CRYPTOCURRENCY INVESTING

First CRYPTO Investing Service In The World SINCE 2017

InvestingHaven was the first to offer a premium research service for cryptocurrency investing, since early 2017. There is no bias in our market calls, we are no perma-bulls. We try to maximize profits during uptrends, identify turning points and protect profits during downtrends.

In 2023, we turned very bullish in what was widely accepted to be a ‘crypto winter’. In 2024, we were very bullish until May. We spotted a ‘volatility window’ in our timeline analysis starting August 2nd, 2024. This shows we are able to successfully spot major tops and bottoms. And that is exactly the way to invest in cryptocurrencies: long term horizon, accumulate after a long term turning point, reduce positions when everyone gets excited.

01

Cryptocurrency super cycle

One of the most powerful super cycle in history of mankind

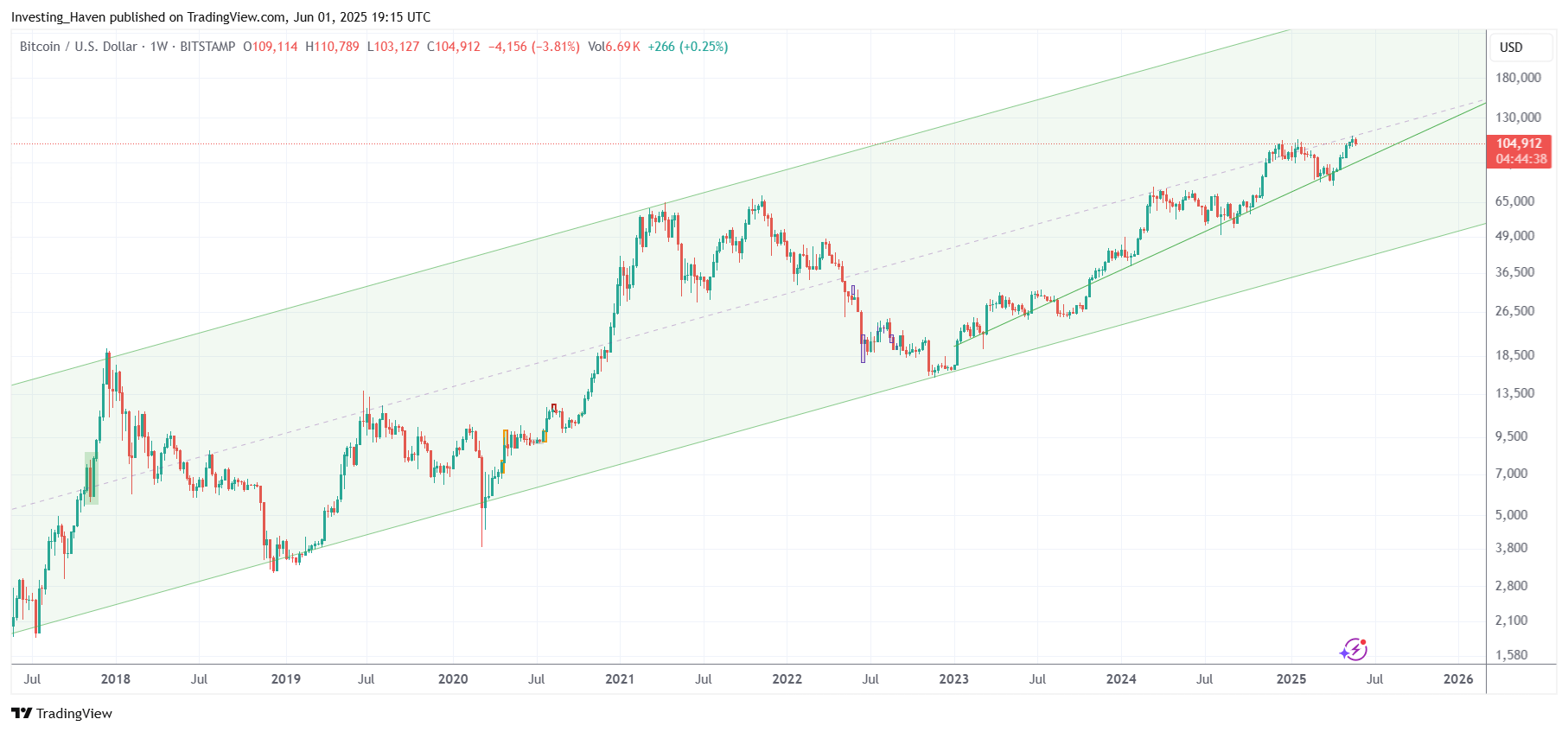

One chart makes the point: the long term Bitcoin chart shown below. This is a phenomenal super cycle, a once-in-a-generation type of bull market.

Interestingly, the cryptocurrency space is only now starting to mature. Even institutional investors are only now starting to enter this market.

In order to successfully invest in this long term super cycle investors must do 2 things well:

- Only take positions occasionally in emerging trends. Less is more, when it comes to crypto investing.

- Select a limited number of high quality cryptocurrencies. Less is more, when it comes to cryptocurrency selection.

02

Spotting winners across +100 coins and 7 segments

The cryptocurrency space has grown tremendously. Our research team has found that coins move in groups, like AI-tokens, DeFi, Cross-chain, Layer1, Layer2, etc. It pays off to track coins in groups.

InvestingHaven tracks a selection of 100 cryptocurrencies. Moreover, we track sector momentum to identify which group of tokens is ready to move (much) higher.

Our selection of 100 coins is based on cryptocurrencies with a premise to grow over time. ADOPTION is the key, and differentiates quality from valueless cryptocurrencies.

These coins fall into a structure of 7 groups: DeFi, NFT, AI & Big Data, meme, etc. We look for sector momentum, then tip the most promising setups in the sector that is ready to take off.

02

03

Highest returns require a long term vision and commitment

Crypto markets can be amazingly profitable. However, short term trades won’t deliver most profits. It is a long term vision combined with accurate market readings that will deliver those astonishing results.

- Long term holdings are buy-and-hold positions: buy at the end of a downtrend, sell near a peak of a bull market.

- Short term crypto trades are too risky. Stop losses will for sure be hit because of the volatile nature of crypto. Sudden turnarounds take place intra-day which makes it not profitable to trade crypto on the short term timeframe!

The problem that most crypto investors face is that they get excited once the crypto market moving higher. Consequently, they tend to sell when crypto markets get volatile. This is the result of not spotting right entry points, not understanding the cyclical nature of crypto markets, not respecting narrative based momentum trends.

InvestingHaven has a selection of top 100 cryptocurrencies based on their tremendous growth potential. Moreover, we track sector momentum to identify which group of tokens is ready to move much higher. That’s what InvestingHaven is great at: spotting those major trend changes.

04

Proof of success

We pride ourselves on hitting many successful calls, yes even in 2023 (‘crypto winter’):

- Fetch.ai went up 30x after we spotted it.

- METIS went up 10x after we spotted it.

- PEPE went up 10x after we spotted it.

- ChainGPT went up 10x after we spotted it.

- Solana went up 8x after we spotted it.

- SHIB went up 5x after we spotted it.

- Thorchain went up 8x after we spotted it.

- Ocean went up 6x after we spotted it.

- Optimism went up 4x after we spotted it.

- Pyth went up 3x after we spotted it.

04

Solana went up 8x after we considered it an attractive long term opportunity (in August and in October 2023)

Fetch.ai went up 30x after we considered it a buy opportunity in the emerging AI trend on Jan 9th, 2023

05

Crypto forecasts since 2017

We are following blockchain and cryptocurrency markets for 8 years. We have a track record of accurate forecasts:

- We initially published our $1,000 Ethereum price forecast in April of 2017. Nobody believed us. Ethereum exceeded $1,300 in December of 2017.

- We called the cryptocurrency market top on December 31st, 2017. Our forecast was spot-on, please check our market call.

- In April of 2020, right after the Corona crash, we recommended to get into crypto when BTC was trading at $5k. Since then, we hit many successful calls, tokens that went up tremendously in value!

- In 2023, we turned very bullish and hit many multi-baggers in what was widely accepted to be a ‘crypto winter’. We flashed a strong buy on Fetch.ai two days before it took off like a rocket (it went 800% higher), we considered Thorchain great value right before it staged a rally of 600!

In 2023, we turned very bullish and hit many successful market calls in what was widely accepted to be ‘crypto winter’. We tipped Fetch.ai as great value, two days before it took off like a rocket. Similarly, we tipped Thorchain as great value right before staging a 600% rally, we tipped Optimism before it went up 400%, and hit many more successesful calls, yes in ‘crypto winter 2023.’

06

How is our service different?

We focus on the timeframe where most money is made – long term trends.

Most crypto investors get into crypto towards the end of a bull run; that’s when it feels safe but least profitable.

We always remain grounded, reiterating that most value is created on the long run.

Crypto investing can be hugely rewarding provided you follow crypto markets for at least 3 years. It’s one of the best kept secrets; it’s also the toughest simple thing to do: wait and let the market do the work for you.

We have many loyal members, following our work for +3 years. Many loyal members have told us how much value they have found in our market thinking process.

06

07

Overview of benefits

We offer continuous research to maximize cryptocurrency investments:

- Forecasting the direction of the crypto market, with a very high level of accuracy.

- Members are alerted when specific cryptocurrencies are ready for bullish momentum.

- AI tokens get specific attention in 2024 and beyond.

- Major move alerts: either in terms of time or in terms of price or both.

- A long and detailed security guide is available in the restricted area: how to secure your cryptocurrencies.

All of the above is shared in the form of ‘crypto alerts’: 1 or 2 such alerts per week.

08

Our latest crypto alerts – instantly accessible

This is how we are guiding our premium members (log in required):

- Crypto Charts Are Improving, Just Have A Look At These 3 Leading Indicators (July 6th)

- Alt Season 2025: The Animals Are Back, This May Be A Very Bullish Signal (June 29)

- BTC And Altcoins About To Hit Big Support Areas (June 22)

- The Alt Season Charts (June 15th)

- Another Test of 106.1k, Is This THE Big One? (June 8th)

- How Much Longer Do We Have To Wait For Alt Season 2025? (June 1st)

- The Bitcoin vs. Altcoin Divergence (May 24th)

- Is A Massive Breakout Coming? (May 17th)

- Top Altcoin Picks in the Strongest Emerging Narrative (May 9th)

- Bitcoin’s Must-Watch Chart Structure, What It Means For Top Altcoins (May 6th)

- Charts – XRP, Theta, Uniswap, and two RWA Token Tips (April 29th)

- Juicy Opportunities Are Starting To Show Up On The Charts (April 24th)

- BTC Stronger Than Markets + 3 Key Narratives Emerging (April 20th)

- BTC: From Failed Breakdown To Breakout Attempt On April 13th (April 13th)

- BTC Hanging On A Cliff As Markets Are Retaliating (April 7th)

- BTC Breaching Critical Trendline. Bitcoin’s Message: Politics Are Destroying Markets. (April 6th)

- Bitcoin: Phenomenal Resilience, Watch April 13th. (April 5th)

- BTC Holding Up Well – But Markets Are Turning Very Vulnerable (April 3d)

- This Is The Most Important Data Point Until April 13, 2025 (March 31st)

- A Promising And Welcome Evolution On Crypto’s Leading Indicator Chart (March 24th)

- The Dates & Data Points To Watch In The Next 3 Weeks (March 17th)

- The Time Window as of March 14 Should Bring Relief (March 11th)

- Buy The Dip Is Here (March 1st)

- BTC Very Close To Its 200 dma – Chart Looks Constructive (Feb 26th)

- How To Know Whether BTC Will Set A Bottom This Week? (Feb 25th)

- Crypto Markets Showing Strong Signs Of Selling Exhaustion. Buy The Dip?! (Feb 23d)

- This Token Is Set To Emerge As An Outperformer as USD Breaks Down. (Feb 16th)

- When Will This Market Finally Start Moving? (Feb 9th)

- Will February 5th Come To The Rescue? (Feb 4th)

- Top 5 Tokens for 2025: Essential and In-Depth Chart Insights (Jan 31st)

- Do You See The LINK? (Jan 24th)

- Bitcoin Up, Altcoins Down? What’s Going On? (Jan 19th)

- If You Missed XRP, This Is Your Potential Alternative Play (Jan 16th)

- The Week of January 15th Is Here. This Is Why The Next 23 Days Matter. (Jan 12th)

- Jan 15th, 2025: A Decisive Date for Crypto + Key Insights on 3 Tokens (Jan 5th)

- 7 Must-Read Tips for Success in 2025 (Dec 28th)

- When To ‘Buy The Dip’ In Crypto? (Dec 23d)

- No Lasting Top. What’s Next For Crypto? Anything Worth Buying Now? (Dec 15th)

- What Is It: a Lasting Top, Local Top or No Top? (Dec 12th)

- Take Profit Opportunities And Insights From The Critical Date December 9th (Dec 10th)

- 3 Fresh Opportunities and 3 Key Updates on Past Recommendations (Nov 29th)

- Are Bitcoin Ecosystem Tokens Ready To Move Higher? And Two More Token Tips. (Nov 23d)

- This Is Our Expectation For The Next 3 Weeks (Nov 21st)

- The Long-Awaited XRP Secular Breakout Is Here – Three XRP Upside Targets (Nov 12th)

- Bitcoin’s Breakout Attempt and The Most Powerful Reactions on Election Results (Nov 6th)

- Entry Guidance On 15 Top Tokens Spot-on. New Decision Dates. (Oct 29th)

- Halfway The Most Important Time Window Of The Year – Key Findings (Oct 27th)

- Ready For Volatility? Here Are 15 Buy The Dip Opportunities With Entry Areas. (Oct 20th)

- THE Most Important Time Window Of The Year Is Here. The Next 21 Days… (Oct 15th)

- [Breakout Alert] This Meme Is Attempting to Break Out (Oct 11th)

- Top DeFi Token Breaking Out – Time For A First Allocation. (Oct 10th)

- Our Top 12 Altcoin List Is Here With Buy The Dip Guidance (Oct 5th)

08

7 reasons why you can trust InvestingHaven’s crypto investing research service

- Long history – the first in the world, since 2017.

- Consistency – weekly updates for nearly 400 consecutive weeks

- Accuracy – unusually accurate crypto market readings

- Track record – many dozens of accurate market calls

- Values – team values are trust, respect, value investing

- Commitment – only one thing, i.e. delivering value

- Risk management – focus on protection and security

Exclusive offer: our 10-year anniversary

Option 1: Our top notch gold/silver reports and crypto alerts.

Option 2: VIP membership – all 3 premium services.

Go to our 10-year anniversary offering >>

About the team

InvestingHaven was founded +10 years ago.

The research team behind InvestingHaven has different areas of expertise: market analysis, chart analysis, technology and risk management expertise. The combination of these areas gives InvestingHaven an edge in analyzing and understanding blockchain & crypto investing. InvestingHaven’s research team members share similar values. They are spread across the globe and have all learnt through pain and gain.

(*) “The first blockchain (stock and cryptocurrency) investing research service of its kind in the world” refers to research services with a focus on crypto token analysis targeting retail investors.