In our top 5 stock forecasts for 2019 we focused on large cap stocks. We also see opportunities in the nano cap segment, especially with Edgewater Wireless. We expect Edgewater Wireless as a stock to do very well in 2019 because it may, both fundamentally and financially, turn out to be THE pivotal year for the company.

We will hasten to say that a year ago we predicted Edgewater Wireless to become a ten-bagger stock in this article: Edgewater Wireless (YFI.V) Ten-Bagger Technology Stock In The Making. This forecast has not materialized yet, but, visibly, we are on the right end as this year appeared to be instrumental for this company.

Before continuing note that Edgewater Wireless is a nano cap stock with a market cap of $17M at the time of writing. It carries a very high risk which is why any investor must consult its financial advisor first and do its down due diligence.

2019 a pivotal year for Edgewater Wireless stock

In our article last year we pointed out two important things we saw in this company’s corporate evolution. These observations are evident to us as we are following this company for 4 years already.

First, the company has clearly worked out a path to generate revenue. Below are three product / market combinations which are worked out better than say one or two years ago. It suggests to us that the company is becoming better in getting successes, which, ultimately, is the basis of growth.

Second, the company is getting traction. That is an incredibly important pivot point for any startup.

Yes, we believe this is finally reflected in the financial results. Fundamentals that become visible in the financials is a great thing, especially for nano and small cap stocks!

As per SEDAR where we found the company’s revenue from recent quarters:

- March 2018: 17,414 (income per share 0.01)

- June 2018: 119,315 (income per share 0.00)

- Sept 2018: 320,120 (income per share 0.00)

By far the most important data point, however, is this one: Order backlog of $948,475.

It shows traction, according to us. That’s exactly what we want to see, and combine this with a growing revenue backlog and growing realized revenues in the coming quarters.

As an illusration, Edgewater Wireless just realized the installation of their high capacity WiFi products in Wagener, the first sports venue in the world to install Edgewater’s MCSR technology. The stadium holds approximately 9,000 guests.

Edgewater Wireless: recent financials

Gross margin of $52,970 in the six months ended October 2018 which is a good signal!

The number of outstanding shares has come down since last year which is good.

On the concerning side of things it is clear that product development as well as G&A weigh heavily on the company with total expenses of $1,237,479 in the six months ended October 2018. Now this is normal in any fast growing tech company.

Similarly, the company has a cash position on Oct 31st 2018 of $399,187. This is what their financial filing says: “There is significant doubt about the appropriateness of the use of the going concern basis of presentation because management has forecast that the Company’s current level of cash and cash equivalents will only be sufficient to execute its current planned expenditures for 6 to 8 months.”

So the company has been actively looking for new capital to facilitate their growth. This is what they said in their earnings filing:

In September, the Company completed a $1.85 million private placement financing. This additional financing amounted to dilution of 7.87%. The proceeds from this financing enabled us to begin scaling manufacturing and production capabilities, focused our engineering and product development and provided working capital and operating expenses. The round also saw us expand our shareholder base to include a number of technology funds and sophisticated technology-focused investors.

The management pointed out that a series of activities marked significant progress in the Company’s development. “We have grown our enterprise business to include Mediacom alongside The Kroger Co. and others, and are now seeing repeat business from existing customers for both network upgrades and additional equipment.”

Edgewater Wireless stock chart going into 2019

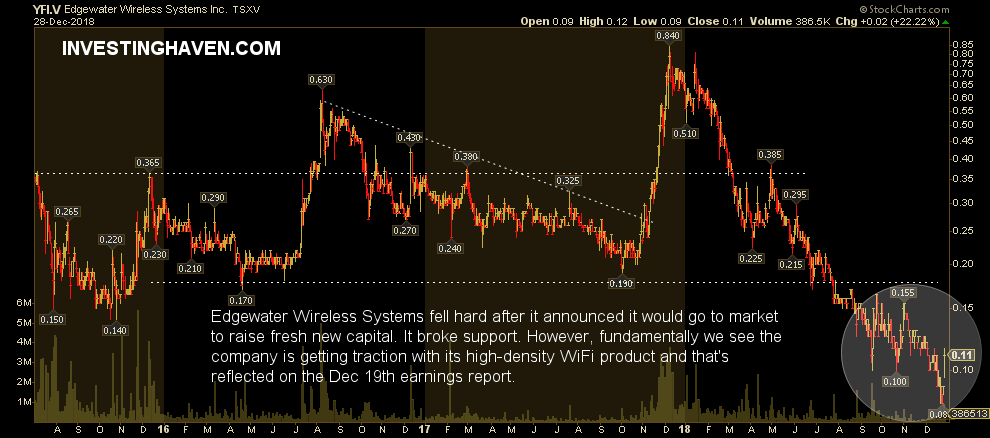

Admittedly, the stock chart of Edgewater Wireless looks quite ugly. But this is the type of opportunity that we have been waiting for. Buying at ridiculously oversold levels right at a time a company shows signs of traction.

It will certainly not be an easy ride for Edgewater Wireless but there is a fair chance they will survive and thrive.

The current stock price factors in the 7% shareholder dilution because of the recently announced capital injection. We believe with the current order backlog that Edgewater Wireless has entered a ‘buy’ area.

This is the type of nano stock to hold for the long term only if investors have high risk appetite. We will continue to follow this company closely.