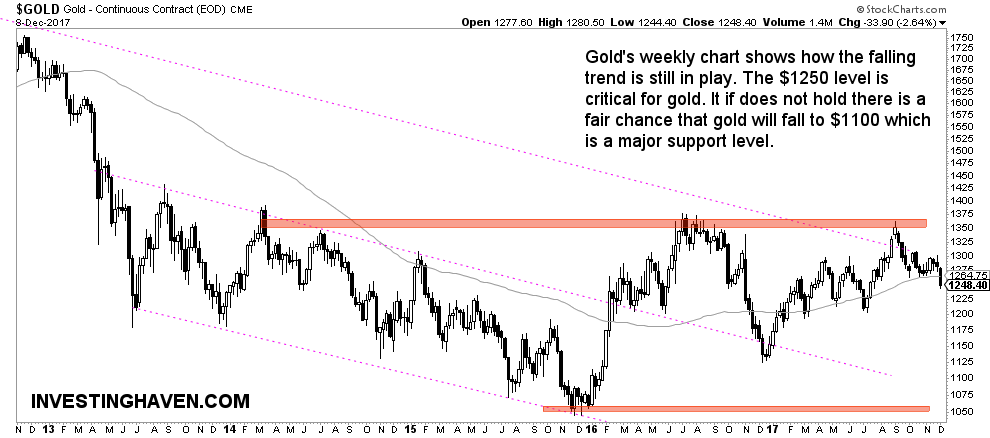

After we wrote our Gold Price Forecast for 2018 the price of gold started doing exactly what we thought it would do: decline. Does this mean that gold will be bearish in 2018? Of course one day does not make a market, and there are some 250 trading days left in 2018.

The point we try to make with the recent gold price decline is not that one of the 3 scenarios from our forecast is about to come true.

We merely want to point out that gold is reaching a critical price level, and what happens here will be telling for the coming weeks and, potentially, months.

Here are a couple of observations:

- The $1250 price level is critical. Though not visible on the chart it marks support on a tactical trendline. Once this level is broken to the downside it looks nasty for the short to medium term, and we would not exclude a test of $1100 early 2018.

- The first part of each year is typically a strong season for precious metals. So that could provide tailwinds to gold’s price, and could help gold stop’s fall.

- Many gold investors are turning to cryptocurrencies, so an outflow of capital out of precious metals is the result, and certainly does not provide much support for gold at current levels.

In the bigger scheme of things we see gold falling if the $1250 price level in gold gives away in the short term in which case the 7-year falling trend continues. That was our first scenario in our gold price forecast for 2018. Depending on where the fall would end we can start seeing whether a sideways trend has started or the secular fall continues.

On the flipside if gold goes higher from here we stay focused on the $1300 to $1360 area for any potential sign of bullishness.