Are Bonds signalling that Risk-on Continues for Stock markets in 2018? This is the question we will cover in this article to assess if the market is still in a Risk-On phase in 2018 or if the tide has turned.

Financial Media outlets are full of stories about how Tariffs and trade war is impacting the stock market, triggering fears and hopes. For investors, this is the time where sticking to charts and the few relevant data points is important to take the right decisions. For that sake, we are going to stick to the basis of our intermarket analysis to try to understand the market’s direction.

Based on the study of the different indices, we see that the trend for most asset classes is unclear. Most major indices are close to crucial support levels. We are even seeing the same in our Blockchain and Cryptocurrency research. And to be clear, when we say Crucial support levels, we mean supports that once broken, could lead to potential reversals. But those are also mega supports that are very likely to hold.

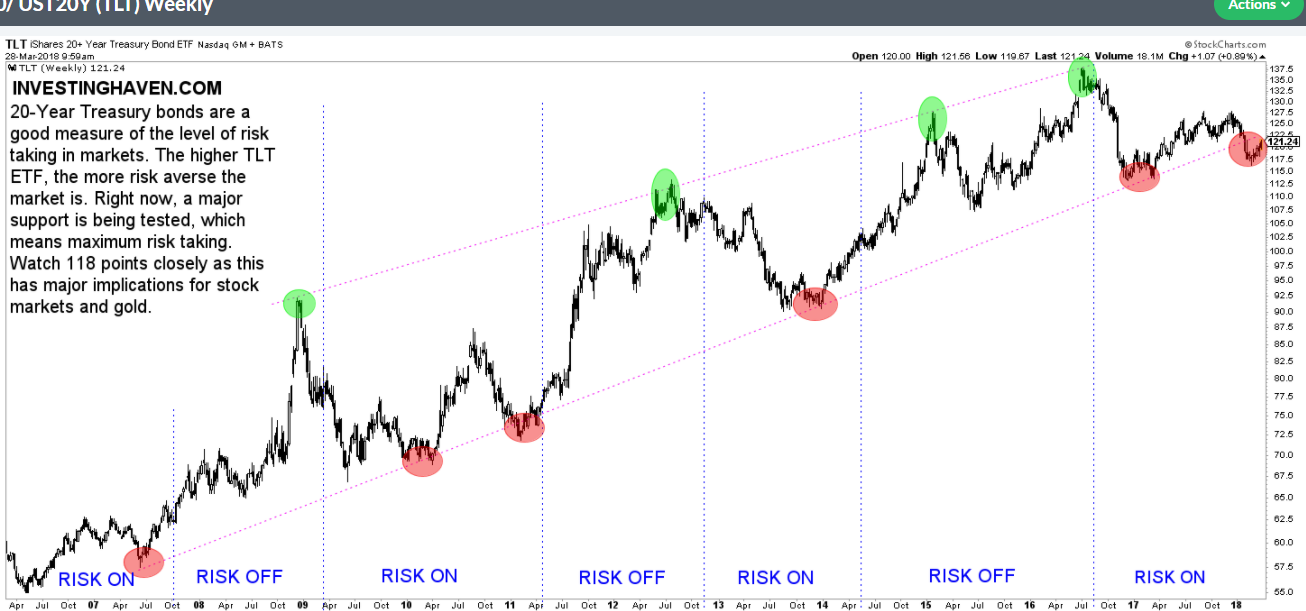

20-Years Treasury Bonds, a leading indicator to assess risk appetite

The chart below shows the iShares 20-years treasury bonds ETF price for the last 10 years. It illustrates clearly how we are at a turning point for bonds and therefore for the level of risk taking in the market.

The 118 points was an important support we were watching to see if the price will be supported or rejected. As shown below, TL bounced at 117.90. The question now is the following: Do we have a false Break down scenario here or are bonds about to go higher?

In fact, the TLT price chart shows how the price dropped below the ascending trendline and is heading back to test it. If successful and TLT’s price crosses above 122.50, we might be heading towards a Risk-Off for markets. That should provide a boost to Gold prices and safe havens such as the Yen. This is particularly interesting as Gold is currently at an important resistance area and could benefit immensely from such a move.

If the TLT price gets rejected at 122.50, we might see the Risk-On continue in the stock market, which would pressure assets such as the Yen. Gold might not necessarily turn bearish in this scenario as we have other factors that could at least lead to a neutral to Bullish trend in Gold for 2018. We still favor the Bullish scenario for Gold and Silver as we mentioned in our recent articles.

The next days to weeks will be crucial as we will be able to find out what the price action in bonds will indicate for markets and investors. The answer for now to the question “Are bonds signalling that Risk on Continues for Stock markets in 2018? is simple, watch the price action around 122.5 to 123. If it breaks above, Risk-Off likely to start. If the price gets rejected, Risk-on to continue.

The direction of the least resistance seems to be downwards and therefore Risk-on but this is a time where investors need to be alert, watch and react once they have the necessary confirmations.