Banking stocks fell sharply today. The bank ETF KBE went 3.97 pct lower, which is significant for the sector. With that, banking stocks are near their 2017 lows. They will break down if they move lower from here.

“Some stocks had their biggest intraday declines since last year’s Brexit vote,” observes Bloomberg analyst Gillian Tan.

The writer on Bloomberg is positive on banking stocks, saying that “banks remain on a path to improving profitability. That’s tied to an assumption that their interest income will rise as interest rates climb, however slowly.”

Now that is the key point: the correlation with interest rates.

InvestingHaven’s view on markets is based on intermarket dynamics, which is about the effect of one market on one or several other markets. Today’s plunge in banking stocks really did not come out of the blue, nor was it the so-called “Trump effect” that suddenly stopped to work. It was the effect of falling interest rates on other markets, primarily banking stocks and other financials. Because of that, the dollar weakened and gold went higher.

That is how markets work. Interest rates were leading and created intermarket effects.

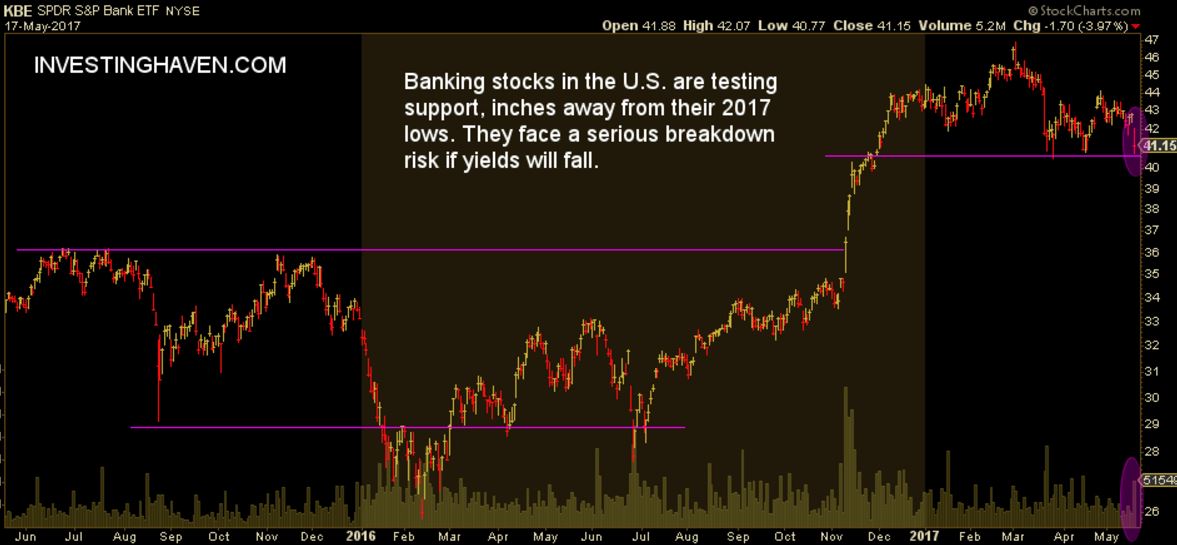

A closer look at the banking sector, represented by the KBE ETF on below chart, shows that the sector has arrived at a critical juncture. KBE is testing its 2017 lows, and it is the 3d test of the same price level (41 points).

If prices go lower from here, we tend to call this a breakdown. If that occurs, it would have very negative implications on banking stocks in 2017. It would suggest that the banking sector will fall to 35 points where it will take a first pause.

Note how today’s fall came with rising volume, which is a bearish sign.

Investors keep a very close eye on the 41 points level in KBE which is the breakdown level.