The anticipated September / October correction is underway.

As said before, it is imperative to closely monitor the behavior of any correction, to get as early as possible indications on where it will run its course.

The mistake that most investors make, however, is that they close their eyes when markets fall (especially the assets or stocks they are invested in), only to open their eyes once prices rally again. Smart investors do the opposite. The lower prices fall, the sharper an investor should become, as retracements/corrections reveals whether the correction is a buying opportunity or the next rally should be sold.

At this point, it is too early to tell, but our instinct and our indicators say stock markets will present an interesting buying opportunity sooner rather than later.

Interestingly, the ongoing retracement in stocks (still only 5% so technically we can’t speak of a correction yet) is accompanied by falling asset prices across ALL markets, including safe havens like Treasuries and the Yen. That is very odd, and probably points to the fact rising interest rates will become the next primary trend. That does not come as a surprise, as we predicted that trend already two months ago, when we wrote that Financials Are Setting Up For Very Strong Rally In 2016. Note that the USD is the only asset refusing to go down.

It is key to watch how this retracement unfolds, and how asset prices will behave as rates will rise.

Our belief is that stocks will be damaged short term, but will recover soon, as rising rates suggest risk taking. Gold would fall in that scenario, unless inflation would pick up which we don’t really expect at this point.

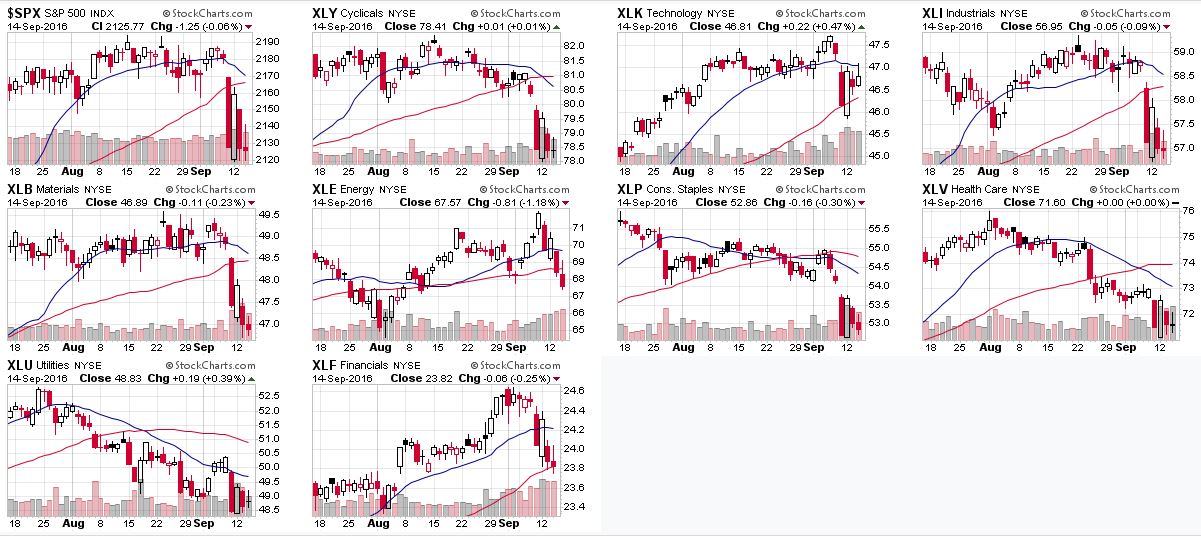

If the above will be correct, investors should watch with stock market segments will outperform. So far, in the last couple of weeks we have seen technology and finance holding up much better than other sectors. Smart investors are now setting up their shortlist of segment leaders in both segments.