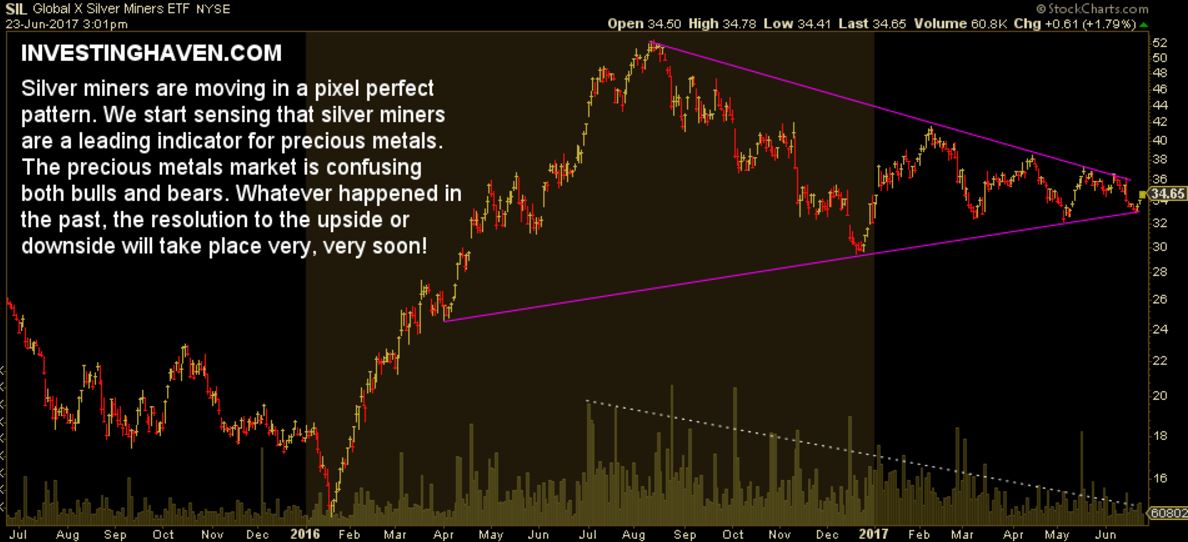

In all honesty, we have not seen very often such a long fight between bulls and bears that is currently ongoing in the silver mining space, and, likewise, in the whole precious metals space.

We start sensing that silver miners are a leading indicator for precious metals. That implies investors better pay very close attention to what is happening on the silver miners chart.

As said one week ago, Silver Miners Are Facing Another Critical Test. Meantime, they bounced from that support level and are heading slightly higher now. With that, they are again 5 percent away from a major breakout point.

Silver miners (SIL), similar to gold and silver, have confused bulls and bears in 2017. The secular downtrend remains in play, but the tactical trend has been tested continuously this year. We wrote several articles each time silver miners arrived at support and resistance:

- Silver Miners: Another Awesome Chart Setup

- A Rarely Seen Silver Price Chart Pattern

- Silver Price: 7th Breakout Attempt, Amazing Chart Setup

Suffice it to say: this is a nerve wracking market at this moment in time. It is very seductive to take positions every time silver or silver miners approach a resistance level (long positions) or support level (short positions). But this one of those many cases which show that investors better wait for a trend to start, rather than try to anticipate it.

From a contrarian perspective it is interesting to note that silver miners have no interest at all in Google News. In other words nobody is paying attention. However, the larger question is what happens to gold and silver, and, unsurprisingly, that gives also a neutral set of stories at this point. That will change very soon though once precious metals breakout OR breakdown … it is a matter of time!