Many love to associate China with doom and gloom, for one or another reason. Though China has passed the stage of exceptional rates of +10% annual GDP growth, it is still growing at rates not seen since many years in the U.S. and Europe.

After last year’s stock market collapse in China, it is clear that its market has stabilized. But here is the good news for stock market investors seeking low risk opportunities: China’s market could be on the verge of a huge breakout, leading to strong gains in its stock market 2017.

The chart of the Shanghai Exchange makes our point. The chart setup is truly exceptional, we have not seen such a pattern in a long time. Two trend lines are colliding right at the 3000 level. This is huge, as a big move is coming very soon. As support lines have held consistently over the last two years, the odds favor a bullish breakout, leading to a very bullish stock market in China in 2017.

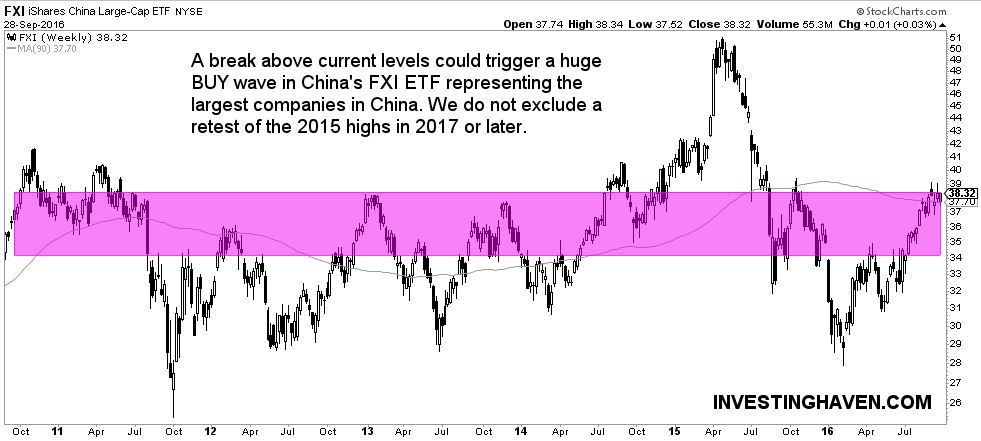

As said before, we have noticed bullish energy in the FXI ETF, which represents the largest companies in China. Its chart confirms the one above: the FXI is ready to break out, and, once done, things will go very fast.

We remain very bullish on China, and believe its stock market will go much higher in 2017. FXI is an excellent ETF to play that trend.