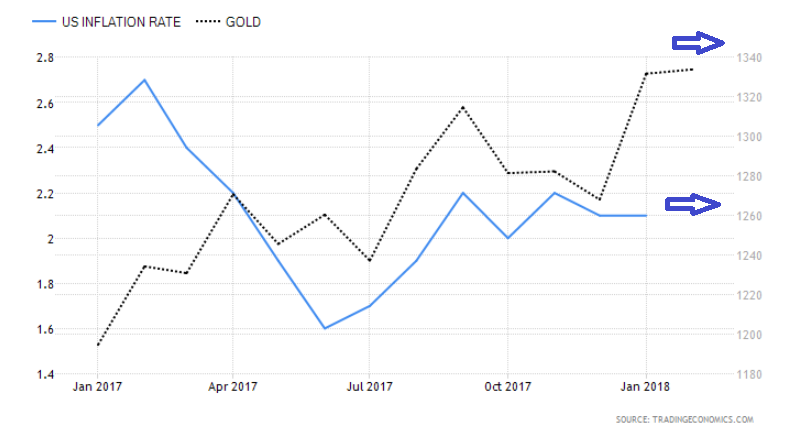

A possible answer could be inflation. The chart below shows how June 2017 was the start of the upwards move in inflation rate in the state. Gold followed as well, more on a sideways movement but trending upwards and Bitcoin price, especially since July, went parabolic. It was also around the same time as the segwitt upgrade which played an important role, however it’s worth noting that inflation was moving in the same direction.

The first chart in our article also illustrates an important ratio for both Gold and Bitcoin investors: The Bitcoin to Gold ratio. The ratio shows that even with the massive retrace in the Bitcoin to Gold ratio, the upwards trend is still intact. Therefore, we can expect more upside for Bitcoin prices. And if Bitcoin price is Bullish for 2018, the whole Cryptocurrency market and Blockchain sector is Bullish and it is important investors know how to participate in this Bull market.

But as Bitcoin price is rising, will Gold keep falling and 1360 be the top for 2018? In other words, If Bitcoin price gains traction, does it mean Gold price will Crash?

Not necessarily, we saw how Gold kept a sideways movement with overall higher highs as Bitcoin was in a parabolic advance. This actually confirms our views shared last week about how Gold is likely to continue in a sideways movement prior to the next move.

With that in mind, the million dollar question is the following: If inflation keeps raising in 2018, what asset class will investors rotate towards? Gold? Cryptocurrencies? Bitcoin as a store of value? Both? Those are some interesting questions we will looking to answer this year as we follow these new trends and correlations.

Our key take-away? At InvestingHaven, we watch very closely what happens at the important secular breakout and breakdown levels, both in gold and Bitcoin, in order to forecast which of both markets will be bullish in 2018!

Interested in investing in the blockchain and cryptocurrency mega bull market? Consider InvestingHaven’s research service >>