We compare silver in USD with silver in other global currencies. Out of 10 currencies, silver is setting new ATH in 4 and silver is inches below ATH in 3 currencies.

RELATED – When Exactly Will Silver Hit $50 An Ounce?

We conclude that the global trend of silver is up. Silver is in a global bull market despite the fact that silver in USD did not hit new all-time highs (ATH).

Take-away – Is this an epic opportunity for silver in USD investors? The most likely answer is YES; it is a matter of time, most likely, until silver in USD is going to test its ATH.

Silver in USD – well below ATH but the chart says…

We have covered the silver in USD chart in most of our silver related articles:

- Silver: Long Term Chart Now Officially The Most Powerful Bullish Reversal In History.

- The 50-Year Silver Price Chart And Its Hidden Message To Investors.

- 5 Reasons Why Silver Is The Investment Opportunity Of The Decade.

- Can The Silver Price Rise To $100?

This is the secular silver chart (silver in USD) without annotations. This chart has a clear setup that any analyst and chartist will recognize as a bullish cup and handle – the chart says that it’s on its way to $50 an Ounce. It’s a matter of time.

For investors that are not used to analyze chart patterns, we present the quarterly candlestick chart which makes the point very clear (below).

While the next silver chart has limited annotations, it should be clear from its structure (especially the breakout out of the consolidation, green shaded area on the chart) that a basing formation is now in the final stage of completing.

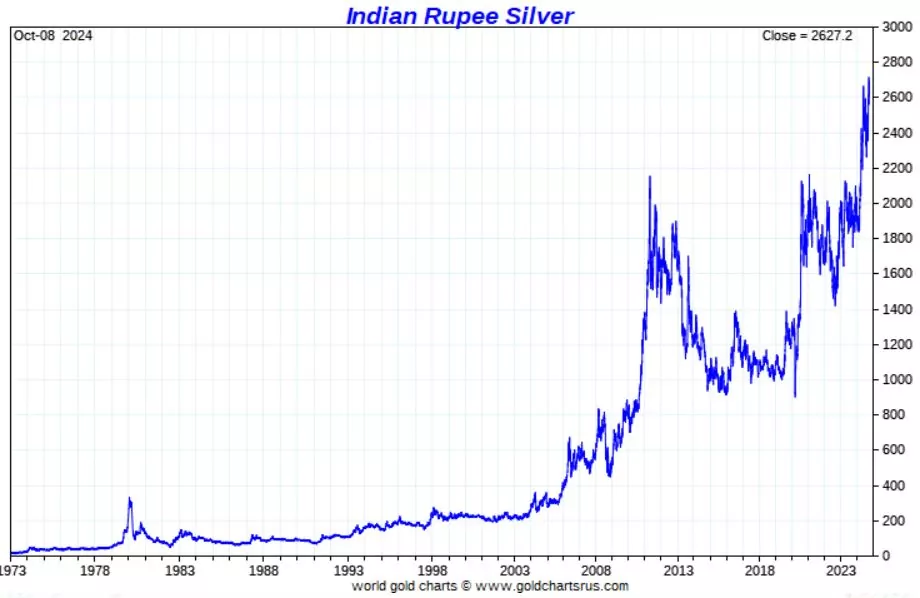

Silver in Indian Rupee: new ATH

Silver priced in Indian Rupee is hitting a series of new ATH in 2024.

No surprise, the retail public as well as investors keep on hoarding physical silver in recent years, also in 2024.

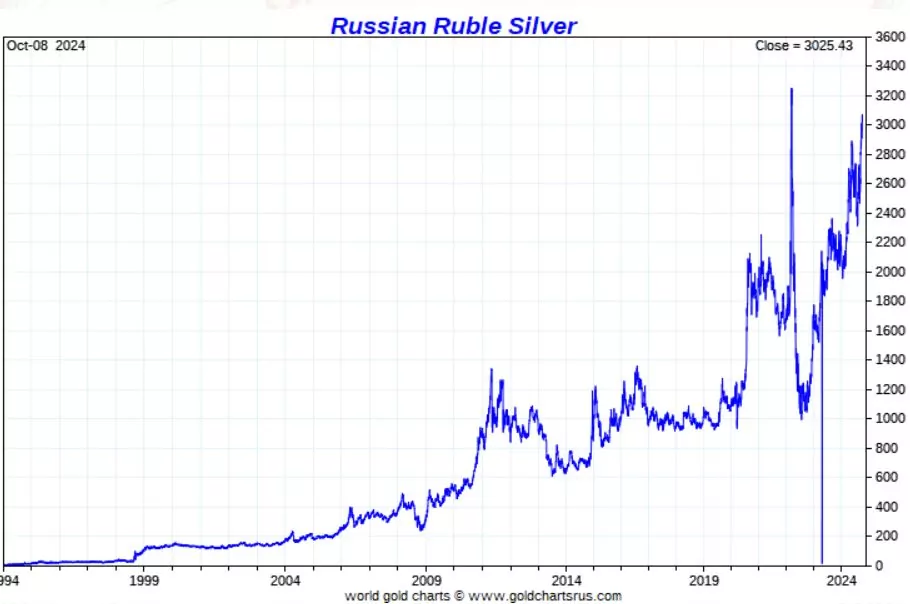

Silver in Russian Ruble: new ATH

Silver priced in Russian Ruble is printing a series of higher highs in 2024.

Arguably, ATH were hit in 2022, so technically silver in Ruble is just not yet hitting ATH. It’s fair to say, however, that the situation in 2022 was an outlier. The spike, back then, was very short-lived. For the purpose of this article, we exclude the temporary and short-lived spike of March 2022.

Silver in Australian Dollar: new ATH

Silver priced in Australian Dollars exceeded ATH in 2024. It went above its 1980 and 2011 highs.

Silver owners in Australia should be very happy with their silver holdings, especially since the breakout above ATH did not result in a big decline, on the contrary.

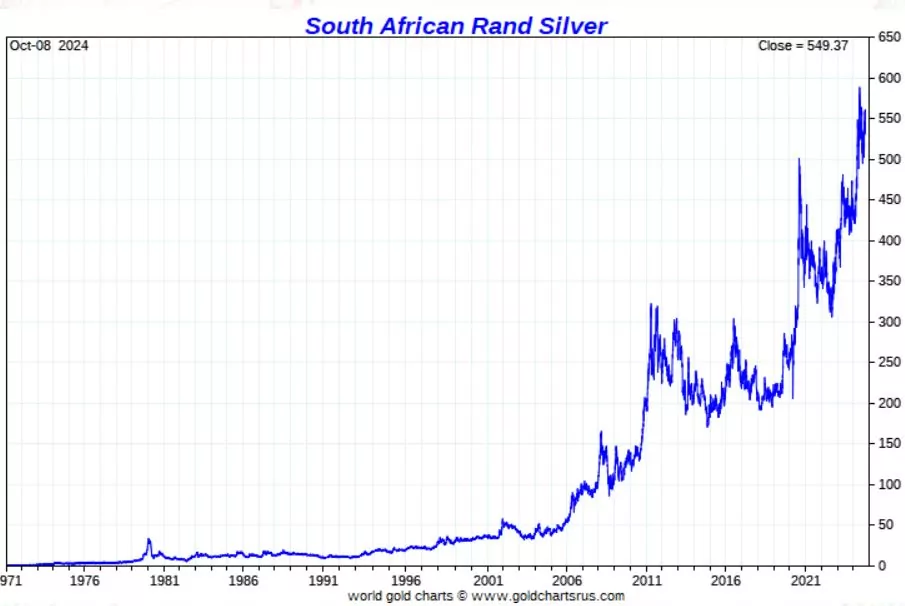

Silver in African Rand: new ATH

Silver priced in African Rand is setting a continuous series of new ATH in 2024.

Silver in Canadian Dollar: inches below ATH

When expressed in Canadian Dollars, silver is right below its ATH. Arguably, it’s a single digit below ATH.

This chart makes it very clear – silver in CAD will be touched very soon, and similar to silver in AUD it will exceed ATH.

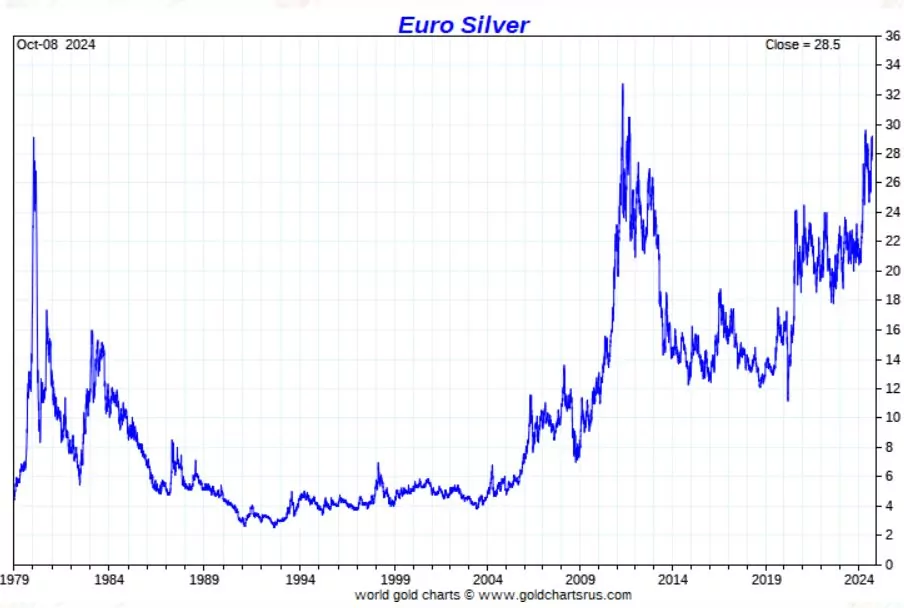

Silver in Euros: inches below ATH

Silver priced in Euros is about to hit its former ATH. Interestingly, silver in Euros is now above the January 1980 peak, right below its 2011 peak though (single digit pct). It’s clear from this chart – it is a matter of time until silver in Euros will hit new ATH.

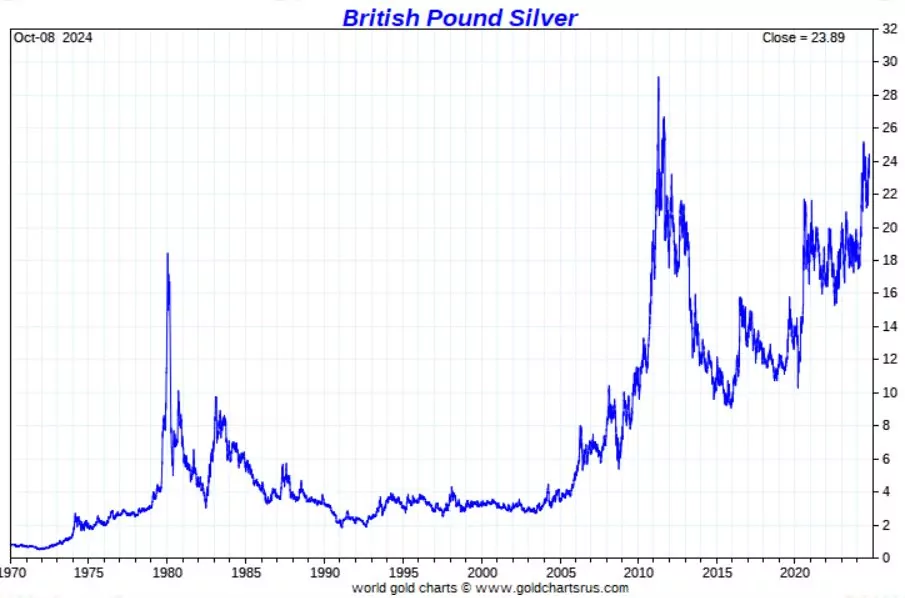

Silver in British Pound: close to hitting ATH

Silver priced in British Pound is far below its previous ATH. The silver chart setup priced in GBP is so aggressively bullish that it’s a matter of time (max. a few months) until silver will hit and exceed its former ATH priced in GBP.

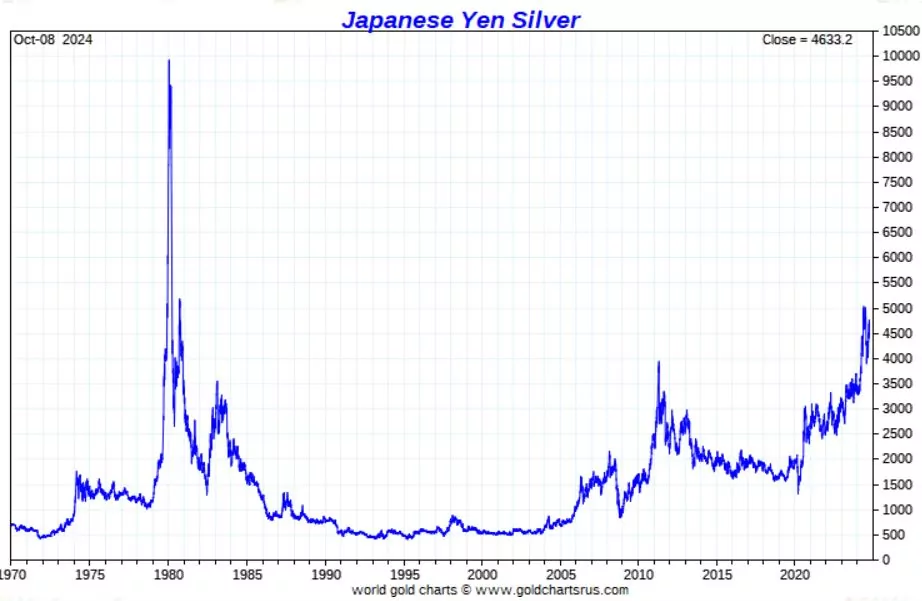

Silver in Japanese Yen

Silver priced in 7 world currencies, shown above, is hitting new ATH is getting very close to former ATH.

The silver situation in Japanese Yen is a little different, also specific.

Silver in Yen experienced an enormous spike, back in January 1980, which was very short-lived. Excluding this outlier (which is technically not accurate but helps us make the point in the context of this article) silver in Yen is hitting its 1981 highs, well above its 2011 highs.

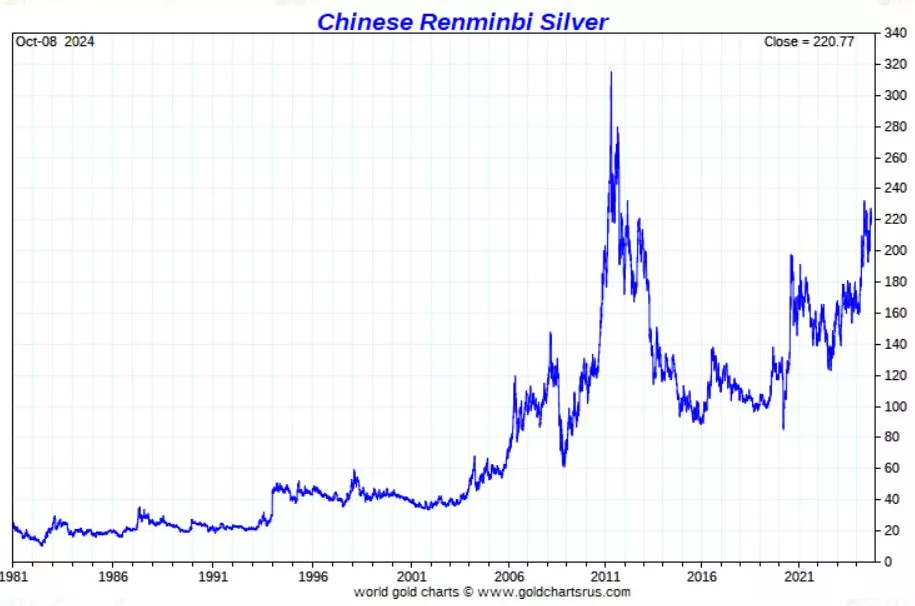

Silver in Chinese Renminbi

Silver in Chinese Renminbi is bellow its ATH. The chart setup is aggressive, and suggests that a test of ATH is underway (will not be hit in the very short turn though).

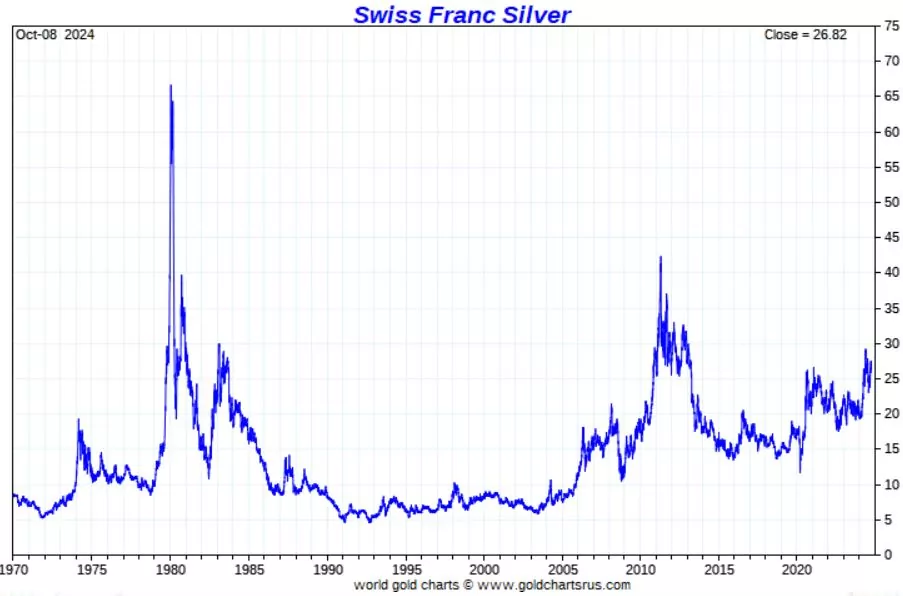

Silver in Swiss Franc

The only exception, when looking at silver priced in world currencies other than the US Dollar, is silver in Swiss Franc. While this silver chart setup is extremely bullish, silver in CHF is well below its ATH.

Silver at ATH in most world currencies, so what?

Why does this silver analysis matter?

Because it puts the silver bull market in perspective.

We have been forecasting a strong silver bull market, since a few years, with silver hitting new ATH in the 2nd half of this decade. To some degree, our forecast did already materialize, but not when looking at the silver in USD chart.

What matters is this – the global silver trend is up, hitting new ATH in most currencies, not yet in the USD. It’s the silver bull market dynamic that truly matters.

It is a matter of time until silver priced in USD will also hit ATH.

This conclusion is simple, no need to overengineer things.