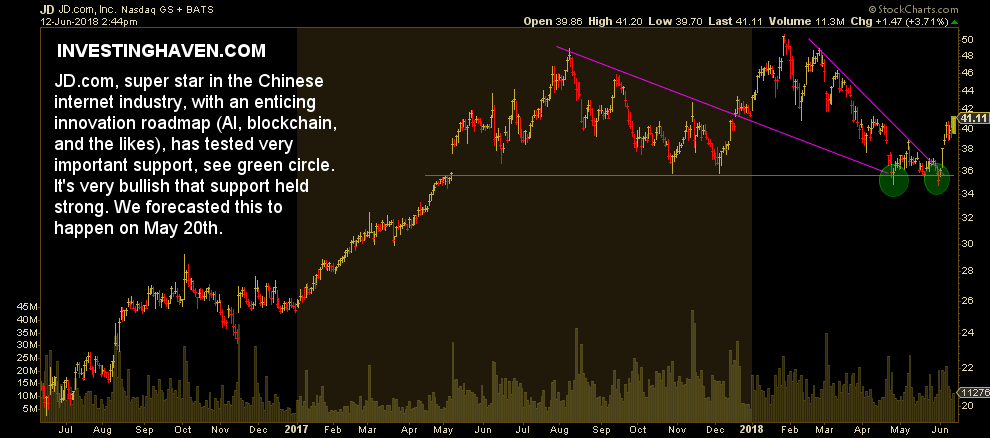

On May 20th, when JD.com’s (JD) stock price was trading at 52-week lows, we wrote the following article: JD.com, Chinese Giant Internet Stock, May Be Firing A Buy Signal.

We analyzed its financials, fundamental conditions and market trends in its industry as well as country. Based on the analysis of all these data points we concluded that “it is clear that this is a buy opportunity more than anything else. However, the chart of JD suggests this stock is trading at critical support right now.”

Indeed, any market or stock trading at important support levels looks scary. Not only does it look scary, it feels extremely scary for sure if you are invested in it. But that’s how Mr. Market plays its game: it scares people at the bottoms. Selling low after buying high, is the end result.

We continued in our previous article:

How to play this? The odds favor a bullish move. However, current support should hold. So smart investors are ready to pick up shares of JD as soon as the market confirms that support at $35 holds strong. A great entry point is the $38 price level, again, only after support at $35 has held. This is a classic case which needs some attention, and weekly followup, before engaging in a trade. Patience, as said many times, will be rewarded, and JD is a textbook example to illustrate this.

The ‘latest and greatest’ chart of JD.com shows our point. Last week was a great entry point after 52-week lows were tested successfully in the last week of May. A strong bounce from support to the $38 level was the trigger exactly in the way we explained it.

This stock has one clear message: it is bullish in 2018, for sure if China’s stock market succeeds in respecting its secular support level as explained in China Stock Market Did Something Important in May 2018.