Successful investing – it seems so easy. But repeating successes over a long period of time is much tougher than the vast majority of market participants believe. There are many pitfalls to overcome. Interestingly, most of them are hidden and counterintuitive so it is really tough to understand what went wrong after a failed investment. What’s probably even more interesting is that most investors get overly brave after hitting a big winner which mostly results in missing the next investment. Successful investing requires a lot of things to be right, and it requires to avoid an even larger number of things (pitfalls).

Investors can only reach the stage of successful investing after a very long journey which involves making many mistakes, adjusting them and spending many thousands of hours on research. It is worth the effort though because the magic of the compound effect will kick in for successful investors. If anything, the compound effect is really worth the effort. Only a very small number of investors ever can see the compound effect come to life in their portfolio. This, in and on itself, should motivate investors to reach those highest levels of success. If all this sounds too tough better to consider discontinuing all efforts. However, if this sounds like a really attractive challenge and motivates to ‘get there’ we encourage readers to continue reading. We will reveal 7 secrets of successful investing in this article.

One insight that is crucial and common to all 7 successful investing secrets is this one: financial market investing success comes with habits and practices that are counterintuitive to humans. Whether it is how you intuitively think about things, or how you handle emotions, or what you typically are aware of (also unaware of) in your day-to-day life… mostly works in the exact opposite way in financial markets.

Think about it. As a market participant you want to give the best of yourself, you want to act and think based on everything you have learnt in your (professional) life, you prepare decisions similar to how you have made the best decisions in your life… and you come to realize that it is the exact opposite you have to do in order to create success in financial markets.

What a bummer. What an illusion. Arguably, a deception.

Are you sure you want to continue reading? If you are brave enough to answer ‘yes, I want to continue reading’ you have already reached a level of success that most market participants will never achieve. Mentally accepting what we have written so far is a step that most simply cannot accept, it is their ego speaking because in day-to-day life you must have a strong ego to succeed. Not so in financial markets, investing in financial markets requires your ego to become as small as possible (ideally even smaller than that).

A lot is written about success in investing. However, almost all of those articles only scratch the surface. They give tips that are not fundamentally important, focus on tactics or even cover topics that are simply irrelevant. More importantly, though, they ‘forget’ to cover the ‘elephant in the room’ which is the inner world of the investor. In this article you will find ‘the real stuff’.

Successful investing secret #1. Emotions lead to bad decisions

Emotions can come in many forms. It can be joy (because your position is going up), it can be fear (because your position is selling off), it can be doubt (not sure what to do now), it can also be braveness or impatience.

The problem with all these emotions is that they are so human that many of us are unaware of them. They ‘are’ just there. We never learnt in life to work with them as an input which means that you recognize them but that you don’t let them influence you. You use them as an input when you are aware of them and when you are able to think of them similar to any other input (information first and foremost).

Most market participants are unaware of their emotions, and also unaware of the way they influence decisions.

One thing is clear: emotions stand in the way of successful investing. They disrupt success.

It requires many years of practice to become aware of emotions and how they relate to your decision process. You know will have achieved the right level of awareness when you are able to write down your emotion and put it next to the other pieces of information that you collected in your research prior to making a decision.

Successful investing secret #2. Narratives create tremendous bias and result in unawareness

Narratives can also come in many forms. They have one thing in common: a very high level of confidence in a specific outcome. It’s dangerous, very dangerous, when you see the outcome prior of it to happen.

The problem with bias is that it mostly comes out of information that an investor has collected. So the source of the information but more importantly the quantity of the information plays a crucial role.

In day-to-day life we are programmed to collect as much as possible information. That’s the pre-requisite for a ‘wise decision’.

Successful investing works in the exact opposite way: you need less information, but the right (relevant) information.

In other words, whenever you find yourself in a situation in which you are searching for information (often as a reaction to a position that is not acting the way you expect or desire) you should realize that you are directly and actively searching to be biased.

The opposite is true as well: whenever you feel that you let the market do its work and you know what your investing thesis is as well as your invalidation thesis you are unbiased. It’s great to be unbiased, it creates peace of mind.

Arguably, emotions combined with bias are the two biggest pitfalls for investors. The problem is the vast majority of them, no matter how biased or emotional. Most are unaware/ unaware about both.

Successful investing secret #3. Micro moments is when the best entry decisions are made

Many investors believe that entry decisions can and should be planned, similar to how we are used decisions in our life. Our lives are centered around planning. There is hardly any room for last-minute decisions. It is almost a negative attribute of a person that operates in life with very limited planning.

We have seen that the very best entry decisions are made in a timeslot of 3 days. Yes, it is great to have a plan which consists of an investing thesis (a market is likely going to move in a certain direction) combined with a shortlist of candidates (stocks that are worth initiating a position). Now, it is not ok to be too rigid about this. Very often, stocks ‘confirm’ their bullish or bearish intention in a short period of 3 days (max 5 to 8 days).

You have to be able to spot those micro-signals in those micro-moments in order to hit those perfect entry points. Nobody, absolutely nobody, can plan them in advance.

If you believe that markets are convenient and you can take perfect entries in a convenient way you may want to thoroughly revise how successful investing works.

Successful investing secret #4. Only perls are worth your capital

Ever looked up the number of stocks that can be traded in the U.S. and Canada? If not, here is the approximate number: between 8,000 and 10,000 stocks.

The intuitive reaction of any human is that this is a great number to choose from. Plenty of choice, it can only help success.

Our point of view is the exact opposite. There is only a handful of stocks, every year, that is worth your capital. Empirical evidence of InvestingHaven’s research teams suggests that approx. 0.25% of the total number of stocks is worth your capital.

We are talking 20 stocks in a given year that are worth your capital.

The way to think of it is ‘hidden gems’. They are very scarce, and it’s preferable holding no position as opposed to compromising to this rule.

In our Momentum Investing research and portfolio we introduced the concept of MUCH LESS IS MUCH MORE. This reflects the 0.25% discussed before, and we institutionalized a ‘shortlist’ (which tracks a list of approx.. ten stocks which we have to update frequently to filter out the ones that improve vs. the ones that don’t).

If you feel that all the points covered so far get really counterintuitive then it is a confirmation that we are on the right path: we are helping you understand how successful investing really works. Most importantly, are principles for success when investing in financial markets are highly counter-intuitive for sure compared to what we consider the ‘norm’ in day-to-day life.

Successful investing secret #5. Principles for success are highly asymmetric

Several years ago we introduced our 1/99 Investing Principles. This is a set of dynamics that illustrate the asymmetric nature of financial markets. Our favorite illustrations of these highly asymmetric rules for success include:

- Only 1% of news is relevant to investors while 99% is noise. In a world of information overload you must be aware that you should not make decisions to buy or sell based on news articles as they are designed to sell advertising, not to be relevant data points for investors. Hence, only 1% of news articles is relevant.

- Only 1% of times are specific markets running fast. It takes a long time before a major rally occurs. However, a market can run very fast if and when once “it” starts. That’s because markets run fast just 1% of the time.

- Only 1% of price points on a chart are relevant while 99% is irrelevant. In a world of chart overload you have to go back to the core, and realize that only 1% of price points on a chart do matter. It is 1% of price points that help you identify dominant trends which is what it is all about for successful investing.

Sound too counter-intuitive? Then it should qualify as an investing secret for success.

Successful investing secret #6. Without a positive mindset and attitude there is no success

Investors can get very negative when things don’t play out the way they desire. As if markets are there to please individual investors.

When negativity accumulates over time it is going to impact the mindset of an investor. This is a slow process which happens in the background, without noticing. The investor is unaware of an increased level of negativity.

If anything, success in markets is achieved with a positive mindset, no matter how bad it gets. Any loss incurred should motivate, not depress. Only positive investors have a chance to make it into the 1% of outrageously successful investors. Without a positive mindset you will never make it into the 1%.

Successful investing secret #7. Identifying turning points in markets is the toughest challenge

We will be very short on this point: a turning point in markets occur mostly unexpectedly. That’s because turning points come after a long bullish or bearish period. The mind of the investor gets used to a specific market direction (up or down). That’s when it gets tough for the brain to ‘see’ the trend change.

Markets can change fast. It is a fool’s game to try to hit the exact top. Being smart about exits is what you need to avoid mental stress but still be relaxed about securing profits (not selling too early). Sounds easy, but it really isn’t.

If you think that points 1 till 6 outlined in this article are easy we are here telling you that point 7 is the toughest one of all of them. But you will only realize this once you have mastered points 1 till 6.

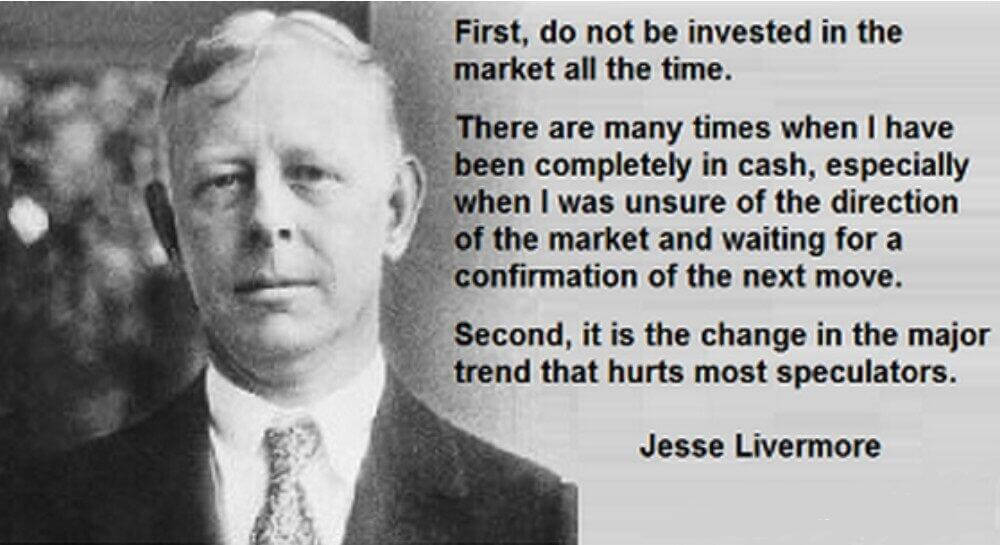

There must be a good reason by legendary Jesse Livermore said so: