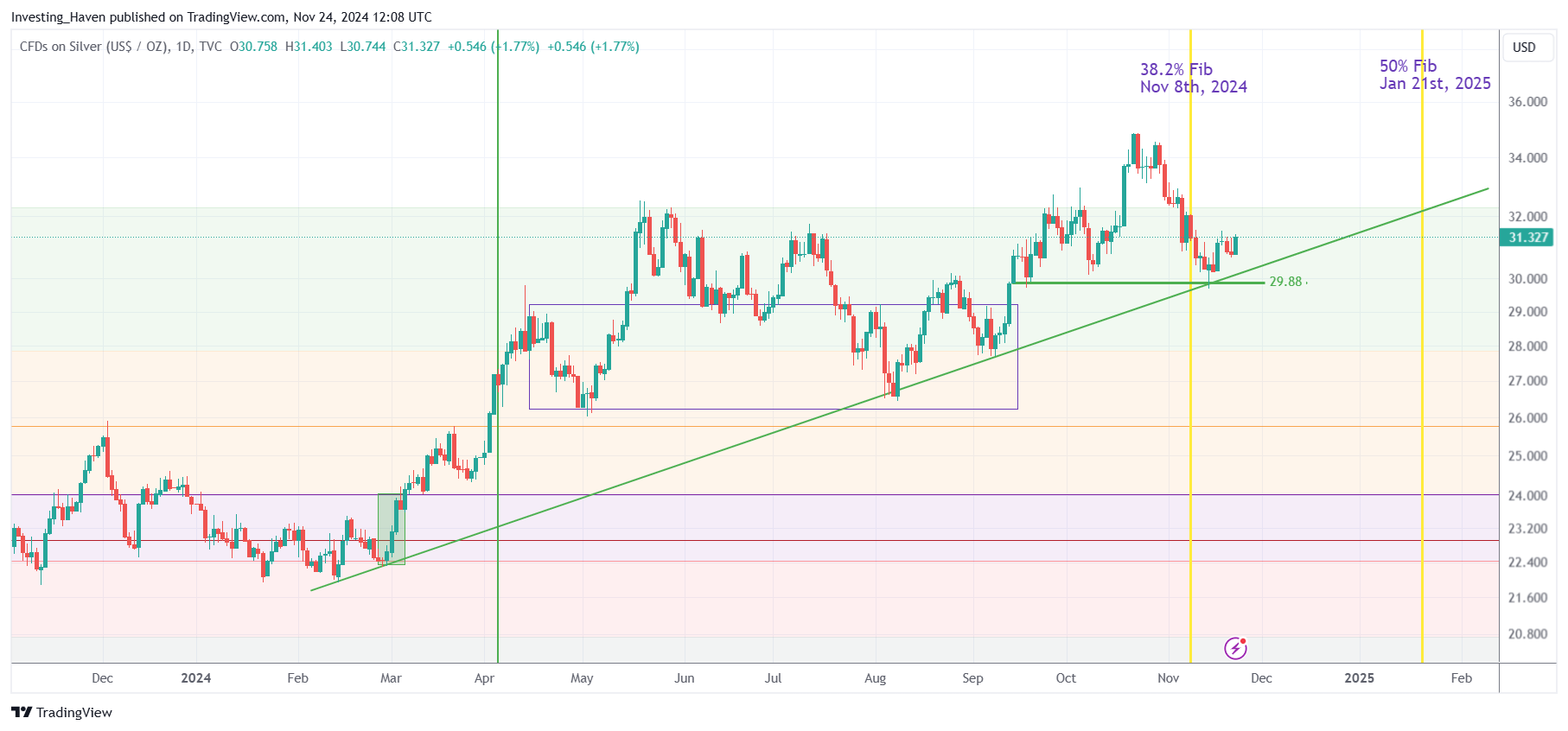

In summary, the bullish silver story will be confirmed if spot silver trades above $32.70, by February 1st, 2025. This will confirm silver ATH before summer 2025.

RELATED – When Exactly Will Silver Hit $50 An Ounce?

In this article, we revise 5 silver price charts.

They are all consistently painting a bullish picture.

They visualize the silver bullish story, and confirm our bullish silver price prediction.

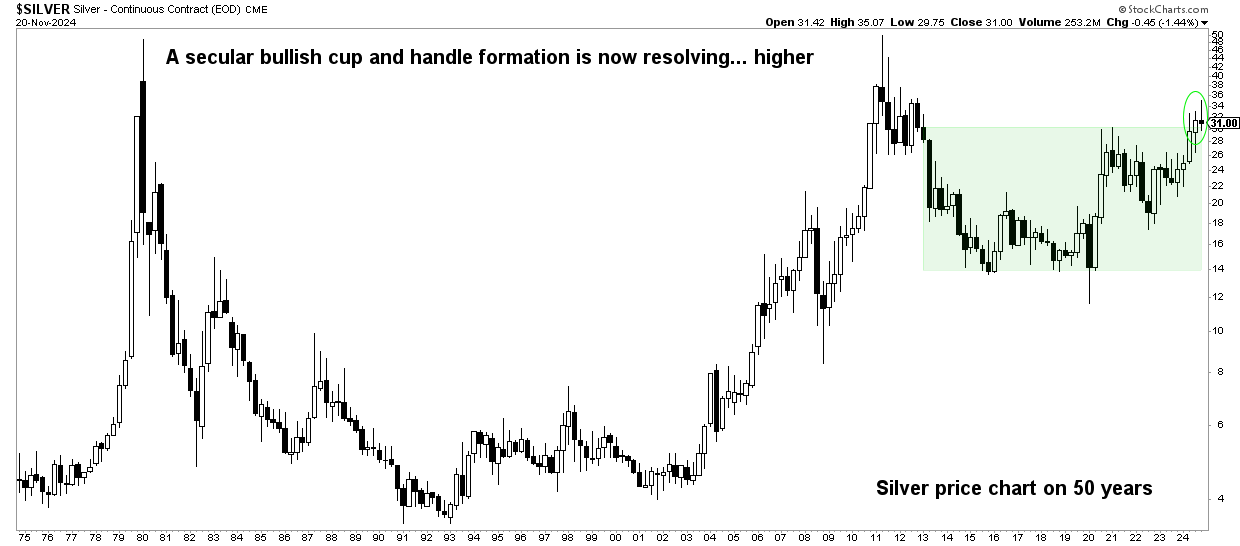

Bullish silver story – the wildest cup and handle reversal in history

We have said it many times – the long term silver price chart is unusually bullish.

We have made the point that this cup and handle reversal is so bullish that it may qualify as THE most bullish cup and handle formation in history of markets.

That’s because of the unusual length of this pattern.

RELATED – Can silver ever rise to 100 USD an Ounce?

The longer a pattern, the stronger it gets.

The bullish silver story can be summarized with this one chart: the 50-year silver price chart.

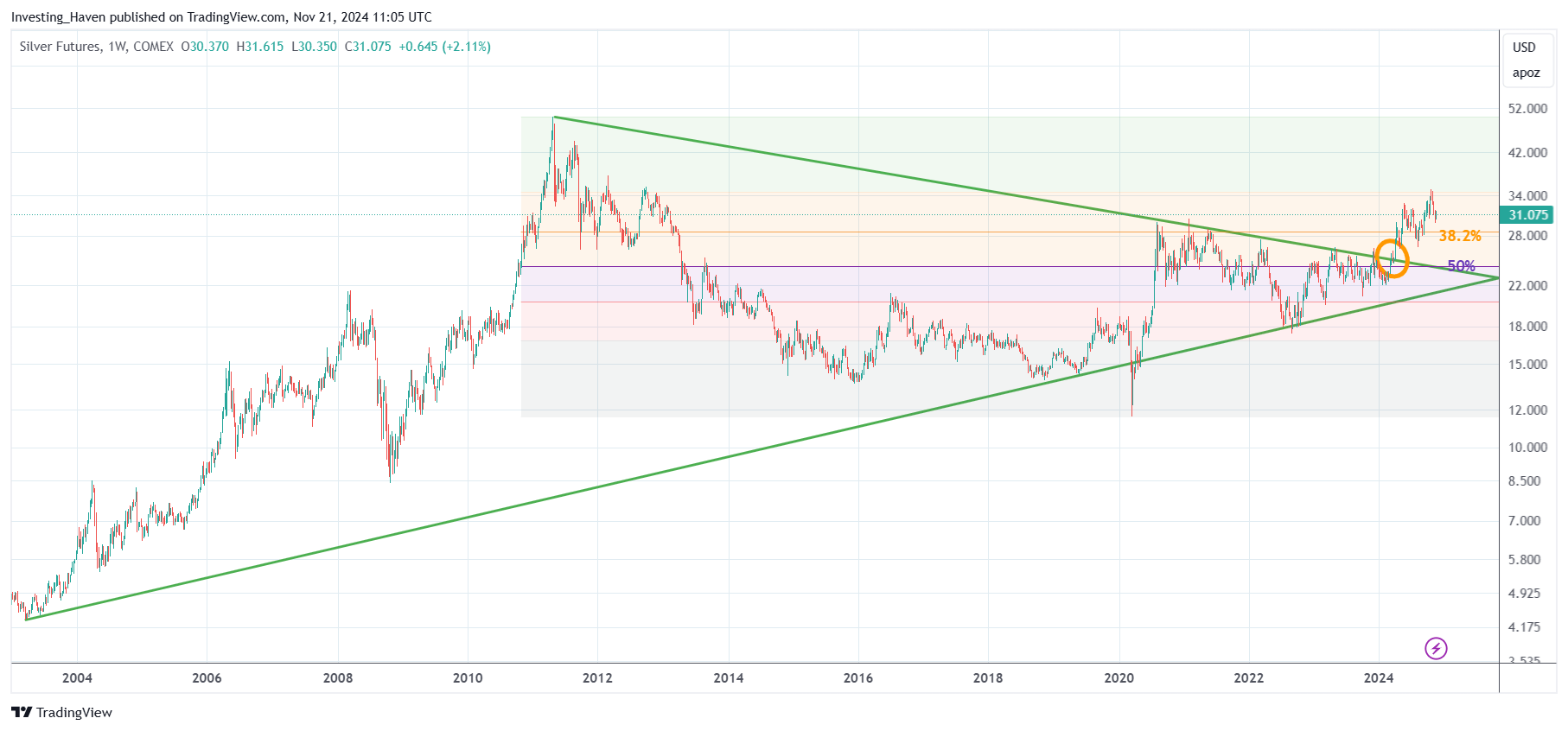

Bullish silver story – bullish triangle breakout

When switching from the 50-year chart to the 20-year silver chart, we cannot ignore strength because of the bullish triangle breakout.

- A bullish triangle breakout does not guarantee anything in terms of price targets.

- It also does not forecast when exactly a higher target may be reached.

- Equally important, it does not exclude a drop in price.

What matters is the dominant chart pattern.

As seen on the 20-year silver price chart, the dominant pattern is very bullish for a few reasons:

- The length of the bullish triangle.

- The clear breakout of the triangle.

- More importantly, the breakout of the triangle occurred right at the 50% Fib level.

Once silver broke out, it was in bullish territory from a Fibonacci perspective.

Those reasons tell a bullish silver story on the 20-year silver chart.

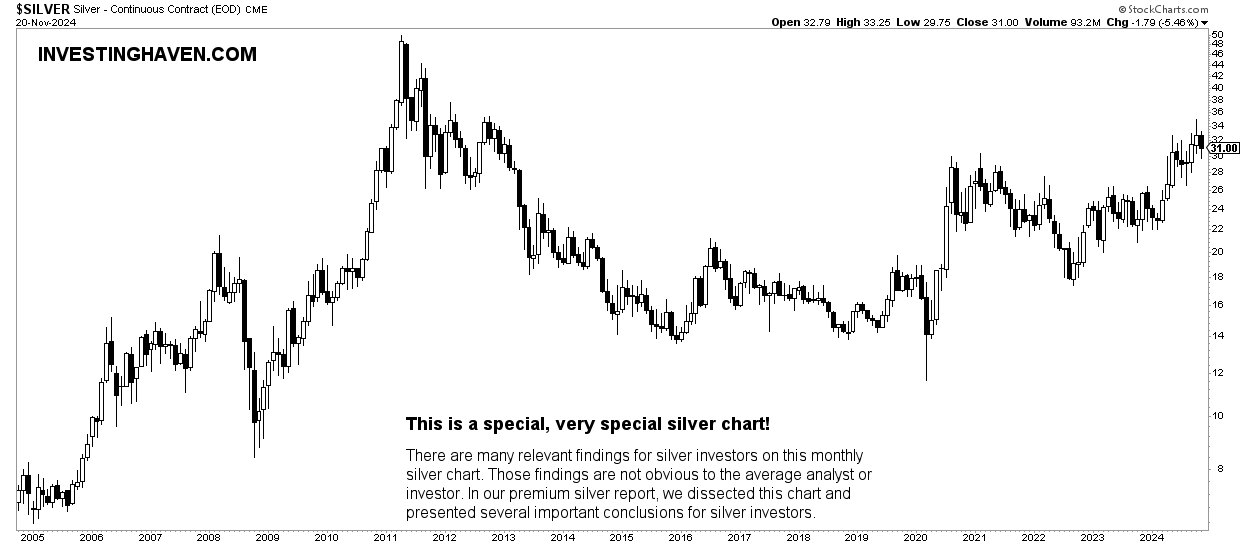

Hidden bullish signal

Candlestick charts come with a wealth of insight.

Similarly, the next silver price chart has hidden signals.

They are bullish.

We have covered the chart insights that we derive from this silver price chart in our premium gold and silver service. While the details are reserved for premium members, the summary is this:

Silver will remain ultra bullish as long as it does not breach $26 /oz.

There are bullish signals on this chart, rather hidden, available and visible on a specific candlestick structure printed in 2024.

Bulls can write a bullish silver story in January 2025

On the shorter timeframe, there is one very specific date that matters for silver investors: January 21st, 2025.

This is why: The Most Insightful Silver Chart Analysis You Will Ever Read

It has to do with Fibonacci and the timeline axis.

While the entire world is focused on Fibonacci on the price axis, we unlock more value by applying Fibonacci on the timeline axis.

Mark the following price and date – 32.70 USD/oz and January 21st, 2025.

Silver has a unique opportunity to write history in 2025 by exceeding $32.70 by 01.21.2025 which will push silver to ATH before summer 2025..

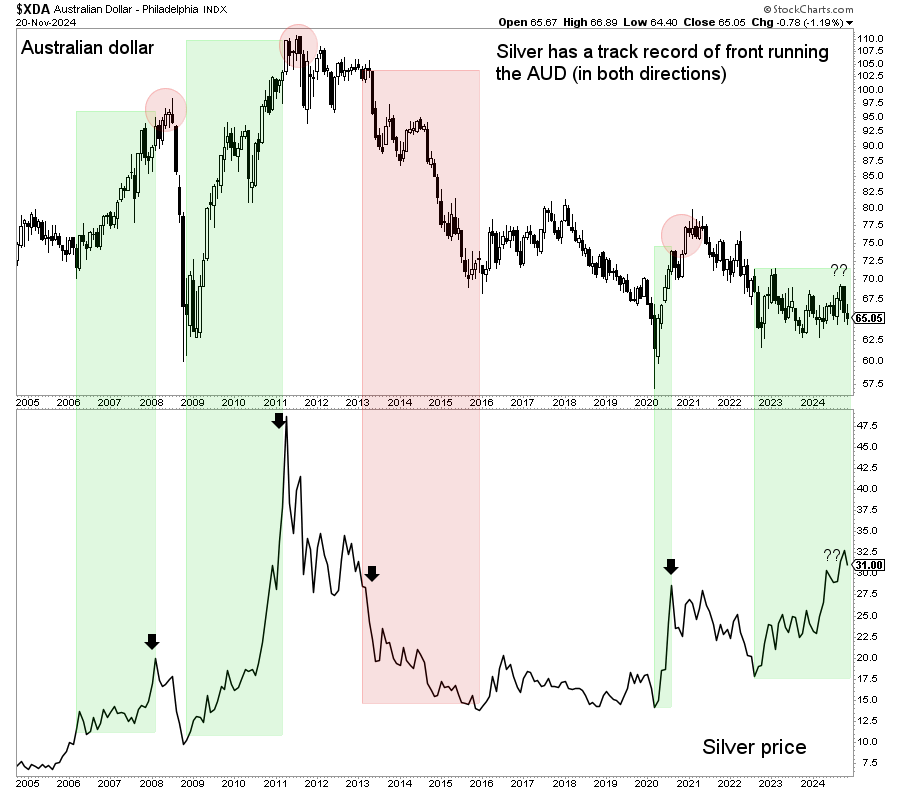

Bullish silver story told by the Aussie

What does the Australian Dollar (Aussie, AUD) have to do with silver?

Very simple the AUD is correlated, directionally (not day-by-day), with the silver price.

The next chart shows the correlation.

Take-away: if the Aussie continues to make higher lows, a structure that it started creating since early 2023, it will bode well for silver.

Silver bull market conclusions

The silver bullish story is clear and straightforward:

- The long term silver chart pattern is unusually bullish. This one chart pattern in and on itself is almost guaranteeing that silver will touch ATH sooner or later.

- The bullish triangle breakout occurred right at the most important Fib level, confirming the silver bullish story.

- The bullish silver story confirmation might be there if and when silver clears $32.70 by Jan 21st, 2025.

The silver story is simple.