The last week of February 2018 closed on a market sell off. The Dow Jones dropped with more than 400 points on a Bearish outlook mostly driven by speculations on Trump’s tariff. Most investors are wondering again if this is the end of the Bullish run in the stock market. We don’t think so, at least not yet. The following 2 charts will clarify why.

Nasdaq and tech Stocks: Charts show a Strong Performance likely to continue

In the midst of the sell off on friday the 2nd of march, Nasdaq composite managed to close 1.08% higher. Nasdaq, an index representing tech stocks has been on a solid uptrend since 2009 as shown by the chart below. There were 2 major consolidation periods and it seems the pattern on the chart is a 2 years upside run, followed by a 2 year consolidation period. In 2009 however, the 2 years consolidation was followed by a major crash for obvious reasons.

So based on that observation, the current leg up that started in 2017 should continue through 2018. This outlook would be invalidated, at least on a shorter term if the price crosses below 6600 USD. It is also worth mentioning that in an environment of rising interest rates, Tech stocks tend to perform well, which corroborates the observation from the chart.

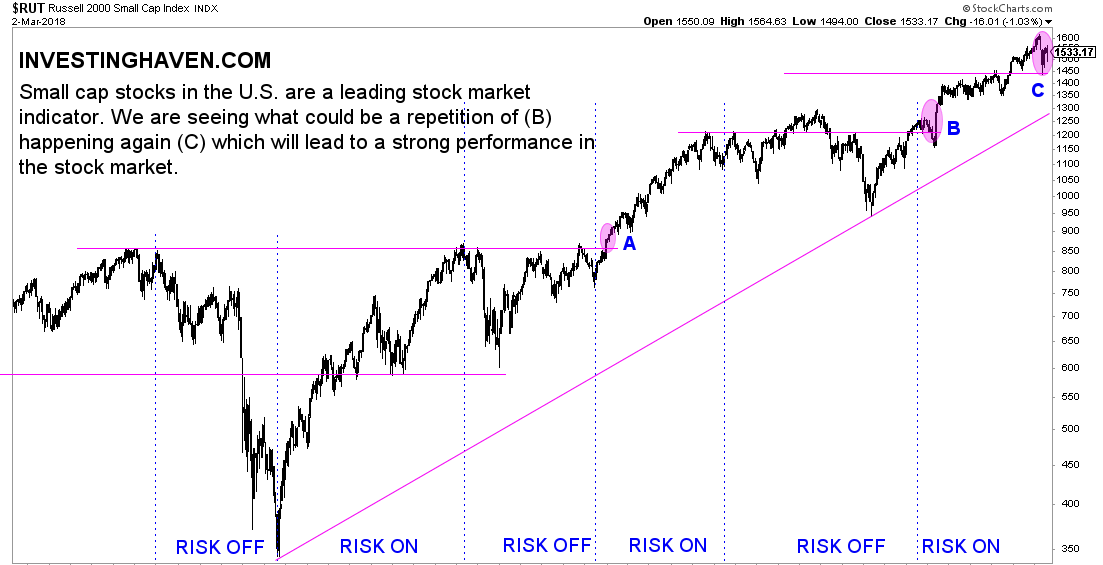

Another chart we thought is worth mentioning is the Russell 2000 (RUT), an index representing 2000 small caps. We covered what Russell 2000’s performance means for the stock market performance more in details before. In the light of the Market sell off last week, we thought it was a good idea to revisit the performance of this important index. In fact, the index managed to close on Friday at a 1.71% increase for the day which is worth noting given the circumstances.

From the longer term perspective, we see in the chart below how it back tested its breakout level which is constructive. It also signifies we might be going higher and if that happens, it will be very bullish for the stock market. Russel 2000 and Nasdaq’s close on Friday combined with the long term outlook show that the sentiment in the market is still Risk-on although the financial media might say otherwise.

Another important confirmation we had is related to a niche we have been very Bullish about to the point of starting a research service: Blockchain stocks. These are Tech stocks and mostly small caps so it is worth noting that if anything, Friday’s price action combined with the long term outlook shows that the Stock market is still on a healthy uptrend and Blockchain stocks are set to benefit the most from this favorable environment.