A lot of good investments should be considered on a long term horizon. But there is every year about 3 investing opportunities that have abnormal returns in the short to medium term. InvestingHaven’s research team is keen on catching those TOP 3 investing opportunities of 2019. This page tracks a shortlist of opportunities that may end up delivering those mega returns in a short period of time. We watch chart specific signals which help us identify the ones that will go ballistic.

In other words this page will be updated constantly throughout 2019. We consider ourselves successful if we have identified upfront and caught at a minimum 2 out of the 3 TOP investing opportunities of 2019.

In order to spot these top investing opportunities we perform analysis on 3 levels:

- High level intermarket analysis to identify high level dominant trends: we track this in the public domain on our 15 leading indicators page which is updated on a monthly basis.

- Sector specific trends: we track some 500 charts representing several hundreds of sectors on multiple timeframes. This is not available in the public domain, it is the Intellectual Property of InvestingHaven’s research team.

- Detailed chart analysis of the sectors / markets / assets / stocks that show unusually attractive chart setups. The longlist is not available in the public domain (Intellectual Property of InvestingHaven’s research team) but we do post the shortlist on this page.

What are those “top investing opportunities” and what are “mega returns”

Mostly, it is technology specific sectors or commodities or emerging markets (countries or sectors).

Examples include:

- 2010: silver price

- 2011: gold price

- 2012: biotech stocks

- 2013: 3D printing stocks

- 2013: solar energy stocks

- 2014: China’s stock market

- 2015: crude oil crash (short opportunity)

- 2016: sugar price and base metals

- 2016: banking stocks

- 2017: Bitcoin and cryptocurrencies

- 2017: semiconductor stocks

- 2018: palladium price

The type of return we are talking about is multifolds (multibaggers) in a couple of months.

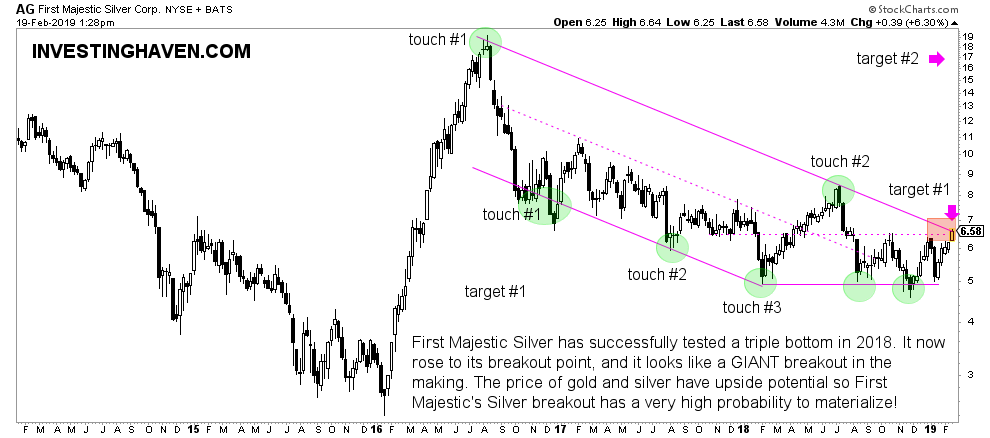

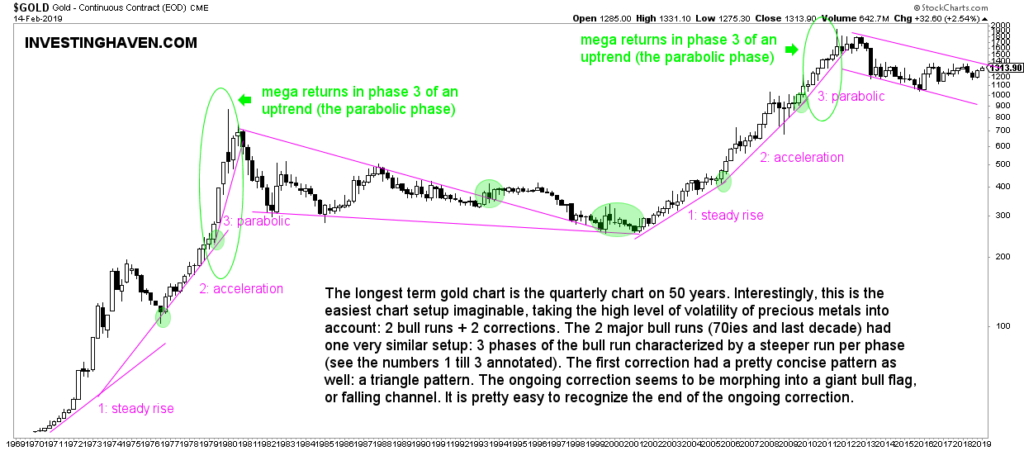

The type of chart we are talking about is this (just 2 illustrative examples):

The Secret To Locking In Mega Returns: Characteristics of TOP Investing Opportunities + A Disciplined Exit Strategy

The point about these TOP investing opportunities is that they follow a similar path. Mostly they rise in 3 phases: a steady rise, an acceleration, a parabolic rise which ends in a blow off top fashion.

The first ‘secret’ (not-so-secret in all fairness) is to identify this pattern. It is mandatory to be in the market during the acceleration phase so to catch the parabolic phase where the most profits are realized in a short period of time. This is where one of our 100 investing tips comes up: better be invested in a good market or asset 1 year too early than 1 day too late.

The second ‘secret’ is to have a very disciplined exit strategy, and define this as soon as the parabolic phase starts. Why so early? Because EMOTIONS are your biggest enemy, and have the potential to destroy your account value. Your exit plan will avoid making you super excited and follow the herd. Remember, when Joe-comes-late-to-the party as well as financial media are talking about an investing opportunity it is time to sell. Look back, and remember the mistakes you have made in the past (buy low sell high, as opposed to buy low sell high).

The long term gold chart is illustrative of this. It has twice in the last 4 decades this 3-phased uptrend which helps make our point.

3 Top Investing Opportunities Of 2019

So which is our shortlist of assets / markets / sectors / stocks that are likely to score mega returns in 2019? As said, we want to score 2 out of 3 TOP investing opportunities in 2019.

- The cannabis stock sector > very high probability.

- The price of palladium > very high probability.

- Silver miners > very high probability.

- The price of coffee.

- Some specific technology sectors.

- Some specific healthcare sectors.

- China’s stock market.

Status on February 14th, 2019

So far it seems that both the cannabis stock sector as well as the price of palladium are about to go ballistic. If this would be the case we need to catch one more sector which will likely be a tech specific sector later in 2019 (likely the signs of a starting boom will appear shortly).