KEY TAKEAWAYS

- Silver trades around $82 after a dramatic January spike to $121.60 and a swift correction that exposed extreme volatility.

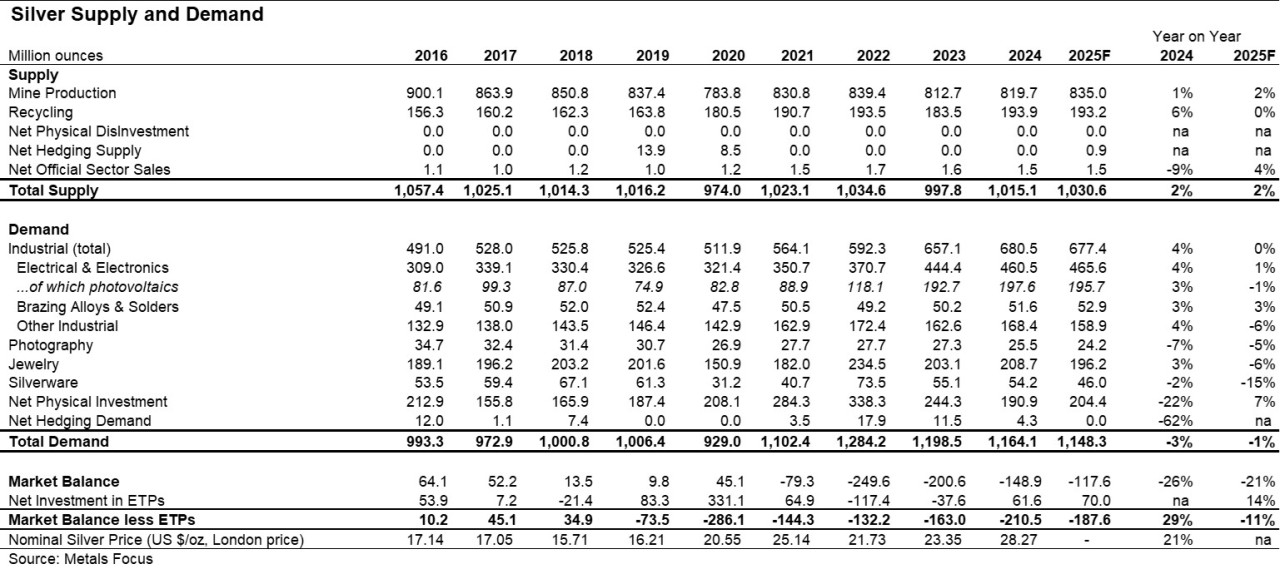

- A projected 67 million ounce deficit and strong coin and bar demand keep long term supply tight.

- A move to $200 would require sustained physical shortages, falling real yields, and strong investment flows over many months.

- Real yields, ETF inflows, retail premiums, and exchange inventories provide early clues about potential major price moves.

Silver’s structural deficit, rising investment demand, and intense volatility create powerful upside potential. Still, reaching $200 requires rare macro shifts and sustained physical shortages.

Silver’s price swings in early 2026 stunned traders and retail investors alike. Spot silver now trades around $82 per ounce after a surge that pushed prices to $121.60 in January before a rapid reversal erased much of the gain.

At the same time, global supply tightness continues. The Silver Institute projects a 2026 structural deficit of about 67 million ounces and expects physical investment to rise 20% to 227 million ounces.

These figures show a market where limited changes in buying or supply can trigger dramatic price reactions and renewed speculation.

But can Silver hit $200 an ounce? Let’s find out.

RELATED: Will Silver Hit $150 An Ounce?

Silver Price Today And Recent Moves

Silver currently trades around $82 per ounce, far below January’s $121.60 spike but still well above levels seen just a few years ago.

The January rally grew from aggressive retail buying and leveraged futures positions that squeezed short sellers and tightened dealer inventories. Coin and bar premiums increased quickly in major markets.

The reversal that followed revealed how fragile speculative rallies can become once leveraged traders exit positions.

Exchange inventories fluctuated sharply during the same period, which tells you how quickly the available float can change when buyers rush into the market.

The recent price action revealed that silver reacts more intensely to sudden liquidity shifts than many larger commodities. Even small imbalances between buyers and sellers can trigger outsized percentage moves.

This keeps speculation high whenever investors expect tighter physical supply or stronger safe haven demand.

ALSO CHECK: A Silver Price Prediction For 2026 2027 2028 – 2030

Silver Supply And Demand Outlook

The Silver Institute expects a structural deficit of roughly 67 million ounces in 2026, while physical investment demand may reach about 227 million ounces.

Global mine output continues to grow slowly, estimated around 1.05 billion ounces. Recycling supply has also increased as higher prices encourage sellers to return old metal to the market.

This means total production remains large, yet liquid and investable supplies remain limited compared to demand surges. Industrial use still plays a major role, especially in solar panels, electronics, and advanced manufacturing.

Some manufacturers have reduced silver intensity in certain applications, which tempers growth projections for fabrication demand.

Even so, concentrated buying waves can overwhelm short term supply channels. Dealers must often rely on existing inventories rather than new production, which takes time to reach markets.

When retail investors increase purchases rapidly, available stock tightens quickly and prices react immediately. However, higher prices also encourage recycling and profit taking, which increases supply and slows extreme rallies.

This balance between structural deficits and flexible secondary supply explains why silver can rise sharply yet still struggle to sustain exponential moves without strong macro support.

RECOMMENDED: Silver Shortage Looms As EVs And AI Chips Consume Supply

What Must Happen For Silver To Reach $200?

Rising from about $82 to $200 requires a solid combination of macro and physical forces that must last longer than typical speculative rallies.

First, real interest rates would need to fall sharply and remain low, making non yielding assets like silver more attractive than bonds.

Second, sustained ETF inflows and retail accumulation must exceed new mine supply and recycled metal for several consecutive months.

This would reduce available inventories on exchanges and force buyers to compete aggressively for limited metal.

Third, a genuine liquidity squeeze must occur where dealers struggle to source physical bars without raising prices significantly.

Past market squeezes show that thin inventories combined with concentrated buying can push prices higher faster than analysts expect.

Some bullish scenarios assume severe market stress, rapid monetary easing, or unexpected spikes in industrial demand that stretch supply chains beyond normal capacity.

Without several of these conditions happening together and persisting, a $200 target remains highly speculative for the short term at least, and difficult to maintain even if prices briefly surge.

Risks And Signals To Watch

The most important signals to watch now are macro data and investment flows as they provide the clearest warning signs of major price shifts.

That said, ensure to also monitor:

- Real interest rates and central bank policy changes because lower yields often increase demand for precious metals.

- ETF inflows, retail coin premiums, and dealer inventory reports for evidence of sustained physical buying pressure.

- Exchange stock levels reveal whether shortages are temporary or expanding.

- Margin changes from brokers can also intensify volatility when leveraged traders rush to exit positions.

These signals will show whether price moves reflect lasting supply stress or short lived speculative enthusiasm.

YOU MIGHT LIKE: Top 3 Metals to Buy for the Clean-Energy Transition: Copper, Nickel, Silver

Conclusion

Silver has strong structural support from supply deficits and growing investment demand, which increases the chance of significant long term gains. Still, reaching $200 requires multiple forces working together for an extended period.

Real yields, physical inventories, and sustained investment flows remain the most reliable indicators of any extreme rally.