The silver market is preparing a breakout after the ultimate ‘risk on’ indicator has started breaking out. In this article, we discuss this hidden indicator and its importance to the entire silver market.

READ – Silver price prediction.

We look at the long term silver price chart (super bullish), and complement it with the silver chart adjusted for CPI (super bullish) as well as our hidden silver indicator (super bullish).

Did we say that we believe the silver market is super bullish? Yes, we did, in this article published one week ago: Silver Reaches All-Time Highs in Most Global Currencies…. Silver in USD is Next!

Silver chart

First things first, the silver price chart pattern, not edited.

The spot silver chart on 20 years is shown below.

While not as powerful as the 50-year silver price chart, it is clearly exhibiting a very bullish chart pattern!

- It’s a bullish chart pattern.

- Its length is making it extremely powerful.

What is the message of this silver chart structure? ATH will be here soon. It’s not a matter of IF, it’s a matter of WHEN will silver hit $50.

Another silver chart

In case the above silver chart is not sufficiently convincing, we share this one fascinating chart from top precious metals analyst Stoeferle his post on X:

If you’re looking for an ultra-bullish #SILVER chart, we’ve got you covered: According to Shadowstats’ inflation-adjusted calculations, silver’s all-time high would be an incredible $1,800 per ounce. 😉 pic.twitter.com/4hdvh7aFKh

— Ronnie Stoeferle (@RonStoeferle) October 16, 2024

No doubt about it – the above mentioned silver chart suggests that silver is hugely undervalued.

Add to this the growing demand/supply imbalance, as explained in our silver squeeze article, based on lots of data points, and you have a confirmation of silver’s undervaluation.

So, looking at silver from three completely different angles, there is a similar outcome – silver is ready for an upward revision as it’s wildly undervalued around $30.

Silver hidden indicator breaking out

Here is the ultimate indicator that confirms strong bullish momentum is about to hit the silver market.

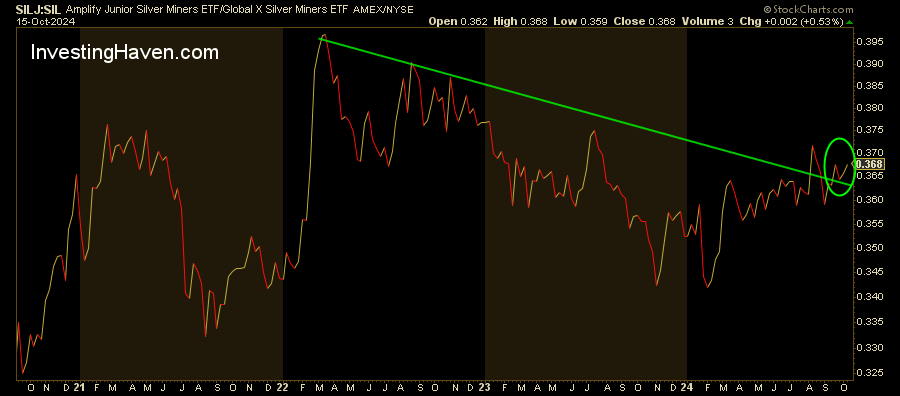

The silver miners to silver junior miners ratio, the ultimate RISK indicator for the silver market, is breaking out!

What’s so special about this ratio?

Very simple, it’s a RISK ON indicator when it’s on the rise.

Why?

- Silver junior miners are the highest risk segment in the entire silver market (when breaking down the silver market in components like silver bullion, senior silver miners, junior silver miners).

- By definition, the highest risk segment will only start rising when the market’s appetite for risk is significantly and structurally on the rise!

- In order to turn the above mentioned dynamic into an unbiased indicator, it requires to look at junior silver miners relative to senior silver miners.

As seen on below chart, the ratio senior to junior silver miners is breaking out now, after a multi-year consolidation. Moreover, this multi-year consolidation has the form of a bullish reversal.

How much more confirmation does anyone need to know that the silver market is about to turn super bullish?

Silver market soon on fire

Yes, indeed, all data points are now in alignment. It’s as if the stars are aligned for the big moment in the silver market to start anytime soon:

- 50-year silver price chart – insanely bullish chart structure.

- 20-year silver price chart – very bullish chart structure.

- Silver adjusted for CPI – silver is wildly undervalued.

- Physical silver market supply squeeze ongoing (and growing).

- Silver RISK ON indicator breakout ongoing.

- Anecdotally, Wall Street Silver is in overdrive.

The silver market will soon be on fire, is what the data is telling.

Are you listening?