The long term silver chart priced in Euros has a few promising characteristics, one of them the soft pullback after its recent ATH test.

As said in recent months, silver investors should check the silver chart priced in their own currency.

Silver priced in global currencies

That’s because silver priced in USD, which is the standard used for analysis, is showing significant divergences with silver priced in other global currencies.

READ – Silver Reaches All-Time Highs in Most Global Currencies… Silver in USD is Next!

We made the point, recently, in the article above, how different the silver charts priced in Canadian Dollar or Indian Rupee (to name a few) are when compared to silver in USD.

A few days ago, we made showed that Silver Is Hitting New All-Time Highs When Priced In AUD.

In this short blog post, we look at silver priced in EUR.

Silver priced in EUR

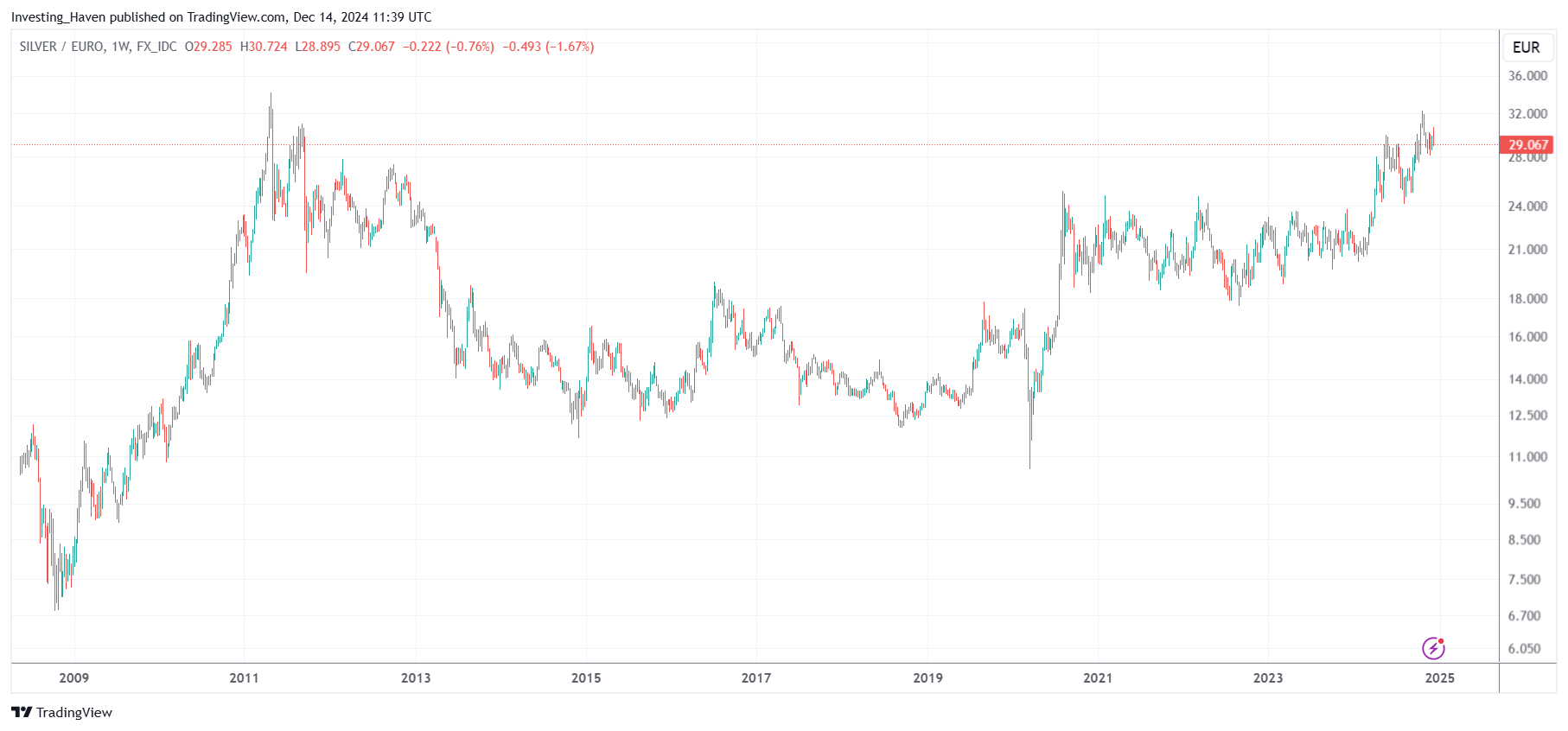

Below is the silver price chart since the last 15 years.

It looks different than the long term silver price chart you are used to see. That’s because ‘the entire world’ uses silver priced in USD. The chart below is silver priced in EUR.

Interestingly, silver in EUR tested ATH in October. Nobody was talking about this, however, because silver priced in USD was more than 30% below its ATH.

Silver in EUR – chart observations

A few observations that stand out when carefully checking the silver price chart expressed in EUR:

- The pullback after hitting ATH was soft. This is great, so far at least, as it implies that there was no heavy selling.

- When compared to the pullback in 2011, after hitting 33-34 EUR/oz, the current setup is so different.

- The run-up to ATH in 2024 has been long and slow. This is great, because the run-up in 2010/2011 was aggressive, fast, without no support structure near ATH.

It looks like THIS TIME IS DIFFERENT. And it’s consistent with our long term bullish silver prediction.

RELATED – When will silver in USD hit ATH?

The silver price chart priced in EUR has a few interesting and encouraging characteristics: it has tons of support in case it decides to continue retracing, it has barely moved higher in 2024 (in relative terms, when compared to the steep rise in 2011), the chart pattern is a powerful bullish reversal.

Therefore, we believe that silver priced in EUR has more upside potential than downside potential, when zooming out and assessing its long term potential.

Note, however, a pullback is perfectly possible, not necessarily a bad thing, as long as $26 will hold. Eventually, the bullish outcome seems inevitable, but the path to such an outcome is going to be rocky… in the end, silver is the restless metal.