In day to day life we like beauty. We like beautiful cars, homes, places, people. But do we attach the same value to beauty when investing in financial markets? Here is one more topic in our series of investing secrets nobody is talking about. Beautiful setups result in profitable investments. Beauty in financial market investing should have the same high value as beauty in daily life. As an extension of our masterwork 7 Secrets of Successful Investing we are sharing a series of investing tips which are easy to remember. The importance of beauty is one of them.

In day to day life we tend to appreciate beauty. People invest a lot of their precious time and money to travel to beautiful landscapes, to drive beautiful cars, to experience the beauty of meals (also drinks), to live in a beautiful house. The list is much longer. But the point is this: when investing in financial markets the bar should be set equally high to own positions in beautiful investments. What are ‘beautiful investments’?

‘Beautiful investments’ as a term or concept doesn’t really exist.

However, there is a way to recognize whether an investment is beautiful. Surprise surprise, it’s the chart that shows beauty. Easy answer right, if so why isn’t it the key topic of any investment advice, premium service, mainstream financial content, gurus and the likes?

Beauty of a stock is visible on the chart. A beautiful chart setup tends to result in a profitable investment.

As investors we should be disciplined to set the bar very high when it comes to chart characteristics. We also have to accept that beautiful chart setups are scarce. So the combination of discipline, high standards, and scarcity is probably the reason why this tip for success is underexposed.

A beautiful chart setup has nothing to do with technical analysis or chart analysis. A beautiful chart reflects a structured supply/ demand situation. Investors and traders are aligned on key support levels, and also on timing the uptrend. That’s what it is: no chaos between traders, investors on short and long term timeframes. There is harmony on the supply/ demand side which ultimately is reflected in the chart structure.

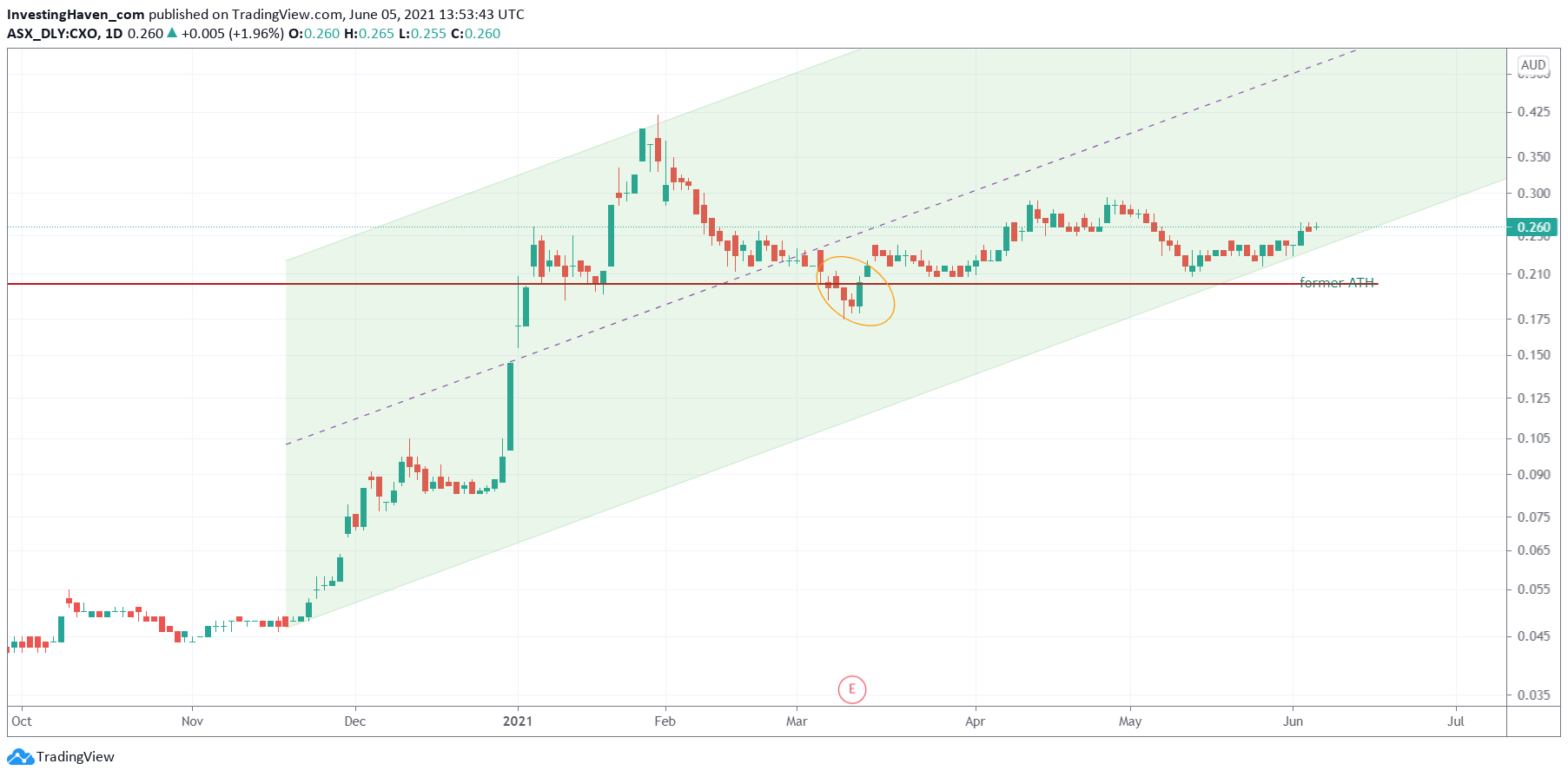

Here is an illustration of this, a lithium stock that we started featuring in our premium service Momentum Investing on June 5th. The stock trades in Sydney under the symbol CXO.AX, the name of the company is Core Lithium. It went up nearly 3-fold since we featured it, it’s not the end of the trend, but in no way do we feature this stock as a stock tip to buy right now. Although there is more upside potential it is late in the game to enter now.

On June 5th, 2021 we wrote this in our weekend update to Momentum Investing members:

We want to re-iterate the wildly bullish setup in Core Lithium, trading in Australia: CXO.AX is the symbol. This is the 3d and last time we say so: this is a multi-bagger stock. We always tell members to keep positions in small cap stocks contained, but full disclosure we built up a huge position in this stock in the last 2 weeks (in our long term portfolio). So IF there is a time when you are going to take a consolidated position in a small cap stock this might be one of the few exceptions in your career. Still, we are obliged to say: never invest more than 2 to 5% of your overall portfolio in one small cap stock, never!

This is the chart with the timestamp from back then (June 5th). Do you see beauty in this chart?

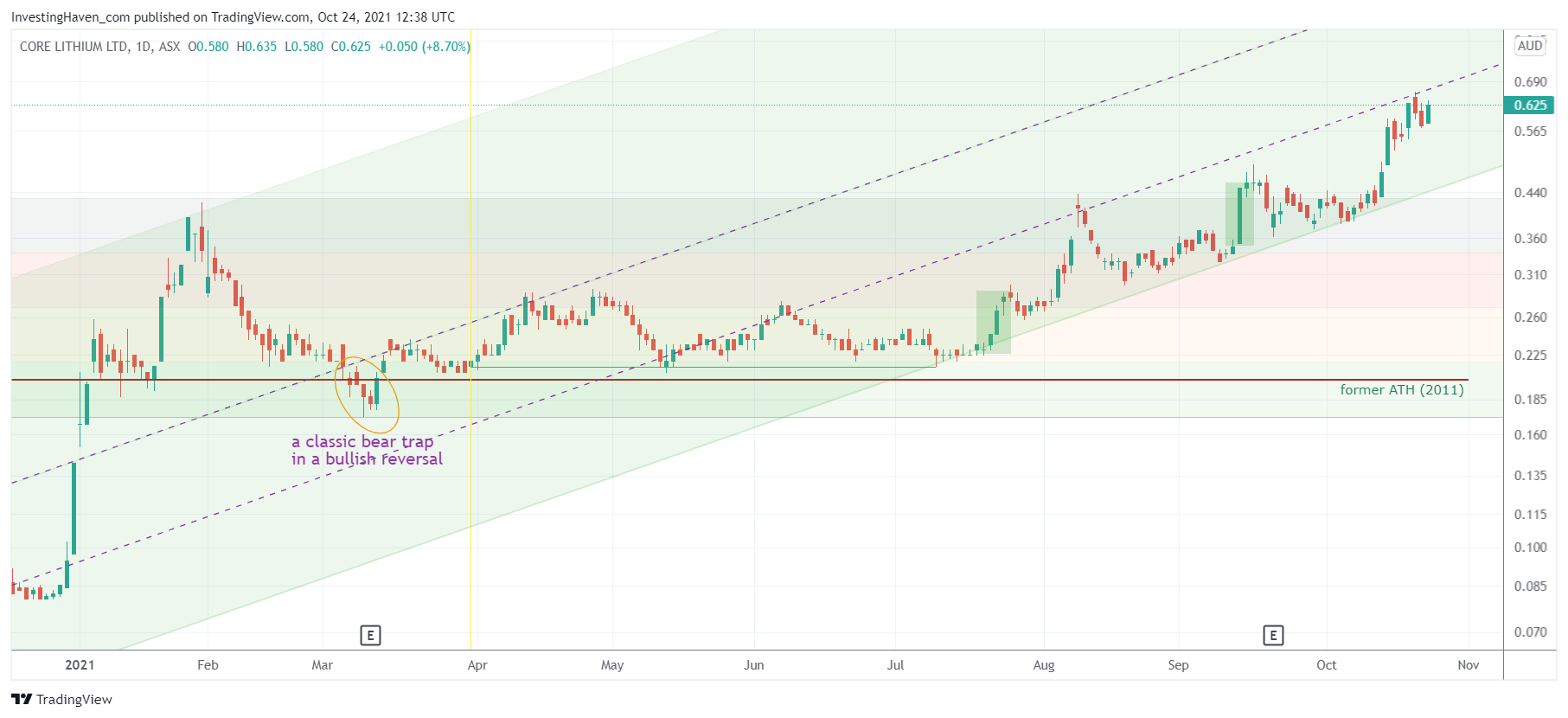

We followed up, one month later, with this quote on July 1st, 2021:

We want to emphasize that Core Lithium in Australia is among our top favorites for the remainder of 2021. Don’t take the OTC position, but only the shares in Sydney.

Fast forward to today you can see what happens with beautiful charts in financial markets. Although the chart is from a few weeks ago there is not a lot that has changed on this setup. Most importantly, beauty results in profits.

Beauty matters in real life in almost all domains of our life. It should matter when you invest in financial markets.

We recently took a pivot in our Momentum Investing strategy which reflects exactly this: exceptionally high standards when it coms to beauty. This will result in high profits. Our current portfolio is doing phenomenal things, and we believe it’s just the beginning. Note that we opened a new position on Thursday, in the lithium space, and it has a lot of room to move higher. Tiny detail: it has a beautiful chart structure!